The FTSE-100 opened in red and was trading at 6,243.45, down by 0.78 per cent (before the market close at 2:40 PM GMT+1 on 22nd June 2020). The rising cases of coronavirus posed as a threat to the market. The other critical factors to watch out, which can impact the market:

- The BOE governor Andrew Bailey stated that the central bank would roll back emergency financial stimulus before it increases the interest rate. The BOE extended its quantitative easing program by additional GBP 100 billion on last Thursday.

- The crude oil prices inched up, the agreement over the supply cut was able to hold the prices; however, investors are weary of low demand. The Brent was trading at USD 42.38 per barrel and was up by 0.45 per cent.

- The People's Bank of China kept its benchmark lending rate unchanged at 3.85 per cent.

Given the above market conditions, we will discuss two media stocks - Hyve Group PLC (LON:HYVE) and Reach PLC (LON:RCH). As on 22nd June 2020 (before the market close at 8:02 AM GMT+1), both Hyve Group PLC and Reach PLC were down by 1.27 per cent and 2.10 per cent, respectively. Let us walk through their financial and operational updates.

Hyve Group PLC (LON:HYVE): Postponement plan implemented to lessen the impact due to coronavirus

Hyve PLC is a worldwide organizer of market-leading events in different sectors and tries to connect retailers and brands to consumers. The Group was included in FTSE 250 in January 2020.

H1 FY2020 results (ending 31st March 2020) update as released on 7th May 2020

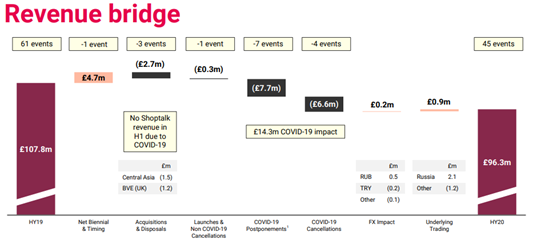

In H1 FY20, Hyve PLC organized 45 events and generated revenue of GBP 96.3 million, which was down by 10.7 per cent year on year. The impact was due to government restriction, cancellation and postponement of events. The statutory loss for the period was GBP 168.3 million which was primarily affected by the non-cash impairment of GBP 166.8 million due to its UK business, Azerbaijan business, Bett, CWIEME and Indonesian JV.

In December 2019, the Company acquired two US-based market-leading events Shoptalk and Grocerytalk focused on e-commerce for retail and grocery, respectively. The two events were bought at a total cost of GBP 110.1 million.

Revenue bridge H1 FY20

(Source: Company Website)

Impact due to Coronavirus and Postponement plan

The Company moved 18 of its FY20 events to FY21 and cancelled 13 events. Under the new plan for events, Hyve has assumed that the events will be organized from August onwards. In order to preserve cash, it has terminated contracts for temporary staff, and it has put some of its staff on furlough. It has cut its capital expenditure by halting the implementation of a group-wide ERP system. It has also suspended its interim dividend payment for FY20. The cost-saving program is planned to save up to GBP 10 million and GBP 42 million in FY20 and FY21, respectively.

Liquidity and Financial Strength

The Company has negotiated to defer the loan repayment of two GBP 17.5 million each due in November 2020 and November 2021 until maturity in December 2023. In December 2019, it refinanced its debt facility of GBP 250 million of which GBP 150 million as revolving credit facility and GBP 100 million term loan.

As reported on 19th June 2020, Hyve submitted the insurance claim for 17 of its FY20 events. It has received payment of GBP 7.35 million for the applications submitted. The insured value of events until 31st October 2020 is approximately GBP 62.0 million.

12th June 2020, the Company announced the completion of right issue of 2,071,568 New Ordinary Shares at 115 pence per share, wherein HSBC, Numic and Barclays acted as underwriters.

Share Price Performance Analysis

Daily Chart as of 22nd June 2020, before the market close (Source: Refinitiv, Thomson Reuters)

The shares of the Hyve Group PLC were trading at GBX 119.50 per share and were up by 2.14 per cent (before the market close at 9.21 AM GMT+1). The stock had it's 52-weeks High and Low of GBX 622.49 per share and GBX 65.76 per share, respectively. The market capitalization of the Company was GBP 328.76 million.

