Source:Copyright © 2021 Kalkine Media Pty Ltd.

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 38.73 points or 1.03 per cent higher at 3,807.20, Dow Jones Industrial Average Index surged by 316.42 points or 1.02 per cent higher at 31,240.56, and the technology benchmark index Nasdaq Composite traded higher at 12,798.28, up by 74.81 points or 0.59 per cent against the previous day close (at the time of writing, before the US market close at 1:20 PM ET).

US Market News: The major indices of Wall Street traded in a green zone after payroll growth set to strengthen again. Among the gaining stocks, Imax Corp shares jumped by approximately 13.44%, even after the Company had reported a wider loss than the consensus estimates. Among the declining stocks, Big Lots shares plunged by approximately 4.40%, although the discount retailer posted quarterly profit more than the consensus estimates. Shares of Corelogic went down by about 3.40% after CoStar Group decided to cancel its offer to buy the Company. Costco Wholesale Corp shares dropped by about 2.72% after the Company reported quarterly earnings well short of the consensus estimate.

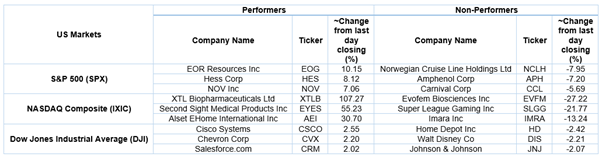

US Stocks Performance*

UK Market News: The London markets traded in red zone reflecting weak investor sentiments regarding inflation fears and a slowdown in the UK house prices. FTSE 100 traded lower by around 0.31% after oil prices reach almost 14-months high. According to the mortgage lender Halifax, UK house prices fell by around 0.1% during February 2021 after witnessing a drop of 0.4% in January 2021.

FTSE 250 listed ConvaTec Group had reported growth in full-year revenue after the Covid-19 pandemic had provided both opportunities as well as challenges during 2020. Meanwhile, the shares jumped by about 2.44%.

Technology Company, Spirent Communications shares surged by approximately 7.22% after it had announced the acquisition of US-based OctoScope for an initial consideration of USD 55 million.

London Stock Exchange shares dropped by around 12.31% even after reporting stronger-than-expected sales and profit in both its Post Trade units and Information units. However, it admitted regarding facing rising competition from Europe.

Britain’s biggest supermarket chain Tesco remained committed to achieving the sale of healthy food to 65% of total sales by 2025. Moreover, the shares went up by approximately 1.82%.

Equipment Rental Company Aggreko shares jumped by around 1.01% after receiving a buyout offer worth approximately 2.32 billion pounds from I Squared Capital and TDR Capital.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 5 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Energy (+2.62%), Basic Materials (+0.68%) and Healthcare (+0.67%).

Top 3 Sectors traded in red*: Real Estate (-0.96%), Industrials (-0.29%) and Utilities (-0.18%).

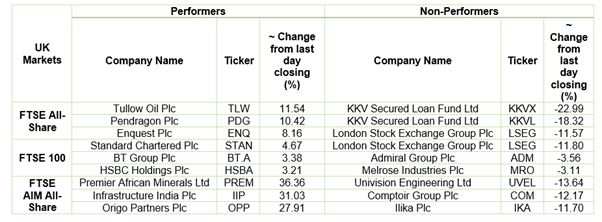

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $69.38/barrel and $66.22/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,701.35 per ounce, up by 0.04% against the prior day closing.

Currency Rates*: GBP to USD: 1.3830; EUR to GBP: 0.8613.

Bond Yields*: US 10-Year Treasury yield: 1.551%; UK 10-Year Government Bond yield: 0.743%.

*At the time of writing