UK Market News: The UK stock market suffered a sharp sell-off on Wednesday, led by a fall in commodity stocks. The blue-chip FTSE 100 index lost over 1% after new figures from the Office for National Statistics (ONS) revealed UK inflation in May rose to 9.1%, its highest since 1982. Meanwhile, UK house prices rose by 12.4% to a record high of 281,000 in April. The pace of growth was the second-highest after April 2021.

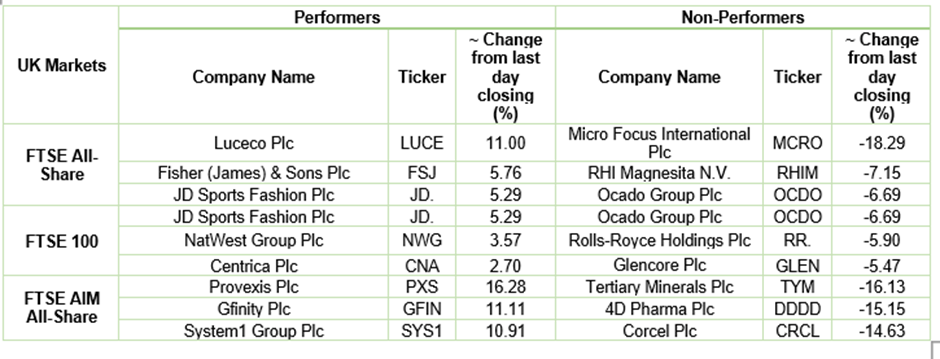

NatWest Group Plc (LON: NWG): The share of the banking and insurance holding company, NatWest Group Plc rose by around 3.5%, with a day’s high of GBX 231.00. The UK government extended its plan to dispose of part of its shareholdings in the group for another 12 months.

JD Sports Fashion Plc (LON: JD.): The share of British sports-fashion retail company, JD Sports Fashion Plc rose by 5.29%, with a day’s high of GBX 113.35. The retailer reported a record profit for the year and has unveiled plans to overhaul its corporate governance and internal controls.

Shell Plc (LON: SHEL): The share of multinational oil and gas company, Shell Plc fell by around 3.5%, with a day’s low of GBX 2,054.00. It came after oil prices skidded over US$6 a barrel amid a push by US President Joe Biden to bring down soaring fuel costs.

US Markets: The US market is likely to get a negative start, as indicated by the futures indices. S&P 500 future was down by 31.16 points or 0.78% at 3,736.13, while the Dow Jones 30 futures was down by 0.92% or 280.02 points at 30,250.23. The technology-heavy index Nasdaq Composite future was down by 0.66% at 11,461.49 (At the time of writing – 9:44 AM ET).

US Market News:

The share of the recreational vehicle maker Winnebago (WGO) jumped by 3.4% in the premarket trading session after beating top and bottom-line estimates for its latest quarter. The company earned an adjusted US$4.13 per share, up from its estimates of US$2.96, driven by an increase in its gross profit margins and higher prices.

The share of the American furniture manufacturer, La-Z-Boy (LZB) surged by 8.2% in the premarket trading session after it reported better than expected quarterly results with record sales. The furniture manufacturer also said it is focusing efforts to reduce its backlog and shorten lead times.

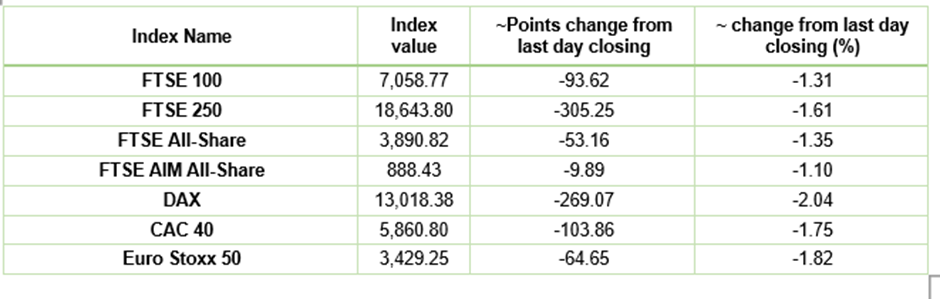

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 22 June 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), JD Sports Fashion Plc (JD.).

Top 3 Sectors traded in green*: Healthcare (0.37%) and Utilities (0.23%).

Top 3 Sectors traded in red*: Basic Material (-4.34%), Energy (-3.57%), Consumer Cyclicals (-1.42%)

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $109.29/barrel and $103.89/barrel, respectively.

Gold Price*: Gold price hovered at around US$ 1,839.35 per ounce, down by 0.02% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2246; EUR to USD: 1.0516.

Bond Yields*: US 10-Year Treasury yield: 3.211%; UK 10-Year Government Bond yield: 2.5355%.

*At the time of writing