US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 59.61 points or 1.67 per cent higher at 3,637.20, Dow Jones Industrial Average Index increased significantly by 506.00 points or 1.71 per cent higher at 30,097.27, and the technology benchmark index Nasdaq Composite traded higher at 12,027.37, up by 146.74 points or 1.24 per cent against the previous day close (at the time of writing, before the US market close at 1:15 PM ET).

US Market News: The Wall Street traded in the green as the presidential transition officially starts in the US. Dow Jones index surpassed 30,000 level, led by the positive vaccine news and expectations of a swift economic recovery by next year. The House Price Index in the US increased by 9.1% year on year in September 2020. Among the gaining stocks, Boeing gained around 3.6% and led the DOW 30 gain. Dick's Sporting Goods was up by approximately 0.3% after it named Lauren Hobart as the new CEO. Among the decliners, shares of Best Buy plunged by around 6.3% after it reported quarterly earnings of 2.06 US cents per share. Hormel was down by close to 3.2% after it reported revenue below consensus. Burlington Stores slipped by nearly 0.9% after its comparable stores' sales declined.

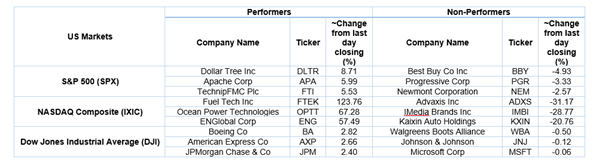

US Stocks Performance*

European News: The London and European markets traded in the green as the investors look beyond the rising covid-19 cases. As per the Confederation of British data, the retail sales balance in the UK declined to -25 in November 2020 from -23 in October 2020. The retail sales declined primarily due to lockdown in November. Among the gaining stocks, Carnival surged around 10.7% after it announced the closing of repurchase of notes. UDG Healthcare gained around 5.9% after it reported a 5% increase in net revenue in FY20. Caledonia Investments was up by about 1.2% after it reported a rise in net assets. Among the decliners, shares of AO World plunged by nearly 8.1%, although it reported a 57.6% increase in revenue in H1 FY21. Pets At Home was down by around 3.1% after it reported a decline in underlying profit before tax for H1 FY21.

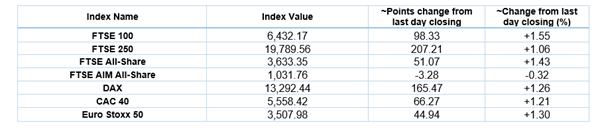

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 24 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group (IAG).

Top 3 Sectors traded in green*: Energy (+4.55%), Basic Materials (+1.36%) and Financials (+1.10%).

Top 2 Sectors traded in red*: Industrials (-0.29%) and Healthcare (-0.02%).

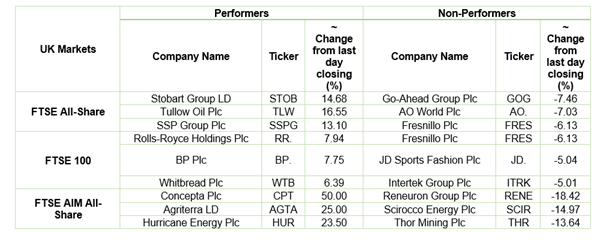

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $47.81/barrel and $44.96/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,804.25 per ounce, down by 1.83% against the prior day closing.

Currency Rates*: GBP to USD: 1.3350; EUR to GBP: 0.8896.

Bond Yields*: US 10-Year Treasury yield: 0.882%; UK 10-Year Government Bond yield: 0.326%.

*At the time of writing