European News: The London and European markets traded in the mixed territory due to the ongoing worries regarding Covid-19 restrictions. The Springboard had reported a drop in the number of shoppers heading to the retail destinations of around 10.9% for the week ended on 16 January 2021 compared to its prior week. Among the gaining stocks, CPP Group shares grew by 53.96% after it had raised the revenue and profit guidance. Shares of Begbies Traynor Group had increased by 6.42% after it had completed the acquisition of CVR Global LLP for £20.8 million. Genus shares grew by 5.38% after the company anticipated the profit growth ahead of its expectations. Among the decliners, shares of Centrica went down by 2.09% after its chief financial officer decided to step down on 31 January 2021. Spirent Communications shares went down by 0.38% although it had expected a robust fourth quarter driven by the 5G infrastructure development. Shares of BT Group had dropped the most on FTSE 100.

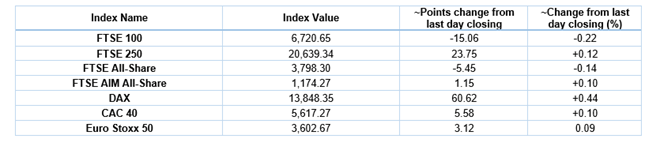

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 18 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); BP Plc (BP.).

Top 3 Sectors traded in green*: Real Estate (+1.90%), Basic Materials (+1.36%) and Healthcare (+0.83%).

Top 2 Sectors traded in red*: Utilities (-0.80%) and Technology (-0.45%).

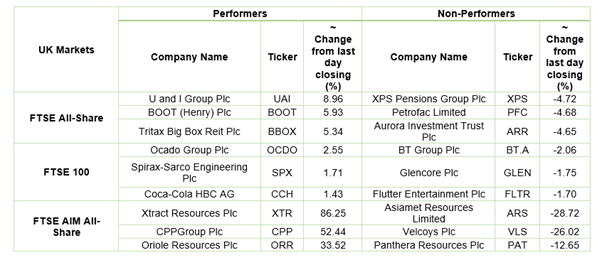

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $54.76/barrel and $52.12/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,836.80 per ounce, up by 0.38% against the prior day closing.

Currency Rates*: GBP to USD: 1.3584; EUR to GBP: 0.8889.

Bond Yields*: US 10-Year Treasury yield: 1.087%; UK 10-Year Government Bond yield: 0.289%.

*At the time of writing