US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 51.26 points or 1.55 per cent higher at 3,349.72, Dow Jones Industrial Average Index expanded by 489.77 points or 1.80 per cent higher at 27,663.73, and the technology benchmark index Nasdaq Composite traded higher at 11,055.52, up by 141.95 points or 1.30 per cent against the previous day close (at the time of writing, before the US market close at 11:55 AM ET).

US Market News: The Wall Street opened in the green after the reports released over the weekend regarding new stimulus package could be achieved. Meanwhile, as per the industry expert’s report, more than 55 percent of the small businesses in the US believe that social distances would harm their survival chances. Among the gaining stocks, shares of WPX Energy and Devon Energy rose by around 8.5 percent and 4.5 percent, respectively after the reports of the merger. Cleveland Cliff was up by around 6.9 percent after the company announced that it would buy the US operation of ArcelorMittal. Uber gained by around 5.6 percent after it won back its operating license in London. Amazon was up by nearly 2.2 percent after it announced the date of this year’s Prime Day. Among the decliners, Inovio Pharmaceuticals plunged by about 29.9 percent after it stated that the covid-19 vaccine candidate for phase 2/3 clinical trial is on partial clinical hold.

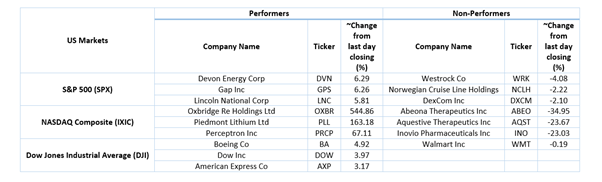

US Stocks Performance*

European News: The London and European markets advanced on Monday as the UK government looks to put further restrictions to curb rising covid-19 cases. Meanwhile, the UK president committed to protecting 30 percent of the UK’s land to boost biodiversity. Among the gaining stocks, Reach surged by close to 17.3 percent after it reported the recovery in the digital advertising business. Scotgold Resources gained about 17.0 percent after it reported encouraging results for an exploration programme at Cononish Gold and Silver Mine. Diageo jumped by around 5.9 percent after it reported a good start for fiscal year FY21. Virgin Money was up by around 5.6 percent after it announced the appointment of Enda Johnson as the interim Group CFO. Among the decliners, shares of William Hill plummeted by nearly 11.8 percent after the reports that the company is in talks with Caesars for takeover. Imperial Brands slipped by almost 0.2 percent after the company announced the sale of its premium cigar business for €1.225 billion that would be completed in October 2020.

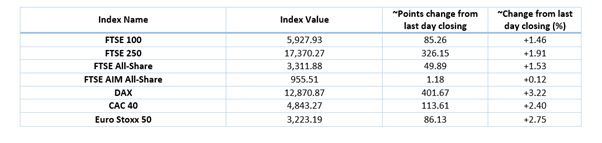

European Index Performance*:

FTSE 100 Index One Year Performance (as on 28 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); HSBC Holdings Plc (HSBA); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Financials (+5.35%), Real Estate (+4.05%) and Consumer Non-Cyclicals (+2.04%).

Top Sector traded in red*: Healthcare (-0.16%).

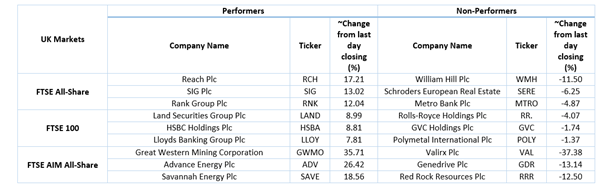

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $42.82/barrel and $40.55/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,884.20 per ounce, up by 0.96% against the prior day closing.

Currency Rates*: GBP to USD: 1.2851; EUR to GBP: 0.9077.

Bond Yields*: US 10-Year Treasury yield: 0.664%; UK 10-Year Government Bond yield: 0.204%.

*At the time of writing