Global Markets: Shares at the Wallstreet were zooming in green on the last trading session of this week, with the broader benchmark index S&P 500 jumped 6.61 points or 0.22% in dayâs session and quoting at 3,007.01, the Dow Jones Industrial Average Index added 144.35 points or 0.53% and trading at 27,232.43 and the technology benchmark index Nasdaq Composite added 32.06 points or 0.39% and quoting at 8,228.61 respectively, at the time of writing.

Global News: Labour Secretary Alexander Acosta left the Trump administration on Friday as pressure started to mount on him regarding his handling of the sex abuse case against financier Jeffrey Epstein a decade ago. As indices continued a strong run on hopes of an interest rate cut this month, the Dow Jones Industrial Average and S&P 500 hit fresh record highs on Friday, despite expectations of a 0.4% dip in profits from a year earlier in the next earnings season. Beating the expectations of experts that prices would be unchanged, US producer prices rose slightly in June, though Treasury yields remained unmoved by it and rose modestly.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 3.85 points or 0.05% lower at 7,505.97, the FTSE 250 index snapped 108.67 points or 0.56% higher at 19,551.83, and the FTSE All-Share Index ended 1.44 points or 0.04% higher at 4,094.94 respectively. Another European benchmark index STOXX 600 ended 0.15 points or 0.04% higher at 386.85 respectively.

European News: Senior Bank of England official Gertjan Vlieghe said that in the event of a no-deal Brexit, the central bank might need to cut interest rates almost all the way down to zero. As the investors factored in the increasing possibility of interest rate cuts in the event of a chaotic Brexit, pound was set for a record 10th week of successive losses against the euro.

London Stock Exchange (LSE)

Top Performers Stocks: ENQUEST PLC (ENQ), SIRIUS MINERALS PLC (SXX), and SOPHOS GROUP PLC (SOPH) surged by 7.27 per cent, 5.54 per cent and 5.40 per cent respectively.

Top Laggards Stocks: THOMAS COOK GROUP PLC (TCG), PENDRAGON PLC (PDG), and LOOKERS PLC (LOOK) decreased by 59.47 per cent, 8.91 per cent and 8.31 per cent respectively.

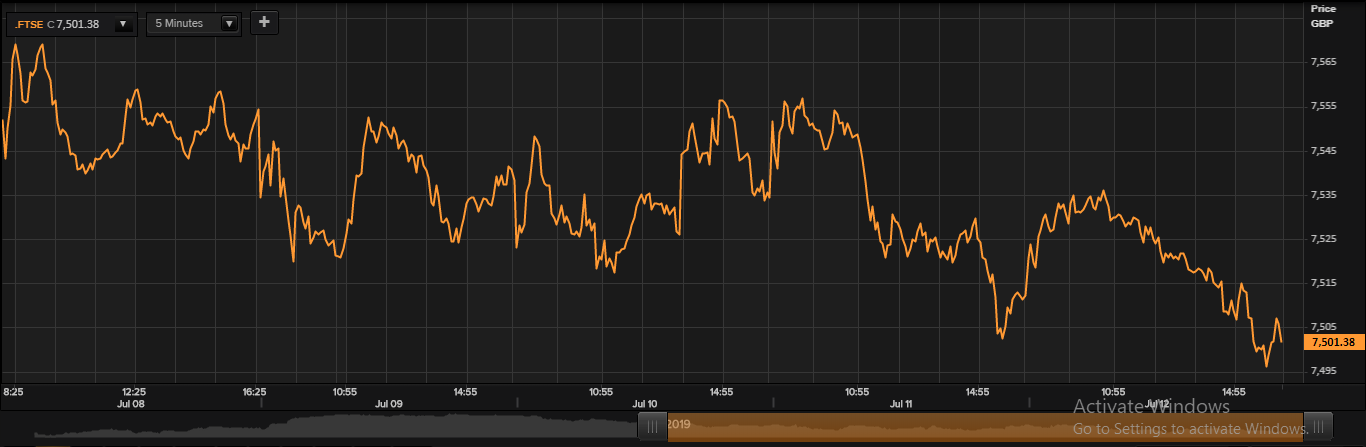

FTSE 100 Index

FTSE100 Index: 5-days Price Chart (as on July 12, 2019), after the market closed. (Source: Thomson Reuters)

Top Risers Stocks: PERSIMMON PLC (PSN), SMITH (DS) PLC (SMDS) and BURBERRY GROUP PLC (BRBY) rose by 4.55 per cent, 3.23 per cent and 2.74 per cent respectively.

Top Fallers Stocks: JUST EAT PL (JE.), HISCOX LD (HSX) and DCC PLC (DCC) reduced by 2.36 per cent, 2.12 per cent and 1.47 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and GLENCORE PLC.

Top Risers Sectors: Consumer Cyclicals (+0.98%), Basic Materials (+0.46%) and Industrials (+0.32%).

Top Fallers Sectors: Healthcare (-0.73%), Telecommunications Services (-0.60%) and Technology (-0.50%).

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2572 and 0.8964 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.115% and 0.831% respectively.Â

*At the time of writing