Highlights

- MyHealthChecked had recently acquired Nell Health Ltd, a technology-led genetic-testing platform and provider of personalised nutrition solutions, for £1.2 million.

- Alliance Pharma declared an interim dividend of 0.563 pence per share, representing an increase of 5% year-on-year.

AIM-listed pharma companies include players that are engaged in developing various drugs, diagnostics, and technologies. Several of the AIM pharma companies have shifted focus entirely or added COVID-19 testing and treatments products to their offerings.

Here we will talk about two such companies, one is MyHealthChecked, which is primarily a manufacturer of fertility monitoring products. The company ventured into the COVID-19 at-home testing business due to growing demand. On the other hand, Alliance Pharma is a dividend paying specialist drugs business with global range of products.

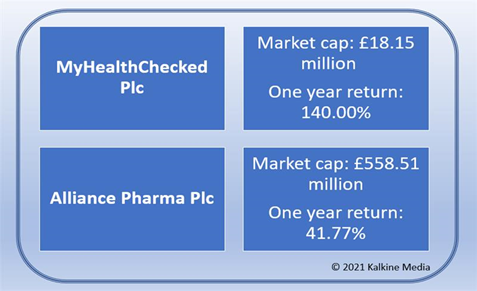

(Data source: Refinitiv)

(Data source: Refinitiv)

MyHealthChecked Plc (LON:MHC)

MyHealthChecked is a provider of healthcare applications and devices used to monitor fertility hormones. It has also been engaged in offering diagnostic healthcare that includes a COVID-19 at-home testing kit. In June 2021, it acquired Nell Health Ltd, a technology-led genetic-testing platform and provider of personalised nutrition solutions, for £1.2 million.

MyHealthChecked shares closed at GBX 2.40 on Wednesday, 29 September 2021.

Its revenues for the half-year period ended 30 June 2021 reached £3.27 million compared to £12,707 in H1 2020. Its cash balance as of 30 June 2021 was £2.21 million compared to £1.35 million as of 30 June 2020.

In the last one year, the shares of MyHealthChecked returned 140.00% to shareholders, and the market cap of the company stands at £18.15 million as of 29 September 2021.

Alliance Pharma Plc (LON:APH)

Alliance Pharma is a British specialty pharmaceutical firm. Alliance Pharma recorded a 24% year-on-year growth in revenue to £80.9 million for H1 2021 ended 30 June 2021. Its underlying profit before tax rose by 24% year-on-year to £20.1 million in H1 2021 compared to £16.3 million in H1 2020 and reported profit before tax of £16.5 million in H1 2021 compared to £0.6 million in H1 2020.

Alliance Pharma shares closed at GBX 104.20 on Wednesday 29 September 2021.

Alliance Pharma declared an interim dividend of 0.563 pence per share, representing an increase of 5% year-on-year from 0.536 pence per share in H1 2020.

In the last one year, the shares of Alliance Pharma returned 41.77% to shareholders, and the market cap of the company stands at £ 558.51 million as of 29 September 2021.

.jpg)