Source: Alexander Raths, Shutterstock

Summary

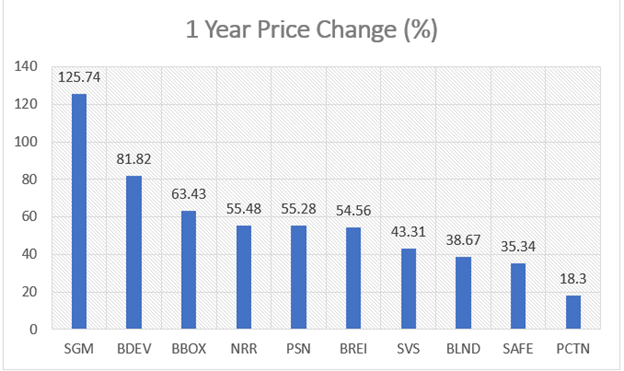

- A majority of real estate stocks have doubled their investor’s money in a years’ time.

- These are considered an ideal choice for portfolio diversification.

Investing in real estate and REITS could add a different dimension to your investment portfolio. These investments can help you diversify your portfolio. For instance, REITS invest in the specific sector of properties such as retail or shopping spaces, hotels & other commercial spaces.

Most importantly, this sector is non-cyclical in nature. Thus, investing in this sector could help in making your portfolio weatherproof. In this article, we would put our lens through 10 Real Estate and REIT Stocks that are listed on the LSE.

Also read: How to ace the real estate game in 2021? Here are few investing tips

(Data Source: LSE) Copyright © 2021 Kalkine Media Pty Ltd.

- Sigma Capital Group Plc

Sigma Capital Group Plc (LON:SGM) is an urban regeneration and property asset management company. Sigma witnessed a bounce back in the delivery momentum to almost pre-coronavirus level as Sigma delivered over 1,000 new rental homes for The PRS REIT plc in the nine-month period ended September 2020.

The company’s joint venture with EQT Real Estate shall help it in advancing into the new geography and secure new long-term income streams. The joint venture shall provide the company with £45 million worth of fee income during the first five years. Under the JV, Sigma shall provide EQT Real Estate with build-to-rent portfolio of 3,000 new London rental homes in Greater London over the next five years.

The company is on track to achieve its targets for the financial year 2021 as demand for rental homes remains strong. SGM shares have delivered a price return of 125.74 per cent in the last 52-week period.

- Barratt Developments Plc

UK-based residential property developer Barratt Developments (LON:BDEV) made an excellent recovery in completions with continued improvement in quality and customer service during the first half of 2021. The company witnessed a strong balance sheet and declared a dividend of 7.5 pence per share during the first half of 2021.

The FY21 guidance was in line with the Board's anticipations, and the company expects wholly owned completions to be in the range of 15,250 to 15,750 homes. BDEV shares have delivered a price return of 81.82 per cent in the last 52-week period.

- Tritax Big Box REIT Plc

FTSE 250-listed real estate investment trust Tritax Big Box REIT Plc (LON:BBOX) manages a portfolio of large logistics warehouse assets in the UK. During the bruising 2020, the company witnessed record demand for the logistics space and therefore made a significant amount of investment in this space. The company had strong operational cash flows and rent collection during 2020.

With a payout ratio of 90 per cent, the company declared a dividend of 6.40 pence per share in respect of the year 2020.The UK-based REIT has the biggest logistics focused land bank. Moreover, the company expects rental revenue to grow in 2021. BBOX shares have delivered a price return of 63.43 per cent in the last 52-week period.

- Newriver Reit Plc

Newriver Reit Plc (LON:NRR) manages a portfolio of shopping centers, retail warehouses, high-street stores, and pubs throughout the UK. The company carried the momentum into the third quarter, seen in the first half of 2020. The company has completed 291,900 sq ft of new lettings and renewals across its retail portfolio that equates to £1.2 million of annualised rent. Also, the company forged lease renewals with Argos, Marks & Spencer and GO Outdoors. During the third quarter of 2020, the company made strong progress on rent collection, cash and liquidity. NRR shares have delivered a price return of 55.48 per cent in the last 52-week period.

- Persimmon Plc

UK-based housebuilder Persimmon Plc (LON: PSN) delivered a robust financial performance driven by a substantial increase in average selling prices during the fiscal year 2020. It witnessed a robust balance sheet and strong liquidity, with high-quality land holdings, cash held of £1,234 million and land creditors reduced by £106 million on 31 December 2020 (2019: £435 million).

During 2020, the net assets per share increased by 8 per cent YoY, with an underlying return on average capital employed of 29.4 per cent. In FY20, the total dividend per share stood at 110 pence. PSN shares have delivered a price return of 55.28 per cent in the last 52-week period.

- BMO Real Estate Investments Ltd

BMO Real Estate Investments Ltd (LON:BREI) invests in a diversified United Kingdom commercial property portfolio to generate a return for its investors. The rent collection rates during 2020 have been ahead of expectations at 94.5 per cent except in the first quarter. During the first quarter of 2021, the rent collection was at 90 per cent and is expected to improve in the upcoming quarters.

Moreover, the company announced a second interim dividend of 0.85 pence per share that will be paid in March 2021. BREI shares have delivered a price return of 54.56 per cent in the last 52-week period.

- Savills Plc

UK-based company Savills (LON: SVS) provides real estate services, including specialist advisory, management, and transactional services. The company managed to deliver a robust performance during the pandemic year 2020, driven by the strength and resilience of its well-diversified global business. Amid the challenging market conditions, the company performed strongly across its transactional service lines and improved upon its market share.

As the market improved in the mid of 2020, Savills witnessed the growth of 10 per cent in UK Residential revenues. Also, the company’s Assets Under Management increased to £19 billion during 2020. The company declared a final dividend of 17 pence for the year 2020. SVS shares have delivered a price return of 43.31 per cent in the last 52-week period.

- British Land Company Plc

UK-based property development and investment company British Land Company Plc (LON: BLND) has a resilient business model and manages a huge property portfolio. Recently, the company paid a dividend of 8.4 pence per share, as announced earlier in its half-yearly results of 2021.

As per the recent operational update, the company managed to collect 71 per cent of the rent proceeds due in December 2020. The company has managed to collect 95 per cent of the December rent from its Offices portfolio. The situation is expected to improve in its retail portfolio as we head further in a post vaccine world. BLND shares have delivered a price return of 38.67 per cent in the last 52-week period.

- Safestore Holdings Plc

UK's largest operator of self-storage sites, Safestore Holdings (LON:SAFE) witnessed a growth of 9.8 per cent in revenue on a CER basis during the first quarter of 2021. The company witnessed a strong performance in its portfolio across UK, Paris, and Spain. The company also renewed the lease with Hayes store for a term of 18 years. The company expects to derive growth in the near term from 1.4m square feet of unlet space in our UK, Paris, and Barcelona markets. Also, the company expects the new stores pipeline to grow over the approaching months. SAFE shares have delivered a price return of 35.34 per cent in the last 52-week period.

- Picton Property Income Limited

UK-based REIT Picton (LON:PCTN) manages a portfolio of commercial properties. During the first half of 2021, the rent collection rates stood at 93 per cent. Also, monthly tariff plans are expected to increase over the coming months.

Recognising the ongoing levels of rent collection and leasing progress, Picton announced an increase of 14 per cent in its quarterly dividend payout for the period ended December 2020. The company is doing well in terms of office lettings and industrial rental uplifts. PCTN shares have delivered a price return of 18.30 per cent in the last 52-week period.