US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 98.54 points or 2.92 per cent higher at 3,467.70, Dow Jones Industrial Average Index expanded by 617.58 points or 2.25 per cent higher at 28,097.61, and the technology benchmark index Nasdaq Composite traded higher at 11,616.65, up by 456.08 points or 4.09 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The key indices of Wall Street traded in the green as the US Presidential election results are awaited. The private payrolls in the US increased by 365,000 in October 2020 that was below expected 600,000. Among the gaining stocks, shares of Lyft and Uber were up by around 11.1% and 10.0%, respectively after California voters approved a proposition, which allowed companies to classify workers as independent contractors. Hilton Worldwide was up by nearly 0.7% after it posted earnings above expectations. Among the decliners, Canopy Growth plunged by around 8.9% after it is moving its US listing from NYSE to Nasdaq. Shares of Wendy declined by 4.8% after the company posted quarterly earnings of 19 USD cents per share. Scotts Miracle-Go was down by around 3.0% after it reported earnings per share below the market’s consensus.

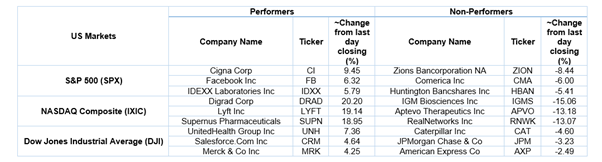

US Stocks Performance*

European News: The London and European markets traded in green as the UK report’s output numbers. The Office for National Statistics reported that the labour productivity in the UK declined by 1.8% year on year in the second quarter. The Services PMI index was at 51.4 in October 2020 and declined from the previous point of 56.1. Among the gaining stocks, shares of Mite Group rose by about 6.6% after it said that it would issue fewer shares for the acquisition of Interserve. Marks & Spencer was up by around 5.1%, although it reported a loss. Provident Financial gained around 3.0% after the company reported a collection performance in the home credit business to the pre-covid level. Among the decliners, BP was down by about 2.3% after the reports that the company is selling its London headquarter. Lloyds Banking fell by around 1.9% after the reports that the company is cutting about 1,070 jobs.

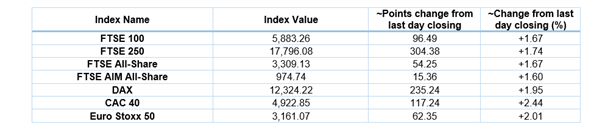

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 4 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); HSBC Holdings Plc (HSBA).

Top 3 Sectors traded in green*: Healthcare (+3.99%), Consumer Non-Cyclicals (+2.00%) and Industrials (+1.74%).

Top 2 Sectors traded in red*: Basic Materials (-0.15%) and Energy (-0.09%).

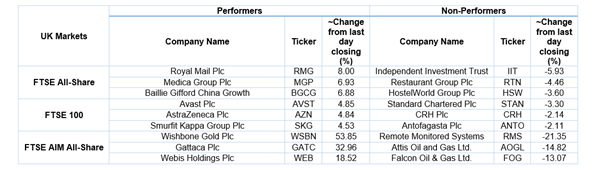

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $41.05/barrel and $38.95/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,894.70 per ounce, down by 0.82% against the prior day closing.

Currency Rates*: GBP to USD: 1.3001; EUR to GBP: 0.9011.

Bond Yields*: US 10-Year Treasury yield: 0.783%; UK 10-Year Government Bond yield: 0.207%.

*At the time of writing