Summary

- The LSE saw a host of announcements regarding mergers and acquisitions.

- Sanne Group Plc shares surged over 25 per cent after rejecting a proposal by Cinven Limited.

- Grainger, Intertek, and Argo Blockchain among others, have announced buying new companies.

The London Stock Exchange has been buzzing with the announcement of a host of mergers and acquisitions (M&A). A number of FTSE 250 and few FTSE 100 companies have announced plans to acquire other assets or other companies or have shown interest to acquire some company.

Here is a look at the stocks that are buzzing with M&A news:

Sanne Group Plc (LON:SNN)

The FTSE 250 asset management services company rejected a proposal by Cinven Limited made on 4 May to take over the company. Cinven had proposed a possible cash offer at 830 pence per share. It had also said that eligible Sanne shareholders could retain a final dividend at 9.9 pence per share announced in March.

Cinven is now considering its position and would be required to make a fresh offer or withdraw interest by 11 June, according to City regulations.

(Source: Refinitiv, Thomson Reuters)

The shares of the company were trading at GBX 757, up by 26.53 per cent on 14 May at 09:12 GMT+1. The FTSE 250 was up by 0.69 per cent at 22,220.62.

Grainger Plc (LON: GRI)

The FTSE 250 residential property company has announced that it would buy, pre-fund, and operate the build-to-rent development of the Becketwell area in Derby. The company would acquire 259-home built to rent in the regeneration scheme for £37.4 million. GMI Construction Limited is the contractor for the project.

Also read: Spotlight On 3 FTSE 250 Real Estate Stocks as March Sees Strongest Mortgage Borrowing

(Source: Refinitiv, Thomson Reuters)

The investment is expected to garner around 7 per cent gross yield on cost for Grainger once after stabilising. CEO Helen Gordon said that the scheme would bring scale to their Midlands cluster and help in improving efficiencies.

The shares of the company were trading at GBX 286.20, up by 0.07 per cent on 14 May at 08:20 GMT+1. FTSE 250 was up 0.87 per cent at 22,260.20.

Intertek Group Plc (LON:ITRK)

The FTSE 100 assurance company acquired a leading assurance services company SAI Global Assurance. The transaction was completed for a consideration of $855 million cash and is on debt free basis. It has been financed through new debt facilities.

For the fiscal year ending 30 June 2021, SAI Global Assurance’s revenue is expected to be $240 million 23 per cent EBITDA margin. The deal is expected to expand Intertek's operations across several high-growth segments like food and agriculture.

Intertek’s CEO Andre Lacroix said that SAI Global Assurance brings a customer base that is large and strong management systems certification. Lacroix said that together the new entity would be able to deliver better services to customers and would benefit from cost and operational efficiencies.

(Source: Refinitiv, Thomson Reuters)

Intertek’s shares were trading at GBX 5,890, up by 1.30 per cent on 14 May at 08:20 GMT+1. FTSE 100 was up 0.76 per cent at 7,016.27.

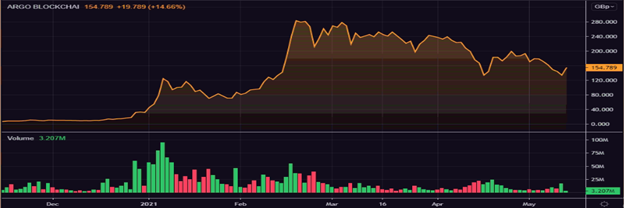

Argo Blockchain Plc (LON: ARB)

The cryptocurrency mining company acquired two data centres in Canada’s Quebec. The consideration made for the acquisition was majorly non-cash, which included the transfer of existing bank obligations of these facilities and a deposit that was paid earlier.

The facilities presently house a significant number of Argo’s mining equipment and have a total power capacity of 20MW. Argo’s CEO Peter Wall said that deal would give the company greater control over its mining cost base and mining production while laying the foundation for long-term growth.

(Source: Refinitiv, Thomson Reuters)

The shares of the company were trading at GBX 154.789, up by 9.26 per cent on 14 May at 08:39 GMT+1.

Essentra Plc (LON:ESNT)

The FTSE 250 listed essential components and solution company announced the purchase of Jiangxi Hengzhu Electrical Cabinet Lock Co. The transaction is expected to be closed in the third quarter of this year.

Initially, Essentra would have a 73 per cent stake in the new company, and the remainder would be with the present principal owner of Hengzhu. The remaining stake would be based on put and call options which would enable Essentra to acquire the minority shareholding. The maximum upper limit for it has been fixed at ¥37.5m (or around £4 million).

Essentra has paid ¥100m (around £11 million), and it would be funded completely from existing facilities. CEO of Essentra Paul Forman said that the deal would help the company to strengthen its position in China and help in expanding the company’s access hardware range.

(Source: Refinitiv, Thomson Reuters)

The shares of the company were trading at GBX 310.0, up by 1.31 per cent on 14 May at 09:02 GMT+1. The FTSE 250 was up by 0.69 per cent at 22,220.62.

.jpg)