US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 31.99 points or 0.94 per cent lower at 3,353.50, Dow Jones Industrial Average Index contracted by 104.05 points or 0.37 per cent lower at 27,928.33, and the technology benchmark index Nasdaq Composite traded lower at 10,869.20, down by 181.27 points or 1.64 per cent against the previous day close (at the time of writing, before the US market close at 11:55 AM ET).

US Market News: The Wall Street traded in red as the technology stocks trended lower. The US jobless claims were 860,000 for the week ended 12 September 2020, and it was below expected claims of 875,000. Among the gaining stocks, Herman Miller surged by around 34.5 percent after it reported earnings better than the estimates and reinstated the quarterly dividend. Ford was up by close to 2.7 percent after the company stated that it plans to make its electric vehicle F-150 different from Tesla and General Motors. Among the decliners, shares of Dave & Bluster’s Entertainment plunged by around 23.0 percent after the reports that the company warned for a bankruptcy. Snowflake was down by close to 11.3 percent on the second day of the market debut after its share price soared 111 percent on Wednesday. Southwest Airlines was down by around 3.0 percent after the company temporarily grounded 130 Boeing planes.

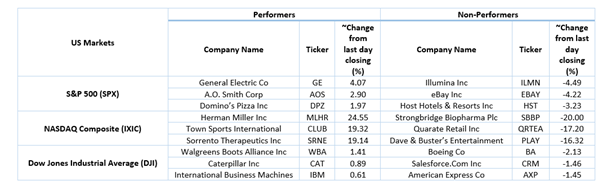

US Stocks Performance*

European News: The UK and European markets trended downwards as the UK government accepted the problem in coronavirus testing system. The car registration in the UK fell by 50.1 percent month on month in August 2020. Meanwhile, the Office for National Statistics stated the 10 percent of the UK’s working class was on furlough programme in two weeks ended on 6 September 2020. Among the gaining stocks, Trainline shares gained by close to 5.6 percent after the company reported better performance in Q2 FY21 as compared to Q1 FY21. Shares of Beowulf Mining were up by nearly 5.0 percent after the company reported validation of high-grade resource. Next was up by close to 4.1 percent after it reported good performance of online sales in six months ended July 2020. Essentra was up by around 0.8 percent after the company announced the acquisition of 3C! Packaging. Among the decliners, shares of Surgical Innovation were down by close to 6.7 percent after the company announced that it raised £2.2 million through the issue of new shares. Duke Royalty was down by close to 2.8 percent, although the company reported improved dividend payment in FY20.

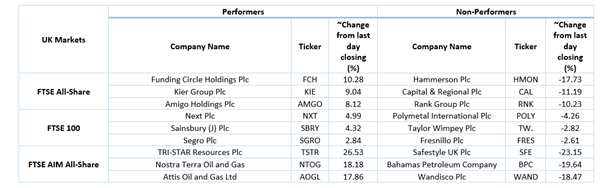

European Index Performance*:

FTSE 100 Index One Year Performance (as on 17 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Healthcare (+1.37%), Consumer Cyclicals (+0.48%) and Industrials (+0.27%).

Top 3 Sectors traded in red*: Telecommunications Services (-1.48%), Basic Materials (-1.44%) and Energy (-0.92%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $43.34/barrel and $41.02/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,951.15 per ounce, down by 0.98% against the prior day closing.

Currency Rates*: GBP to USD: 1.2962; EUR to GBP: 0.9136.

Bond Yields*: US 10-Year Treasury yield: 0.687%; UK 10-Year Government Bond yield: 0.177%.

*At the time of writing

.jpg)