Highlights

- Royal Mail group expects adjusted operating profit for H1 2021-22 to be in the range of £395 million to £400 million, with about £230 million emanating from only Royal Mail’s operations.

- Xpediator’s board announced an interim dividend of 0.50 pence per share, representing an increase of 11% year-on-year from 0.45 pence per share in H1 2020.

- Wincanton recorded revenue of £1,221.9 million in 2020/2021 compared to £1,201.2 million in 2019/2020.

Shortage of qualified HGV drivers drove petrol shortages and supermarket supply chain disruptions. The haulage industry in the UK has recommended Prime Minister Boris Johnson to put additional effort to tackle the shortage of about 100,000 heavy good vehicle drivers, to improve supply and avoid the Christmas crisis.

Heads of various trade associations such as the Road Haulage Association (RHA) and businesses operating in the trucking, fuel and food sectors have urged the prime minister to step up initiatives to resolve the crisis. Measures taken, such as the issuance of temporary three-month visas for immigrant HGV drivers have not been efficient in tackling the crisis until now.

The haulage industry is recommending the addition of HGV drivers to the government’s shortage occupation list that would make it simpler for skilled workers to obtain visas. They also requested the government to reform the drivers’ qualification known as the Certificate of Professional Competence (CPC), encouraging experienced and retired drivers to return to work.

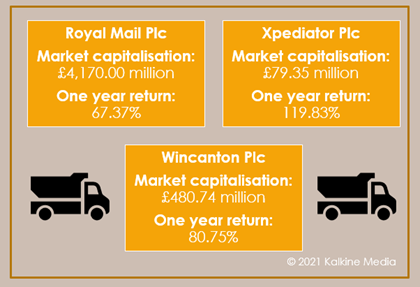

Here we will review in detail the investment potential in three FTSE logistics stocks – Royal Mail, Xpediator and Wincanton.

(Data source: Refinitiv)

Royal Mail Plc (LON: RMG)

Royal Mail is an FTSE 100 listed courier and postal service provider. Recently, Royal Mail’s subsidiary General Logistics Systems inked an agreement to acquire Mid-Nite Sun Transportation Ltd, a Canada-based logistics firm that operates as Rosenau Transport.

Royal Mail registered a 34% increase in domestic parcel volumes in August 2021 compared to pre-pandemic levels. The group revenue was £5,123 million in August 2021 compared to £4,736 million in August 2020. The group expects adjusted operating profit for H1 2021-22 to be in the range of £395 million to £400 million, with about £230 million emanating from only Royal Mail’s operations.

The shares of Royal Mail are currently trading at GBX 417.10, up by 0.02% at 8:01 AM BST on Tuesday, 26 October 2021. The shares of the company gave a return of 67.37% to shareholders in the last one year. Its market capitalisation stands at £4,170.00 million.

Xpediator Plc (LON: XPD)

Xpediator is an FTSE AIM All-Share-listed freight management services provider. The company is engaged in offering logistics, transport support and freight forwarding solutions across Central and Eastern Europe and the United Kingdom. In August, Xpediator inked a strategic partnership with Synergy Retail Support Limited, an e-Commerce fulfilment specialist.

Xpediator’s revenue reached £126.6 million in H1 2021 compared to £99.6 million in H1 2020. Its adjusted profit before tax increased to £3.6 million in the first half of 2021 compared to £2.1 million in the same period in 2020.

Xpediator’s board announced an interim dividend of 0.50 pence per share, representing an increase of 11% year-on-year from 0.45 pence per share in H1 2020.

The shares of Xpediator Plc are currently trading at GBX 52.00, down by 7.14% at 8:12 AM BST on Tuesday, 26 October 2021. The shares of the company gave a return of 119.83% to shareholders in the last one year. Its market capitalisation stands at £79.35 million.

Wincanton Plc (LON: WIN)

Wincanton is a logistics provider engaged in offering automated high bay, large capacity warehouses, and supply chain management services. Last month, Wincanton entered into an agreement to takeover 100% stake in Caledonia Bidco Limited, the holding firm of Cygnia Logistics, a multichannel e-Fulfilment and e-Commerce provider from Crescent Capital for £23.9 million.

Wincanton recorded revenue of £1,221.9 million in 2020/2021 compared to £1,201.2 million in 2019/2020. Its underlying profits were recorded as £47.2 million compared to £52.8 million in the previous year. Wincanton recommended a final dividend of 7.50 pence per share to shareholders for the year ended 31 March 2021.

The shares of Wincanton Plc are currently trading at GBX 386.00 at 8:27 AM BST on Tuesday, 26 October 2021. The shares of the company gave a return of 80.75% to shareholders in the last one year. Its market capitalisation stands at £480.74 million.