US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 2.42 points or 0.07 per cent lower at 3,406.20, Dow Jones Industrial Average Index expanded by 27.02 points or 0.10 per cent higher at 28,175.66, and the technology benchmark index Nasdaq Composite traded lower at 11,299.25, down by 33.23 points or 0.29 per cent against the previous day close (at the time of writing, before the US market close at 12:30 PM ET).

US Market News: The Wall Street opened mixed as the investors look for stimulus talk. The US trade deficit increased to USD 67.1 billion in August 2020. Meanwhile, the Fed Chairman Jerome Powell stated that incomplete recovery could trigger recessionary dynamics. Among the gaining stocks, Vir Biotechnology nudged up by nearly 5.0 percent after it said that its experimental covid-19 vaccine with GSK would enter phase-3 of trial. Cisco Systems gained close to 1.0 percent after it was asked to pay USD 1.9 billion to Centripetal, a cybersecurity company. Shares of Southwest Airlines were up by around 0.9 percent after it discussed pay cut with its employees in return for not putting them on furlough. Among the decliners, shares of Boeing were down by about 2.6 percent after it highlighted lower demand for new aircraft. Apple slipped by close to 1.5 percent after the company announced the new product launch date.

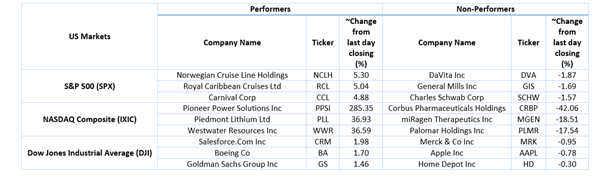

US Stocks Performance*

European News: The London and European markets traded in the green as the UK government is working on the new programme for jobs. Meanwhile, the UK’s Construction PMI moved up to 56.8 in September 2020 from 54.6 in August 2020. Among the gaining stocks, shares of Watches Of Switzerland Group surged by close to 25.3 percent after the company increased its revenue guidance for FY21. Restaurant Group rose by around 4.4 percent after it reported improved like for like sales for 11 weeks from 4 July to 20 September 2020. Premier Oil was up by close to 2.1 percent as it reached a merger deal with Chrysaor. Among the decliners, shares of Ocado fell the most by 8.3 percent on the FTSE-100. Ferrexpo was down by around 3.2 percent after it reported a decline in pellet production from own ore in 3Q 20. Victrex slipped by nearly 1.2 percent after it said the performance to remain subdued in FY21.

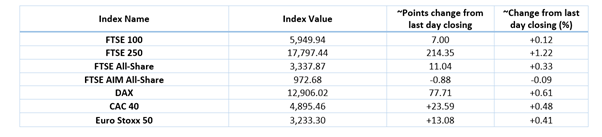

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 6 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Energy (+2.33%), Real Estate (+1.05%) and Financials (+0.97%).

Top 3 Sectors traded in red*: Healthcare (-1.05%), Basic Materials (-0.76%) and Consumer Non-Cyclicals (-0.52%).

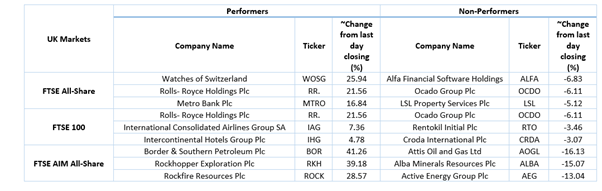

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $42.50/barrel and $40.49/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,906.15 per ounce, down by 0.73% against the prior day closing.

Currency Rates*: GBP to USD: 1.2940; EUR to GBP: 0.9104.

Bond Yields*: US 10-Year Treasury yield: 0.775%; UK 10-Year Government Bond yield: 0.285%.

*At the time of writing