US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 42.57 points or 1.02 per cent lower at 4,145.86, Dow Jones Industrial Average Index dipped by 463.84 points or 1.34 per cent lower at 34,278.98, and the technology benchmark index Nasdaq Composite traded lower at 13,336.63, down by 65.23 points or 0.49 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a red zone due to the weak performance of the tech-related stocks. Among the gaining stocks, Palantir Technologies (PLTR) shares went up by about 7.58% after the Company had reported a quarterly profit of 4 cents per share. Callaway Golf (ELY) shares jumped by around 3.91% after the quarterly earnings came out to be more than the consensus estimates. Perrigo (PRGO) shares went up by about 3.30%, even after the Company’s quarterly profit and revenue fell short of consensus estimates. Among the declining stocks, HanesBrands (HBI) shares went down by about 14.75% after the Company’s current quarter, and the full-year forecast fell short of expectations. Virgin Galactic Holdings (SPCE) shares plunged by about 5.74% after the Company had reported a loss of 55 cents per share for the latest quarter.

UK Market News: The London markets traded in a red zone as inflation fears rattled the markets. All stocks of FTSE 100 traded in negative territory, except London Stock Exchange (up by 0.06%).

Renishaw shares dropped by about 7.13% after the Company struggled to attract takeover interest due to the high valuation and the list of ownership demands.

British Retailer WM Morrison Supermarkets had reported a robust growth in the first-quarter sales and maintained the financial guidance for higher profits. Moreover, the shares grew by around 0.11%.

Natwest Group shares went down by around 3.53% after the government kicked off the sale of a further stake in the Bank.

British Airways owner International Consolidated Airlines Group SA would boost the liquidity as it would plan to raise 825 million euros from a convertible bond. Furthermore, the shares plunged by around 6.75%.

Scottish Mortgage Investment Trust shares dropped by around 5.31% amid a decline in tech stocks.

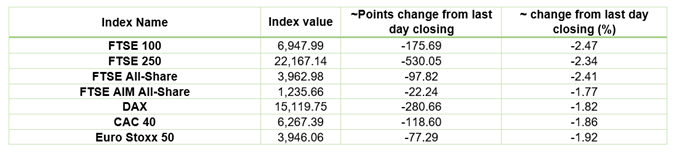

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 11 May 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); Rolls-Royce Holdings PLC (RR.).

Top 3 Sectors traded in red*: Consumer Cyclicals (-3.90%), Industrials (-3.40%) and Energy (-3.23%).

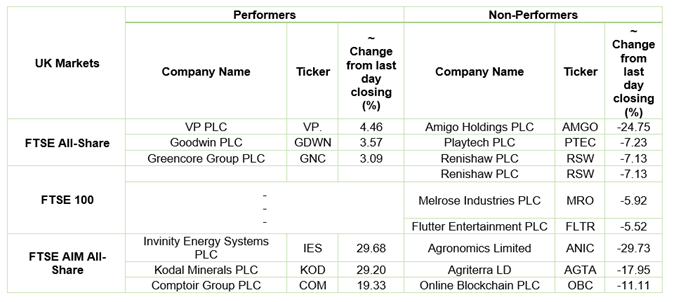

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $68.50/barrel and $65.21/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,835.05 per ounce, down by 0.14% against the prior day closing.

Currency Rates*: GBP to USD: 1.4153; EUR to GBP: 0.8584.

Bond Yields*: US 10-Year Treasury yield: 1.622%; UK 10-Year Government Bond yield: 0.8320%.

*At the time of writing