Highlights

- Whitbread’s total UK accommodation sales were 60.9% lower in Q1 FY 2022 than Q1 FY2020.

- Marston’s acquired on lease a warehouse in Runcorn spread across an area of 40,000 sq. ft., to develop its national in-house secondary logistics network

The global hospitality sector was hard hit by the pandemic. Over the past 18 months, the sector lost business due to the imposition of lockdowns and poor demand due to the ensuing economic slowdown. As a result, the majority of the hospitality sector businesses have been reeling under the impact of low revenues and losses since April 2020.

Nevertheless, with the reopening of the economy, rising vaccination rates, and easing of COVID-19 related restrictions, the hospitality sector is witnessing a resurgence. Investors seeking to leverage the changing macroeconomic scenario could explore the investment potential in hospitality sector stocks.

(Data source: Refinitiv)

Here is a detailed review of the investment prospect in two FTSE listed hospitality stocks.

Whitbread Plc (LON: WTB)

Whitbread is a leading hotel and restaurant business in the UK. It is the owner of Premier Inn - the country’s leading hotel brand.

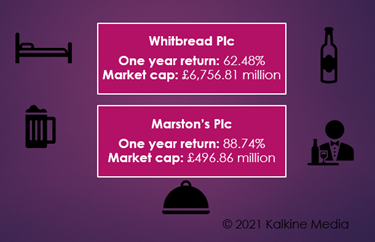

Whitbread’s shares are trading at a GBX 3,333.00, down slightly by 0.36% at 12:38 PM BST on 23 September 2021. The market cap of the company stands at £6,756.81 million. Over the last one year, the shares of Whitbread gave a return of 62.48% to shareholders.

For Q1 FY 2022, Whitbread’s total UK accommodation sales were 60.9% lower than that in Q1 FY2020 due to the result of government-imposed COVID-19 restrictions throughout the quarter. As only essential business travel stays were permitted before 17 May 2021, occupancy levels grew steadily from 35% at the beginning of the quarter to nearly 50% in the first two weeks of May.

Marston’s Plc (LON: MARS)

Marston's is a UK-based operator of pubs and hotels. It currently operates about over 1,500 pubs in the UK. Recently, Marston’s acquired on lease a warehouse in Runcorn spread across an area of 40,000 sq. ft., to develop its national in-house secondary logistics network.

Marston’s shares are trading at a GBX 77.80, down slightly by 0.70% at 12:37 PM BST on 23 September 2021. The market cap of the company stands at £496.86 million. Over the last one year, the shares of Marston’s gave a return of 88.74% to shareholders.

For the half-year ended 3 April 2021, Marston’s revenue reached £55.1 million from £343.3 million for the same period in 2020. It recorded a net cash flow of £110 million for the six months ended 3 April 2021 compared to £3 million in H1 2020.

.jpg)