US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 16.07 points or 0.36 per cent lower at 4,480.12, Dow Jones Industrial Average Index dipped by 80.42 points or 0.23 per cent lower at 35,325.08, and the technology benchmark index Nasdaq Composite traded lower at 14,994.20, down by 47.70 points or 0.32 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded in a red zone after the release of US GDP data. Among the gaining stocks, Coty (COTY) shares went up by about 15.43% after the Company had anticipated delivering sales growth for the current fiscal year. Williams-Sonoma (WSM) shares grew by around 11.10% after the Company’s quarterly top-line revenue and bottom-line profitability came out to be more than the consensus estimates. Ulta Beauty (ULTA) shares rose by about 0.14% after the Company raised the full-year outlook. Among the declining stocks, Dollar General (DG) shares went down by around 5.34% after the Company forecasted lower-than-expected earnings for the full year.

UK Market News: The London markets traded in a red zone as investors waited for the fresh growth catalysts.

Polymetal International shares dropped by about 3.22% after the Company had shown a marginal reduction in the gold production during the first half and subsequently raised full-year capital expenditure guidance. Moreover, the Company remained on track to meet 2021 production guidance.

FTSE 100 listed CRH shares rose by around 3.66% after the Company had reported robust growth in the top-line revenue and EBITDA in the recently announced interim results. Moreover, the Company had also raised interim dividend payments and announced a share buyback programme.

Hays had reported a strong recovery in full-year fees and delivered robust growth in profitability. The Company had also resumed dividend payments. Moreover, the shares jumped by around 4.65%.

British Land Company shares dropped by around 0.23% after the Company decided to have a focus on two strategic themes, Campuses and Retail & Fulfilment.

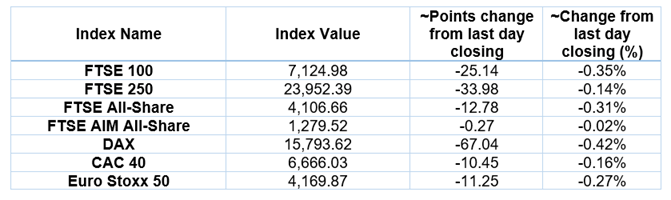

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 26 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Barclays PLC (BARC); Vodafone Group PLC (VOD).

Top Sector traded in green*: Healthcare (+0.03%).

Top 3 Sectors traded in red*: Basic Materials (-1.22%), Utilities (-1.15%) and Financials (-0.63%).

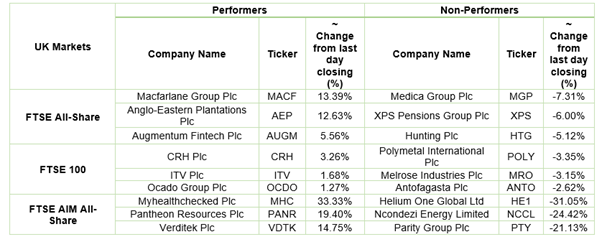

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $70.10/barrel and $67.34/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,792.95 per ounce, up by 0.11% against the prior day closing.

Currency Rates*: GBP to USD: 1.3698; EUR to USD: 1.1752.

Bond Yields*: US 10-Year Treasury yield: 1.344%; UK 10-Year Government Bond yield: 0.5995%.

*At the time of writing