US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 5.01 points or 0.15 per cent lower at 3,395.96, Dow Jones Industrial Average Index contracted by 135.04 points or 0.49 per cent lower at 27,550.34, and the technology benchmark index Nasdaq Composite traded higher at 11,423.40, up by 64.46 points or 0.57 per cent against the previous day close (at the time of writing, before the US market close at 11:45 AM ET).

US Market News: The Wall Street opened mixed amid the weaker investor sentiments as covid-19 cases climbed. The Durable Goods Orders in the US increased by 1.9% month on month in September 2020 than was better than the estimate of 0.5%. Among the gaining stocks, Harley Davidson surged by approximately 26.9% after its profit improved year on year. Xilinx gained by close to 9.7% as it would be bought by AMD for USD 35 billion in an all-stock deal. Merck was up by around 0.2% as it reported earnings per share of USD 1.74. Among the decliners, the shares of Advanced Micro Devices were down by around 3.3% as the company is expected to buy Xilinx. Caterpillar declined by about 2.9%, although it reported earnings better than the estimates. 3M slipped by nearly 1.4% after it reported earnings per share of USD 2.43.

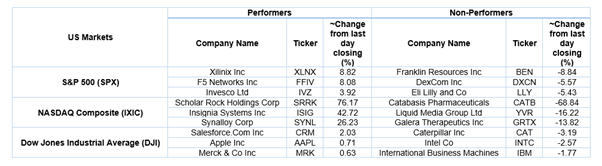

US Stocks Performance*

European News: The London and European markets traded in the red as the pandemic weighs down. The UK retail sales indicated by the Confederation of British Industry fell to -23 in October 2020 from +11 in September 2020. Among the gaining stocks, Bloomsbury Publishing rose by around 19.5% after it reported profit growth of 60% in H1. HSBC gained close to 3.3% after it reported a lower expected credit loss and impairment charge. Unilever was up by around 0.1% after the company announced that it intends to proceed with the unification procedure of corporate structure. Among the decliners, Easyjet fell by about 2.0% after it announced aircraft sale and leaseback. Whitbread was down by nearly 0.9% after it reported year on year decline in sales.

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 27 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); International Consolidated Airlines Group SA (IAG).

Top Sector traded in green*: Healthcare (+0.60%).

Top 3 Sectors traded in red*: Energy (-2.26%), Real Estate (-1.67%), and Basic Materials (-1.60%).

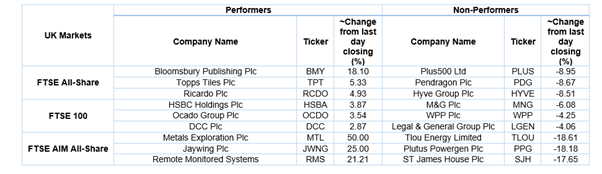

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $41.63/barrel and $39.61/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,910.35 per ounce, up by 0.24% against the prior day closing.

Currency Rates*: GBP to USD: 1.3063; EUR to GBP: 0.9053.

Bond Yields*: US 10-Year Treasury yield: 0.779%; UK 10-Year Government Bond yield: 0.234%.

*At the time of writing

.jpg)