Summary

- The defence industry of the UK plays a vital role in generating economic prosperity and safeguarding national security

- Though the pandemic has battered most sectors, the defence sector’s performance was more or less as per expectations

- Chemring Group PLC in its full-year results for the year ending 31 October mentioned that it continued to perform ahead of the Board’s expectations

So far, the year 2020 has been a troublesome year with the coronavirus pandemic causing widespread disruption and economic hardship for businesses, consumers, and communities worldwide.

Talking about the UK defence industry, the situation appears to be less appalling with demand secured by budgeted government spending and a supply chain with minimal exposure.

The defence sector of the UK has been prominent in responding to the Covid-19 pandemic and has also contributed towards the ongoing recovery. The industry has helped play an important role in building hospitals within weeks, delivered oxygen to the needy and also turned to produce medical equipment.

However, defence suppliers are battling with the direct impact of the crisis. The domestic and foreign supply chains of the defence industry have been affected by the pandemic highlighting the need to ensure defence readiness and protect critical assets.

Let’s have a look at how the defence stocks of the UK performed during these tough times:

|

Sl. NO. |

COMPANY |

TICKER |

SHARE PRICE (GBX) AS ON 15 DEC 2020 |

YTD RETURNS (PER CENT) |

MARKET CAPITALISATION (£m) |

|

1 |

AVON Rubber PLC |

AVON |

3,705.00 |

79.81 |

1,160.27 |

|

2 |

BAE Systems PLC |

BA. |

502 |

-12.2 |

16,219.30 |

|

3 |

Boeing Co. |

BOE |

US$ 226.98 |

-28.63 |

1,00,048.07 |

|

4 |

Chemring PLC |

CHG |

300 |

9.49 |

764.72 |

|

5 |

Cohort PLC |

CHRT |

586 |

-19.11 |

239.27 |

|

6 |

Meggitt PLC |

MGGT |

441.7 |

-31.36 |

3,509.26 |

|

7 |

Qinetiq Group PLC |

QQ. |

298 |

-19.01 |

1,703.25 |

|

8 |

Rolls-Royce Holdings PLC |

RR. |

115.3 |

- |

9,647.84 |

|

9 |

Senior PLC |

SNR |

79.75 |

-56.99 |

335.53 |

|

10 |

TP Group PLC |

TPG |

6.35 |

-1.55 |

49.48 |

|

11 |

Ultra-Electronics Holdings PLC |

ULE |

2,062.00 |

-3.31 |

1,451.86 |

|

12 |

Velocity Composites PLC |

VEL |

20.5 |

-42.45 |

7.43 |

(Data Source- London Stock Exchange)

Chemring Group PLC (LON:CHG)

Based in Romsey, UK, Chemring Group is a 100-year-old company which provides a range of products and services to aerospace, defence, and security markets and has clients in over 50 countries in the world. The FTSE 250 listed company uses its world-class expertise and innovation to protect people, platforms, missions, and information against threats.

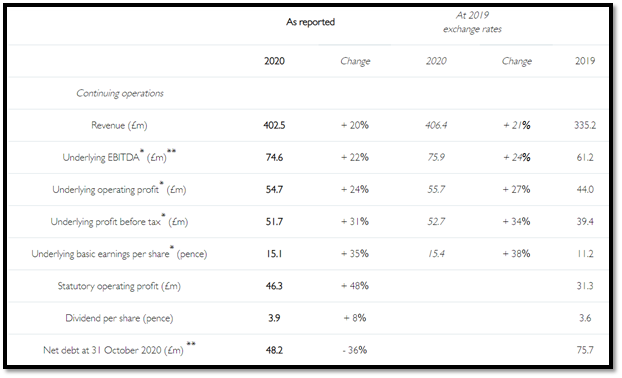

On Tuesday, the Group released its full-year results for the year ending 31 October 2020 mentioning that it has continued to perform ahead of the Board’s expectations.

Operational Updates

- Despite the challenges due to the pandemic, all the businesses continued to operate and remained open all through the year.

- The Group has been investing in manufacturing infrastructure, which has resulted in improvements in efficiency and safety, and has enhanced operational resilience.

- The company has been making good progress in securing new business in the UK, the US and Australia for the supply of global countermeasures.

Financial highlights

Order intake for continuing operations saw a 6 per cent increase to £436.6 million this fiscal year from £410.6 million in 2019, led by the release of further delivery orders on the HMDS IDIQ contract as well as orders secured by the Australian and US countermeasures businesses.

Revenue from continuing operations: A 20 per cent increase to £402.5 million from £335.2 million in 2019 was reported, mostly driven by the continuous functioning of the Australia and Salisbury’s countermeasures facilities. Also, the Sensors & Information segment delivered a strong performance.

Total finance expenses recorded a significant fall to £3.0 million from £4.6 million in 2010, driven by the repayment of the private placement loan notes in November 2019.

Underlying profit before tax was reported at £51.7 million for the full year. It was £39.4 million in 2019. The effective tax rate on the underlying profit before tax from continuing operations was 17.6 per cent (2019: 20.1 per cent).

Underlying earnings from continuing operations was 15.1 pence (2019: 11.2 pence)

Diluted underlying earnings from continuing operations was 14.8 pence (2019: 11.0 pence).

Statutory operating profit from continuing operations was £46.3 million, whereas in 2019, it was £31.3 million, and after statutory finance expenses of £3.0 million (2019: £4.6 million) was recorded by the Group.

Statutory profit before tax from continuing operations was £43.3 million (2019: £26.7 million), resulting in the statutory earnings per share to be at 12.3 pence (2019: 8.2 pence).

Revenue from discontinued operations plummeted to £9.5 million (2019: £43.4 million), and underlying operating loss fell to £0.1 million (2019: £3.5 million), driven by the disposals made in the last two years.

Dividend: The Board is recommending a final dividend this fiscal year of 2.6 pence per ordinary share in comparison to 2.4 pence in 2019. With the interim dividend of 1.3 pence per share as compared to 1.2 pence in 2019, this results in a total dividend of 3.9 pence per share (2019: 3.6 pence).

(Source: Chemring’s Result Release)

Stock Performance

CHG shares quoted at GBX 300.50 on 16 December 2020 at 08:25 AM, with a market capitalisation of £846.55 million. The shares of Chemring skyrocketed from GBX 271.00 on 14 December after the company released its results yesterday, witnessing a 12.36 per cent increase from its last trading session.