US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 72.96 points or 2.19 per cent higher at 3,404.80, Dow Jones Industrial Average Index expanded by 526.96 points or 1.92 per cent higher at 28,027.85, and the technology benchmark index Nasdaq Composite traded higher at 11,140.22, up by 292.53 points or 2.70 per cent against the previous day close (at the time of writing, before the US market close at 12:05 PM ET).

US Market News: The US market opened higher with an uptick seen in technology stocks. The US Bureau of Labor Statistics reported job openings of 6.618 million in July 2020 against expected job openings of 6 million. Technology stocks make headway, with Apple up by close to 4.4 percent, Microsoft up by around 4.0 percent and Amazon up by around 3.3 percent. Healthcare stocks such as Novavax and Moderna gained by around 3.1 percent and 2.5 percent, respectively after AstraZeneca halted the trial for the covid-19 vaccine. Among the decliners, Tiffany shares plunged by 9.3 percent after LVMH cancelled the takeover deal. Lululemon was down by close to 8.7 percent, although the company reported quarterly profit above the market’s expectation.

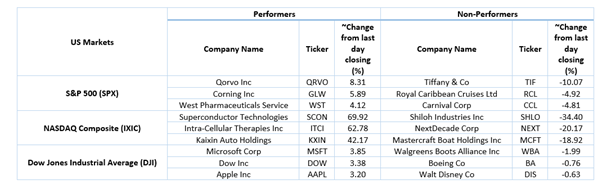

US Stocks Performance*

European News: The UK and European market advanced on Wednesday and recovered for the previous day loss. FTSE-100 was trading above the 6,000 mark for the first time in September 2020. Meanwhile, as per the industry experts report, the temporary staff hiring in the UK increased in August 2020; however, the employers are uncertain over the recovery. Among the upward trending stocks, Computacenter shares trended upwards by around 4.6 percent after the company reported improved performance in H1 FY20. Biffa shares were up by close to 2.0 percent after the company stated that its business activity was above its base scenario. Among the decliners, shares of restaurant stocks such as Restaurant Group and JD Wetherspoon plunged 10.0 percent and 9.0 percent, respectively as the UK government is set to ban the gathering of more than six people. AstraZeneca declined 0.7 percent after the company announces that it has halted the development of the coronavirus vaccine.

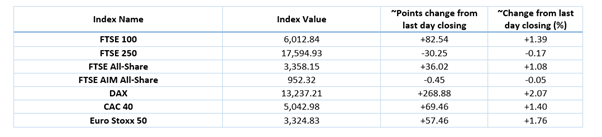

European Index Performance*

FTSE 100 Index One Year Performance (as on 9 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Plc (VOD); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Telecommunications Services (+3.86%), Consumer Non-Cyclicals (+3.16%) and Energy (+2.28%).

Top Sector traded in red*: Consumer Cyclicals (-0.20%).

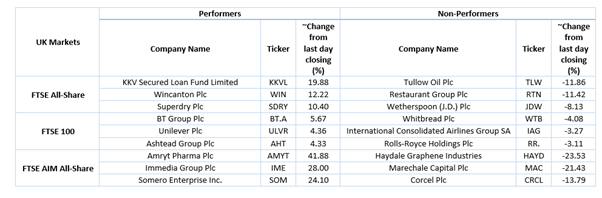

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $40.83 per barrel and $38.12 per barrel, respectively.

Gold Price*: Gold price was quoting at US$1,955.00 per ounce, up by 0.61% against the prior day closing.

Currency Rates*: GBP to USD: 1.2994; EUR to GBP: 0.9092.

Bond Yields*: U.S 10-Year Treasury yield: 0.697%; UK 10-Year Government Bond yield: 0.237%.

*At the time of writing