US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 55.63 points or 1.67 per cent higher at 3,396.60, Dow Jones Industrial Average Index expanded by 354.53 points or 1.28 per cent higher at 28,020.17, and the technology benchmark index Nasdaq Composite traded higher at 11,096.56, up by 243.01 points or 2.24 per cent against the previous day close (at the time of writing, before the US market close at 12:05 PM ET).

US Market News: The Wall Street started the week in the green over the hopes of covid-19 vaccine development. As per industry expert’s data analysis, the covid-19 cases were growing by around 5 percent weekly in 11 US states. Among the gaining stocks, shares of Nvidia moved up by approximately 5.5 percent after the company would buy Arm Holdings from Softbank for USD 40 billion. Oracle Corporation was up by close to 5.0 percent as it reached a preliminary partnership with ByteDance for TikTok’s US operation. Gilead Sciences was up by around 3.0 percent after the company announced it would buy Immunomedics, a cancer drugmaker for USD 21 billion. Delta Airlines was up close to 2.5 percent after it launched a USD 6.5 billion debt programme backed by frequent flyers programme. Microsoft was up by around 1.6 percent after the company was out of the race for purchase of TikTok US. Among the decliners, Dollar Tree was down by about 1.1 percent, and Caterpillar was down by close to 0.3 percent.

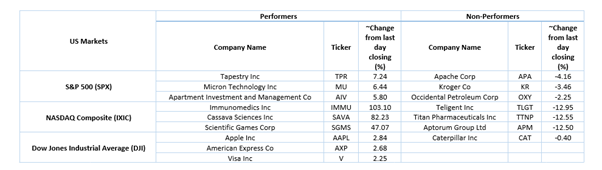

US Stocks Performance*

European News: The UK and European market traded in the green as the European Union stands against British Prime Minister Boris Johnson for trying to break the Brexit treaty. As per industry expert’s report, the footfall at the shopping destination fell by 6.3 percent for the week ended 12 September 2020 as compared to the previous week. Among the gaining stocks, G4S shares jumped by around 25.0 percent after the company announced that it received an all-cash offer of 190 pence per share from GardaWorld. BAE Systems shares were up by about 2.4 percent after the company published the prospectus for USD 2 billion notes. Spirax-Sarco Engineering shares were up by close to 1.1 percent after the company announced that its CFO, Kevin Boyd would retire in September 2020 and Nimesh Patel would take up his responsibilities. Among the decliners, point of care healthcare product manufacturer, EKF Diagnostics was down by about 6.1 percent after the company experienced a fall in core business sales in H1 FY2020. Vodafone was down by about 0.5 percent after the company stated that the due-diligence for sale of its 55 percent stake in Vodafone Egypt to Saudi Telecom is completed. AstraZeneca was down by close to 0.3 percent although the company resumed covid-19 vaccine trials.

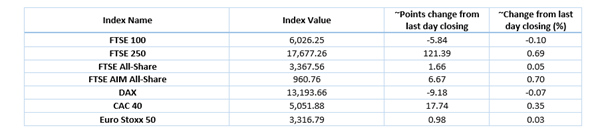

European Index Performance*:

FTSE 100 Index One Year Performance (as on 14 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); Vodafone Plc (VOD).

Top 2 Sectors traded in green*: Consumer Cyclicals (+0.82%) and Industrials (+0.59%).

Top 3 Sectors traded in red*: Energy (-1.23%), Healthcare (-0.77%) and Telecommunications Services (-0.29%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $39.60/barrel and $37.18/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,964.85 per ounce, up by 0.87% against the prior day closing.

Currency Rates*: GBP to USD: 1.2856; EUR to GBP: 0.9227.

Bond Yields*: US 10-Year Treasury yield: 0.666%; UK 10-Year Government Bond yield: 0.187%.

*At the time of writing