Source: Copyright © 2021 Kalkine Media Pty Ltd.

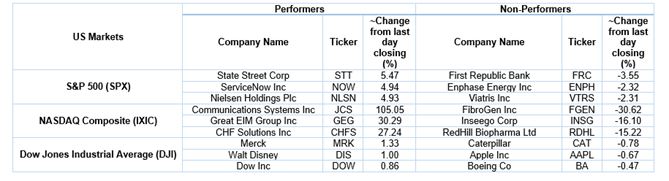

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 1.52 points or 0.04 per cent lower at 3,900.30, Dow Jones Industrial Average Index surged by 46.41 points or 0.15 per cent higher at 31,581.92, and the technology benchmark index Nasdaq Composite traded lower at 13,545.76, down by 43.07 points or 0.32 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after China’s warning of a financial market bubble. Among the gaining stocks, Zoom Video Communications shares jumped by approximately 7.71% after the Company reported better fourth-quarter results than the consensus estimates. Kohl’s Corp shares went up by about 1.02% after the retailer posted strong fourth-quarter sales. Among the declining stocks, Lemonade shares plunged by approximately 6.61% after the Company reported a fourth-quarter loss of USD 33.9 million. Shares of NIO went down by about 6.55% after the Company reported a more-than-expected loss.

US Stocks Performance*

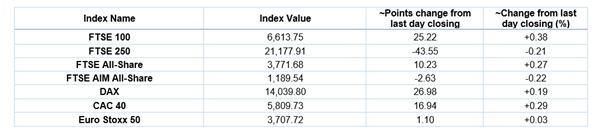

UK Market News: The London markets traded in a green zone, reflecting positive investor confidence regarding a flurry of earning results. FTSE 100 traded higher by around 0.38%, driven by strong investor sentiments regarding the UK budget announcement. The UK Nationwide House Price Index had shown a surge of 0.7% during February 2021, while it had shown a decline of 0.2% during January 2021.

Britain’s Housebuilder Taylor Wimpey had resumed the dividend payments. Moreover, it expected the operating margin to fall between 18.5% and 19.0% during 2021. Meanwhile, the shares jumped by around 2.04%.

FTSE 100 listed, Intertek Group shares surged by approximately 0.80% after it said that the earning performance remained ahead of the group’s expectations. However, it had posted a drop in full-year revenue and profits.

Mining giant Fresnillo had reported an increase in full-year revenue and profit, driven by higher precious metal prices. However, the Company had warned regarding Covid-19 related uncertainty. Moreover, the shares went up by approximately 0.44%.

Equipment Rental Company Ashtead Group shares plunged by about 1.37% after it had reported a drop in revenue and operating profit for the third quarter. However, the Company had lifted financial guidance.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 2 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); BP Plc (BP.).

Top 3 Sectors traded in green*: Financials (+1.24%), Basic Materials (+0.93%) and Utilities (+0.75%).

Top Sector traded in red*: Energy (-0.66%).

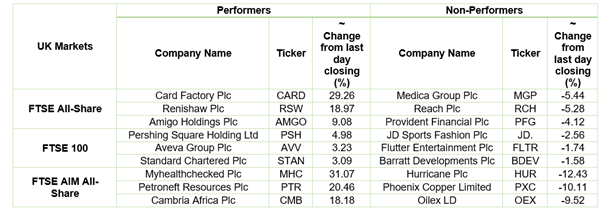

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $63.76/barrel and $60.81/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,733.85 per ounce, up by 0.63% against the prior day closing.

Currency Rates*: GBP to USD: 1.3974; EUR to GBP: 0.8650.

Bond Yields*: US 10-Year Treasury yield: 1.417%; UK 10-Year Government Bond yield: 0.687%.

*At the time of writing