Summary

- As per the industry experts, the UK and EU are not able to reach a consensus on free trade agreement.

- Jonathan Haskel of the BOE, warned the slow recovery of the British economy.

- Gear4music witnessed an increase in the demand during April and May 2020. The total sales in Q1 FY21 were up by 68 percent year on year.

- Gear4music is hopeful of achieving full year FY21 result better than the previous expectations.

- Symphony Environmental's shares touched their 52-week high of GBX 33.10 (on 23 July 2020, before the market close at 2:00 PM GMT+1), as the Company reported positive test results for bovine coronavirus on d2p masterbatch technology.

- SYM received FDA approval for the antimicrobial technology used in food packaging.

Given the above market-conditions, we would review stocks - Gear4music Holdings PLC (LON:G4M) & Symphony Environmental Technologies PLC (LON:SYM). Gear4music is a consumer stock, whereas Symphony Environmental is a industrials stock. Shares of G4M and SYM touched their 52-week high of GBX 539.00 and GBX 33.10, respectively (on 23 July 2020, before the market close at 2:00 PM GMT+1). The year to date return of G4M was around 153.65 percent, and SYM was around 177.83 percent. Let's walk through their financial and operational updates to understand the stocks better.

Gear4music Holdings (LON:G4M) - Own brand sales grew by 21.8 percent year on year in FY20

Gear4music Holdings is a UK based online seller of musical instruments and musical equipment. The Company operates 20 websites in multi-language and sells its own brands along with premium brands such as Fender, Yamaha and Roland. The Company is headquartered in York, and it has distribution centres in York, Sweden and Germany. Gear4music is included in the FTSE AIM All-Share index.

Q1 FY21 Trading update (ended 30 June 2020) as reported on 23 June 2020

In Q1 FY21, the Company's total sales surged by 68 percent year on year to £37.3 million from £22.2 million in Q1 FY20. The UK and international sales increased by 80 percent and 55 percent year on year to £21.2 million and £16.1 million, respectively.

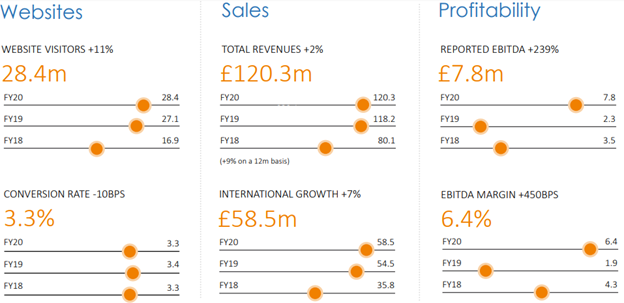

FY2020 Preliminary results (ended 31 March 2020) as reported on 23 July 2020

The Company reported revenue of £120.3 million, which increased by 2 percent year on year from £118.2 million in FY19. The gross profit and EBITDA were £31.2 million and £7.8 million, respectively. The gross profit margin was 25.9 percent in FY20, that increased by 3.1 percent from last year. The net profit in FY20 was £2.6 million, which improved from a loss of £0.2 million in FY19. The UK business division added £61.8 million, whereas the international business added £58.5 million to the total revenue. Gear4music had 28.4 million visitors on the websites, of which 3.29 percent converted to actual buyers. The average value for the purchase remained flat at £117.0 as compared to the last year. The Company has a total of 54,200 products listed on the websites. In FY20, the Company's Own brand sales growth was 21.8 percent year on year to £35.4 million, whereas Other-brand sales growth was 3.5 percent year on year to £79.4 million. As on 31 March 2020, Gear4music had cash of £7.8 million and net debt of £5.5 million. Under the product sales Guitars sales was £31.6 million, Keys was £25.0 million, Live & PA was £21.8 million, whereas Drums, Studio and Orchestral sales were £12.9 million, £14.6 million and £7.8 million, respectively

FY2020 Key Performance Indicators

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-23-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Gear4music Holdings PLC's shares last traded at GBX 527.00 (as on 23 July 2020, before the market close at 2:40 PM GMT+1). Stock 52-week High and Low were GBX 539.00 and GBX 135.00, respectively. The Company had a market capitalization of £84.83 million.

Business Outlook

The Company is confident over a positive outlook and would focus on expanding business in the UK and Europe. The pandemic has shifted the demand for purchase of musical instruments from physical stores to online websites. The Company's trading momentum was strong in July in tandem with Q1 FY21, and the Company would target higher gross margin following the lower marketing cost. The Company is hopeful of achieving full year FY21 result better than the previous expectations. Gear4music's growth strategy remains in e-commerce excellence, supply chain improvement and international expansion.

Symphony Environmental Technologies PLC (LON:SYM) - An increased requirement of oxo-biodegradable plastics to support the business

Symphony Environmental Technologies PLC is a UK based Company engaged in the development and marketing of plastic products. The Company offers packaging technology that is used in all types of packaging applications and deals with plastic pollution. The leading brands of the Company include d2w (oxo-biodegradable plastic) and d2p. The Company is included in the FTSE AIM All-Share index.

Positive test results for bovine coronavirus

On 23 July 2020, the Company reported positive antiviral test for the d2p antimicrobial masterbatch technology. D2p masterbatch technology is used in making personal protective equipment and packaging products. The technology was tested in Eurofins Laboratories. It was found that 99.84 percent of the virus was reduced in 24 hours. The bovine coronavirus is closely related to Covid-19. The Company expects to receive the final report soon.

Six months trading update (ended 30 June 2020) as reported on 16 July 2020

In H1 FY20, the Company generated revenue of £4.8 million, which was up by 17 percent year on year from £4.1 million in H1 FY19. The business was impacted in the last three months of the reported period due to the lockdown. As on 30 June 2020, the Company had cash of £0.3 million and letters of credit and invoice financing of £1.0 million. In February 2020, the Company received FDA approval to use d2p antimicrobial technology in polyethylene (LLDPE) film for wrapping bread. The food-contact approval from FDA would help the Company to expand the commercial footprint in the US. The Company has received orders for personal protective equipment of more than £0.95 million of which £0.50 million order was received in May 2020. The products are expected to be delivered in H2 FY20.

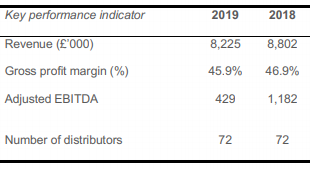

FY2019 Key Performance Indicators

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-23-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Symphony Environmental Technologies PLC's shares last traded at GBX 31.33 (as on 23 July 2020, before the market close at 2:40 PM GMT+1). Stock 52-week High and Low were GBX 33.10 and GBX 5.02, respectively. The Company had a market capitalization of £25.50 million.

Business Outlook

Symphony Environmental Technologies remains confident over increasing demand for plastic products as the Company's biodegradable and antimicrobial products play a critical role. The Company witnessed increased demand for the products and has a healthy order book. Few countries in the Middle East have enacted the requirement of oxo-biodegradable plastics. As the Company has received a positive result for bovine virus test, the sales team would focus to bring the product quickly to the market. The Company refrained from providing any guidance following the uncertainty in the economic conditions.