US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 21.81 points or 0.60 per cent lower at 3,605.10, Dow Jones Industrial Average Index contracted by 274.17 points or 0.92 per cent lower at 29,676.27, and the technology benchmark index Nasdaq Composite traded lower at 11,912.32, down by 11.81 points or 0.10 per cent against the previous day close (at the time of writing, before the US market close at 10:50 AM ET).

US Market News: The key indices of Wall Street traded in the red as the coronavirus cases continue to climb. The retail sales in the US increased by 0.3% month on month in October 2020, which was lower than the expected growth of 0.5%. Among the gaining stocks, shares of Tesla surged by around 9.9% after the announcement that the company would join the S&P 500 from 21 December 2020. Kohls gained approximately 3.1% after it posted a profit against the analyst’s expectation of a loss. Amazon was up by about 0.7% after the company launched Amazon Pharmacy in the US. Among the decliners, Home Depot shares were down by about 2.9%, although it reported revenue above estimates. Walmart was down by around 0.2% after it posted quarterly earnings of USD 1.34 per share.

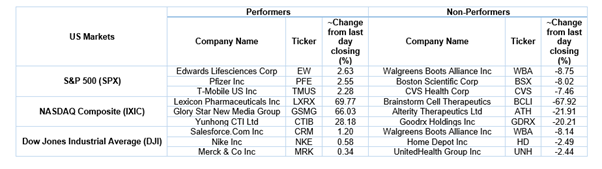

US Stocks Performance*

European News: The London and European markets retreated as the covid-19 cases continue to rise. The UK signed a deal with Moderna for the supply of covid-19 vaccines from March 2021. Meanwhile, British Prime Minister Boris Johnson stated that the EU deal is far from certain. Among the gaining stocks, Intermediate Capital gained around 6.5% after the company raised new funding of €2.6 billion in H1 FY21. Imperial Brands was up by nearly 6.0% after it reported a 0.8% increase in net revenue in FY20. Homeserve rose about 1.9% after it reported a 17% increase in revenue in H1 FY21. Among the decliners, shares of HSBC were down by around 4.1% after it announced the tender offer for nine series of notes. Experian declined by approximately 3.0%, although it reported an increase in revenue.

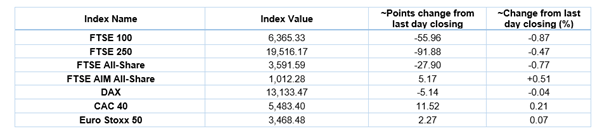

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 17 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Barclays Plc (BARC).

Top 3 Sectors traded in red*: Healthcare (-3.13%), Industrials (-1.66%) and Technology (-1.65%).

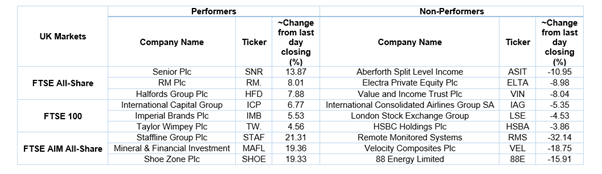

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $43.39/barrel and $40.98/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,886.75 per ounce, down by 0.06% against the prior day closing.

Currency Rates*: GBP to USD: 1.3244; EUR to GBP: 0.8961.

Bond Yields*: US 10-Year Treasury yield: 0.872%; UK 10-Year Government Bond yield: 0.321%.

*At the time of writing

.jpg)