Business Outlook

The Company expects events scheduled in Shanghai; China after 31st July 2020 to take place. It will conduct a virtual Shoptalk's Retail Meetup in Q1 FY21. The in-person events will be severely impacted due to reduced attendance at events which will be held in remaining FY20 and FY21. The travel restrictions and travel budget constraints will restrict the audience. The domestic audiences are expected to be recovered quicker than the international audience. It is building its omni-channel capabilities where the virtual events will complement the in-person events with year-round activity. The Company believes that the global economic backdrop will take some time to stabilize.

Reach PLC (LON:RCH) - Focussing on the online audience and revenue growth

Reach PLC is one of the largest media houses in the UK. The Group operates under two divisions, Print and Digital. It develops and generates content across the UK and Ireland. Some of the major brands in the portfolio are Daily Mirror, Daily Express, Irish Mirror.

Trading update for four months ending 24th April 2020 as released on 07th May 2020

The Group revenue declined by 13.1 per cent for four months year on year. The print revenue was down by 15.8 per cent mainly due to the decline in circulation sales, fall in print advertising due to the cancelled events and lower advertising demand. However, the digital revenue grew by 4.7 per cent due to the increased demand for news and content across digital titles. It had 42 million online users in the UK in March, and there were 1.7 billion page views in April.

In April, the Group revenue fell by 30.5 per cent year on year. The print revenue was down by 31.8 per cent, and digital revenue fell by 22.5 per cent. The decline was primarily due to the impact of lock-down and decline in advertising yield.

- To preserve cash and mitigate the impact of coronavirus on business, the Group had cancelled the final dividend payment for FY19. It has also deducted the salaries, slashed the bonus scheme and has put employees on furlough. It has also deferred the monthly contribution of pension of three months to pension funds.

- As on 26th April 2020, the Group had a net cash balance of GBP 33.2 million. It has a 4-year revolving credit facility of GBP 65.0 million of which it has drawn GBP 25.0 million.

Print Media Presence

Digital Media Presence

(Source: Company Website)

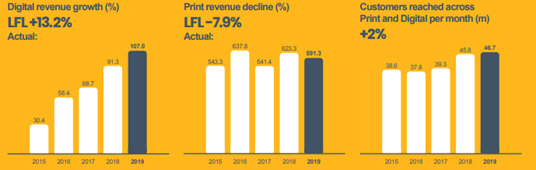

Digital Media

The print news revenue is declining, whereas online news is growing. However, the model for reader paying for online news is indefinable. The Company is the fifth-largest digital news provider in the UK. The content reached 40 million unique users in 2019, and Manchester Evening News became the first website to cross 1 billion views in a single year. As per the annual reports the Company has plans to launch new regional sites in Bolton, Bradford, County Durham, Newport, North Yorkshire, Sheffield and Sunderland in 2020. The digital audience growth, along with digital revenue growth is essential.

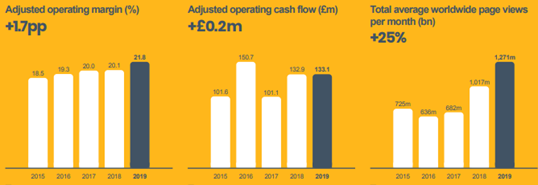

KPIs in FY19

(Source: Company Website)

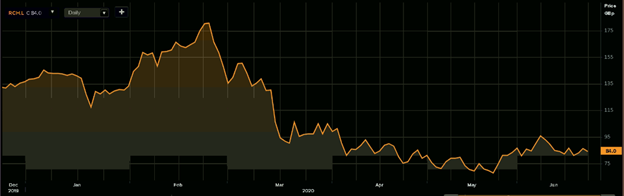

Share Price Performance Analysis

Daily Chart as of 22nd June 2020, before the market close (Source: Refinitiv, Thomson Reuters)

The shares of the Reach PLC were trading at GBX 84.00 per share and were down by 2.21 per cent (before the market close at 9.40 AM GMT+1). The stock had it's 52-weeks High and Low of GBX 186.86 per share and GBX 67.00 per share, respectively. The market capitalization of the Company was GBP 257.07 million.

Business Outlook

The Group has withdrawn guidance for FY20. It believes the COVID-19 to have a significant impact on the revenue; however, the cost mitigation measures taken should offset the effect on profitability and cash flows up to some extent. The advertising will remain very challenging and uncertain, with a significant impact on regional advertising. It will focus on driving digital engagement to gain more audience and revenue.