Source: Copyright © 2021 Kalkine Media Pty Ltd.

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 11.36 points or 0.28 per cent higher at 4,091.31, Dow Jones Industrial Average Index dipped by 26.78 points or 0.08 per cent lower at 33,419.48, and the technology benchmark index Nasdaq Composite traded higher at 13,806.36, up by 117.52 points or 0.86 per cent against the previous day close (at the time of writing - 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after a straight rise for consecutive two weeks in the weekly jobless claims. Among the gaining stocks, Twitter shares rose by around 1.33% after the media reports that the Company would purchase audio app Clubhouse for around USD 4 billion. Among the declining stocks, Constellation Brands shares dropped by about 5.31% after the Company had reported a drop in the fourth-quarter profit. Canopy Growth Corp shares fell by approximately 3.87% after it announced that it would buy Supreme Cannabis for 435 million Canadian dollars. GameStop shares went down by approximately 0.77% after it announced plans to appoint Ryan Cohen as the Chairman after the annual general meeting.

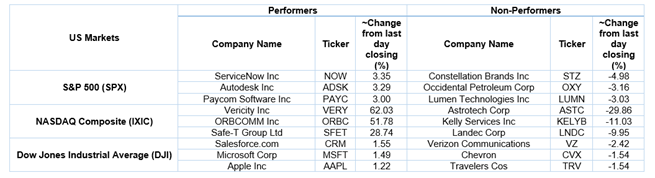

US Stocks Performance*

UK Market News: The London markets traded in a green zone, illustrating positive investor confidence regarding the reopening of the UK economy. FTSE 100 advanced higher by around 0.83% after an increase in the UK construction activity during March 2021. Meanwhile, the IHS Markit/CIPS construction PMI (“Purchasing Managers Index”) had increased to 61.7 during March 2021, its highest level since September 2014.

Speciality Chemicals business, Johnson Matthey shares went up by around 1.81%, after the Company said that the annual performance would remain around the top end of the market expectations. Moreover, the Company had announced a strategic review of the Health business.

FTSE 250 listed OSB Group had announced a dividend worth around 25% of full-year underlying earnings. Moreover, the Company had reported a drop of 9% in underlying profit due to an increase in the bad debt. Meanwhile, the shares jumped by around 2.02%.

Dunelm Group had expected to end the year modestly ahead of the top of the current range of the expectations. Thus, the shares went up by around 2.08%.

Anglo American shares went up by about 2.88% after it announced the demerger of the thermal coal operations in South Africa.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 08 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Vodafone Group Plc (VOD); Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Utilities (+1.95%), Consumer Non-Cyclicals (+1.66%) and Healthcare (+1.61%).

Top 2 Sectors traded in red*: Energy (-2.55%) and Basic Materials (-0.23%).

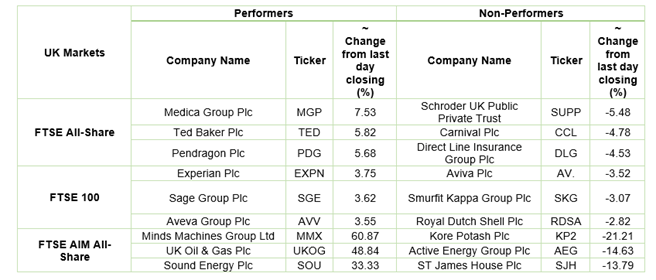

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $63.19/barrel and $59.57/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,756.05 per ounce, up by 0.83% against the prior day closing.

Currency Rates*: GBP to USD: 1.3738; EUR to GBP: 0.8676.

Bond Yields*: US 10-Year Treasury yield: 1.633%; UK 10-Year Government Bond yield: 0.747%.

*At the time of writing

.jpg)