Highlights

- Blackbird recently inked an OEM licensing agreement with a global broadcasting firm for its core video technology and patented video codec technology for a 5-year period.

- In July 2021, Vela announced an investment of £750,000 in Northcoders Group as a part of its £3.5 million IPO funding round.

The need for digital transformation is guiding organisations across all sectors to adopt advanced technology solutions that ensure improved business operations and security in the backdrop of an increasing number of cyberattacks.

The COVID-19 crisis and restrictions imposed in response to the pandemic have played a pivotal role in developing new technology solutions and driving its robust uptake across various sectors. The need for innovative tech solutions has led to several startups mushrooming and a subsequent rush to be listed on the LSE main market or its sub-markets.

(Data source: Refinitiv)

Here we explore in detail the investment prospects in two AIM-listed technology stocks.

Blackbird Plc (LON: BIRD)

Blackbird is a cloud-based professional video editing and publishing platform. Recently, Blackbird announced its collaboration with TownNews that enables the use of Blackbird’s technology across a total of 75 TV stations in the US for digital news production.

In September 2021, Blackbird also inked an OEM licensing agreement with a global broadcasting firm for its core video technology and patented video codec technology, for a 5-year period, valued at €2 million.

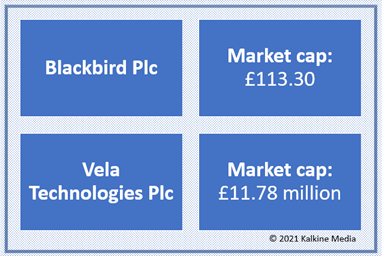

At the day’s close on Tuesday 28 September 2021, the shares of Blackbird traded at GBX 34.50, up by 2.99%. The market cap of the company currently stands at £113.30 million.

Blackbird’s revenues stood at £867k for the H1 2021 ended 30 June 2021, up 21% year-on-year from £714k for the same period in H1 2020. Its net loss before tax was £1,168k in H1 2021 compared to £942k in H1 2020. Its contracted but unrecognised revenues rose by 6% year-on-year to £1,974k compared to £1,860k in H1 2020.

Vela Technologies Plc (LON: VELA)

Vela Technologies is an early-stage investor in disruptive technology businesses. It is also involved in buying and consolidating holdings in small- and medium-sized businesses (SMBs) active in developing engineering and technology solutions.

In February 2021, Vela invested £350k in Aeristech for its £5.1 million pre-IPO funding. It also made a £150k investment in Spinnaker Opportunities (to be re-named as Kanabo Group) through a 2.3 million share subscription at a per-share price of 6.5 pence.

In July 2021, Vela announced an investment of £750k in Northcoders Group Plc as a part of its £3.5 million IPO funding round.

At the day’s close on Tuesday 28 September 2021, the shares of Vela Technologies were at GBX 0.07. The market cap of the company currently stands at £11.78 million.

.jpg)