Global Markets*: Equities at the Wallstreet extended gains in the last trading day of this week, with broader index S&P 500 increased by 6.02 points or 0.19% to 2,982.02, the Dow Jones Industrial Average Index surged by 70.80 points or 0.26% to 26,798.97 and the technology benchmark index Nasdaq Composite index expanded by 12.40 points or 0.15% to 8,128.60, respectively.

Global News: Amid rising threats from trade tensions, the Labour Department reported that even as wage growth remained strong, job growth slowed more than expected in August as nonfarm payrolls increased 130,000 last month, keeping the unemployment rate steady at 3.7%. Hiring in the retail sector fell for a seventh straight month. White House economic adviser Larry Kudlow said on Friday that no precise date for the October negotiations had been set and he expected the talks to heat up during the meetings. Increased expectations of an interest rate cut, due to weak jobs data, and stimulus plan by China helped equities to open higher on Friday.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 11.17 points or 0.15% higher at 7,282.34, the FTSE 250 index snapped 55.96 points or 0.28% higher at 19,705.52, and the FTSE All-Share Index ended 7.53 points or 0.19% higher at 3,998.18 respectively. Another European equity benchmark index STOXX 600 ended at 387.14, up by 1.22 points or 0.32 per cent.

European News: Increasing tensions with the administration of Boris Johnson over delaying Brexit, British opposition parties said on Friday that demands by the PM to call an early general election in mid-October would be blocked by them, complicating the task of Johnson who has promised to leave the bloc by 31 October. Mr Johnson said on Friday that resigning was not in his mind, and he still seeks to get a deal from the EU. A Bank of England survey showed that public expectations for inflation in the next 12 months hit an almost six-year high last month, reflecting the fall in the value of the pound as the Brexit crisis escalates.

London Stock Exchange (LSE)

Top Performers*: JUST GROUP PLC (JUST), MCCOLL'S RETAIL GROUP PLC (MCLS) and G4S PLC (GFS) were the gainers for the day (at the time of writing) and expanded by 8.23%, 6.59% and 6.11% respectively.

Worst Performers*: MOTORPOINT GROUP PLC (MOTR), MCBRIDE PLC (MCB) and METRO BANK PLC (MTRO) were the top three laggards of the day and down by 14.58%, 5.83% and 5.69% respectively.

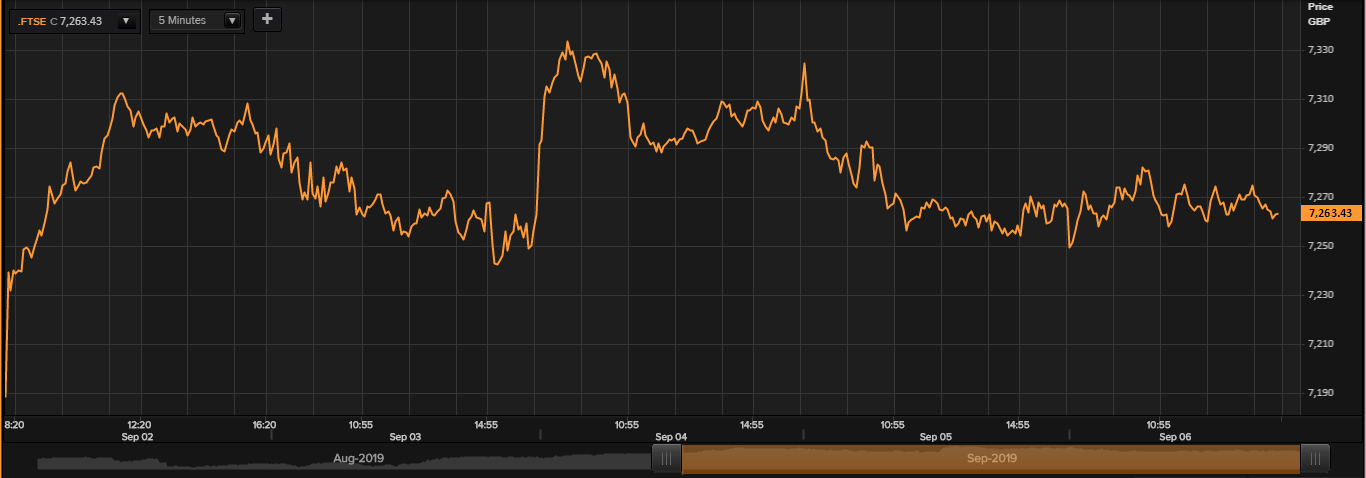

FTSE 100 Index

5-days Daily Price Chart (as on September 06, 2019, before the market close). (Source: TR)

Performers*: SMURFIT KAPPA GROUP PLC (SKG), BERKELEY GROUP HOLDINGS (THE) PLC (BKG) and LONDON STOCK EXCHANGE GROUP PLC (LSE) were the top gaining stocks in todayâs session and surged by 4.76%, 2.53% and 2.08% respectively.

Laggards*: UNITED UTILITIES GROUP PLC (UU.), CENTRICA PLC (CNA), and SEVERN TRENT PLC (SVT) were the losers for the day (FTSE 100 index) and contracted by 3.39%, 2.31% and 2.04% respectively.

Volume Movers*: LLOYDS BANKING GROUP PLC (LLOY), ROYAL BANK OF SCOTLAND GROUP PLC (RBS) and VODAFONE GROUP PLC (VOD) were the top volume movers for the day (at the time of writing).

FTSE 100 Sectors Cues

Performers*: Industrials (+0.71%), Basic Materials (+0.60%), and Healthcare (+0.52%).

Laggards*: Utilities (-1.43%), Energy (-1.27%) and Consumer Non-Cyclicals (-0.22%).

FX Rates (the time of writing): GBP/USD and EUR/GBP were trading at 1.2294 and 0.8976 respectively.

10-Year Bond Yields (at the time of writing): US 10Y Treasury and UK 10Y Bond yields were exchanging at 1.543% and 0.504% respectively.

*At the time of writing