Highlights

- GSK’s board announced a dividend payout of 19 pence per share to shareholders for Q2 2021.

- AstraZeneca recorded a revenue of $15,540 million in H1 2021, up by 23% year-on-year.

The UK pharmaceutical industry is a major global hub for the research, development and production of pharmaceuticals and also plays a crucial role in the country’s economy. Pharmaceutical companies gained heavily from the development and commercialisation of COVID-19 testing kits, vaccines and therapies. Two major pharmaceutical companies in the UK - GlaxoSmithKline Plc and AstraZeneca Plc, along with the University of Cambridge, collaborated to boost testing for COVID-19 as a part of the UK Government’s announcement of a new five-pillar plan.

The companies have also been focusing on the development and production of vaccines and therapies for the treatment of COVID-19. Investors keen on diversifying their portfolios can add these pharma stocks, as they offer attractive dividend payout to shareholders. Below is a review of the investment potential in 2 FTSE pharma companies – GlaxoSmithKline and AstraZeneca.

(Data source: Refinitiv)

GlaxoSmithKline Plc (LON: GSK)

GlaxoSmithKline is a UK-based pharmaceutical company. In August, GlaxoSmithKline, in collaboration with SK bioscience, announced the commencement of Phase 3 clinical trial of SK's COVID-19 vaccine candidate, GBP510, in combination with GSK's pandemic adjuvant.

The British drug maker is under fresh pressure from Bluebell Capital Partners, a small stakeholder in the company, to sell off the consumer healthcare division.

GlaxoSmithKline’s overall revenue from sales for Q2 was reported to be £8.1 billion. It recorded an operating profit of £1.68 billion in the quarter. Its pharmaceuticals, vaccines and consumer healthcare divisions reported revenues of £4.2 billion, £1.6 billion and £2.3 billion, respectively.

Dividend paying pharma stocks for income investors

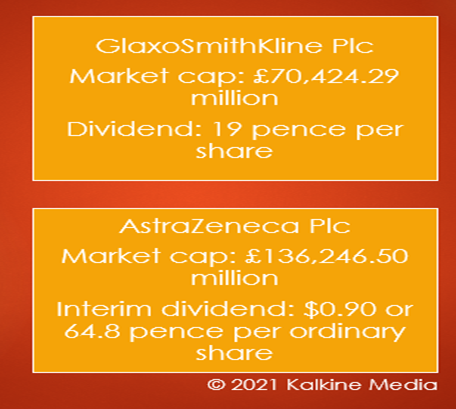

The shares of GlaxoSmithKline are trading at GBX 1,402.40, up by 0.20% at 10:28 AM BST on 18 September 2021. The market cap of GlaxoSmithKline currently stands at £70,424.29 million.

GSK’s board announced a dividend payout of 19 pence per share to shareholders for Q2 2021.

AstraZeneca Plc (LON: AZN)

AstraZeneca is a UK-based pharmaceutical and biotechnology firm. Recently, the European Medicines Agency (EMA), Europe's drug regulator, commenced the real-time review of AstraZeneca's antibody COVID-19 therapy. The company also demonstrated positive results from the HIMALAYA Phase III trial of tremelimumab added to Imfinzi as a first-line treatment for liver cancer. AstraZeneca's Alexion plans to fully acquire Caelum Biosciences for its CAEL-101, a fibril-reactive monoclonal antibody for light chain amyloidosis treatment.

AstraZeneca recorded a revenue of $15,540 million in H1 2021, up by 23% year-on-year. Its new medicines revenue improved by 31% to $8,332 million.

The shares of AstraZeneca are trading at GBX 8,742.00, down by 0.60% at 11:05 AM BST on 18 September 2021. The market cap of AstraZeneca currently stands at £136,246.50 million.

AstraZeneca announced an interim dividend of $0.90 or 64.8 pence per ordinary share to shareholders.

.jpg)