US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 50.74 points or 1.40 per cent higher at 3,672.37, Dow Jones Industrial Average Index increased by 416.65 points or 1.41 per cent higher at 30,055.29, and the technology benchmark index Nasdaq Composite traded higher at 12,322.01, up by 123.27 points or 1.01 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: Wall Street traded in the green over the vaccine hopes. The US reported Manufacturing PMI of 56.7 in November 2020, which was in line with expectation. Construction spending increased by 1.3% month on month in October 2020. Among the gaining stocks, shares of Sunnova Energy moved up by nearly 3.5% after it announced an offering of 7 million shares. Exxon Mobil gained around 3.3% after it announced the capital spending plan. Tesla was up by about 2.7% after Dow Jones explained how the company would be integrated into the S&P 500. Among the decliners, Zoom shares plunged by around 13.7%, although the company reported better than expected earnings. Nio was down by nearly 7.2% after it reported that it delivered 5,291 vehicles in November 2020.

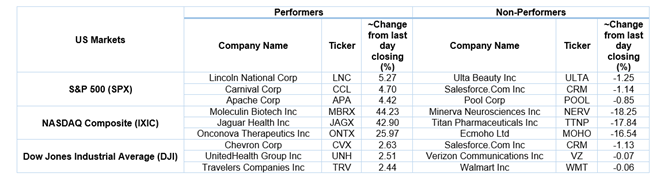

US Stocks Performance*

European News: The London and European markets traded in the green amid the positive hopes of vaccines. The Housing Price Index in the UK increased by 6.5% year on year in November 2020, and it was up by 0.9% month on month. The Manufacturing PMI in the UK was 55.6 for November 2020, which was better than the expected PMI of 55.2. Among the gaining stocks, shares of Fresnillo were up by nearly 6.0% and led the FTSE-100 gain. Grafton rose close to 4.0% after it acquired StairBox. Tate & Lyle was up by around 1.8% after the company announced the acquisition of Sweet Green Fields. Weir rose about 1.3% after the company won an aftermarket order of £95 million. Among the decliners, Pets At Home slipped by around 0.7% after it disposed of the Specialist Group.

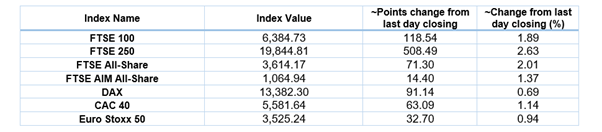

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 1 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Energy (+3.08%), Basic Materials (+2.99%) and Financials (+2.58%).

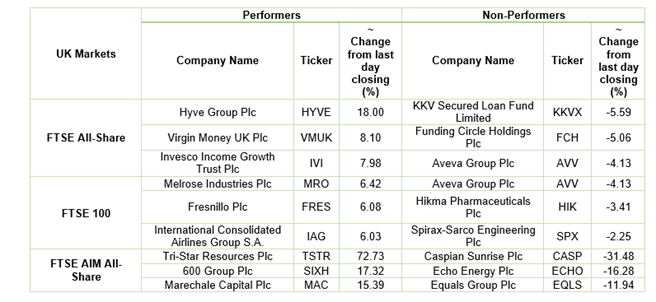

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $47.40/barrel and $44.66/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,819.15 per ounce, up by 2.15% against the prior day closing.

Currency Rates*: GBP to USD: 1.3423; EUR to GBP: 0.8974.

Bond Yields*: US 10-Year Treasury yield: 0.921%; UK 10-Year Government Bond yield: 0.349%.

*At the time of writing