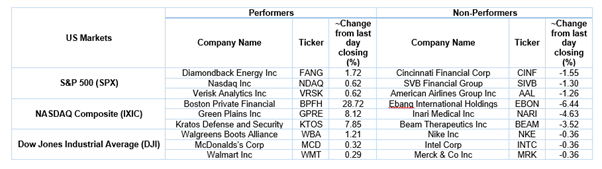

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 7.99 points or 0.22 per cent higher at 3,708.64, Dow Jones Industrial Average Index expanded by 27.44 points or 0.09 per cent higher at 30,251.33, and the technology benchmark index Nasdaq Composite traded higher at 12,760.17, up by 61.73 points or 0.49 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in the mixed territory as Covid-19 vaccinations fall below the Government predictions. The manufacturing PMI had climbed to 57.1 during December 2020, while it was 56.7 during November 2020. Among the gaining stocks, Jefferies Financial Group grew by about 2.02% after the company reported impressive quarterly earnings per share of US$1.11. Bilibili gained about 1.59% after the company announced its plan to raise US$2 billion through a secondary listing in Hong Kong. Shares of Moderna went up by around 1.17% after the company received approval from Israeli regulators for its Covid-19 vaccine. Among the declining stocks, Alibaba shares fell by about 0.31% after the company planned to shut its streaming platform Xiami Music. Shares of Mondelez went down by 0.16% after the company reached on the verge of closing its deal to buy chocolate bar maker, Hu Master Holdings.

US Stocks Performance*

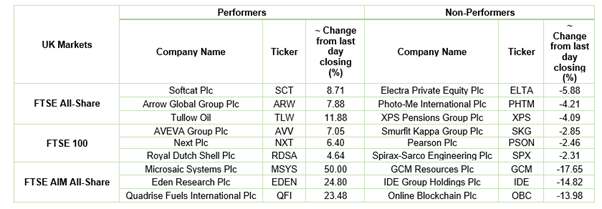

European News: The London markets traded in the green zone though Prime Minister Boris Johnson announced a third national lockdown. The chancellor, Rishi Sunak had announced £4.6 billion of the business support package. Among the gaining stocks, Shares of Softcat grew by 9.50% after it had reported positive trading since its first-quarter statement in November 2020. Ferrexpo surged by about 6.21% after the company announced a special interim dividend of 13.2 US cents per share. Shares of Next went up by 5.41% after the company reported less than expected drop in its sales. Among the decliners, Mondi was declined by about 1.11% after the company agreed to buy a significant stake in the Turkish packaging firm. Shares of WM Morrison Supermarkets went down by 0.83% despite the fact that it had reported a growth in sales over Christmas and New year period. Shares of Smurfit Kappa Group had dropped the most on the FTSE-100 index.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 5 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Energy (+3.10%), Technology (+0.50%) and Healthcare (+0.18%).

Top 3 Sectors traded in red*: Utilities (-1.59%), Financials (-0.81%) and Basic Materials (-0.76%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $53.27/barrel and $49.88/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,953.45 per ounce, up by 0.35% against the prior day closing.

Currency Rates*: GBP to USD: 1.3639; EUR to GBP: 0.9019.

Bond Yields*: US 10-Year Treasury yield: 0.962%; UK 10-Year Government Bond yield: 0.211%.

*At the time of writing

.jpg)