Summary

- JD Wetherspoon reported 16.9 percent year on year fall in the bar and food sales for 44 days ended 16 August 2020. Around 844 pubs have been reopened out of the total 873 pubs.

- The Company opened two new pubs in the UK in July 2020.

- Mitchells & Butlers revenue declined by 12.4 percent year on year in H1 FY2020 and borrowing facility was extended by £100 million in June 2020.

- Also, the Company incurred impairment charge of £524 million related to property valuation in H1 FY2020.

JD Wetherspoon PLC (LON:JDW) & Mitchells & Butlers PLC (LON:MAB) are two FTSE 250 listed consumer stocks. Shares of JDW and MAB were up by around 1.44 percent and 0.45 percent, respectively (as on 27 August 2020, before the market close at 11:10 AM GMT+1). It is mindful to note that the UK government has announced the Eat Out to Help Out scheme to support the outdoor food outlets. There is a 50 percent discount on food and non-alcoholic beverages capped at £10 per person. The scheme is applicable between 3 August 2020 and 31 August 2020.

JD Wetherspoon PLC (LON:JDW) – Sales supported by the government outside eating scheme

JD Wetherspoon PLC is a UK based company that owns and operates retail pub chains. The Company has 873 pubs and employs close to 43,000 staff. JD Wetherspoon is included in the FTSE 250 index.

Trading update as reported on 24 August 2020

The Company reported 16.9 percent year on year fall in bar and food sales for 44 days ended 16 August 2020. It has reopened 844 pubs out of a total of 873 pubs in the UK, Scotland and Wales. Some of the outlets at the station and airport are still closed. The sales have improved by the government's scheme to support the outdoor eating that has increased the consumption of food, soft drinks and coffee. The Company has added extra outside eating capacity.

The Company highlighted that pricing gap between pubs & restaurants (on-trade) and supermarkets (off-trade) was increasing as on-trade were paying tax of 20 percent on food, whereas the VAT was zero for off-trade. However, the UK government has temporarily reduced the VAT on food sales to 5 percent to support the restaurant & pubs. As on 26 July 2020, JD Wetherspoon had net debt of £825 million. The Company raised £141 million through the placement of new shares and £48.3 million loans under the UK government's scheme, and it has received a waiver for covenants in April and July.

In July 2020, the Company opened two new pubs. One pub was opened in Cross gates in Leeds and one in Kingswinford in the West Midlands. JD Wetherspoon pointed out that the media companies posted damaging contents against the Company to which the media organizations apologized, and a correction was made on the content. The Company took up these issues related to the safety of clients, and it has ensured that proper safety measures were implemented at each of its sites. Close to one million customers registered their test and trace details at the pubs operated by the Company for the week ended 16 August 2020.

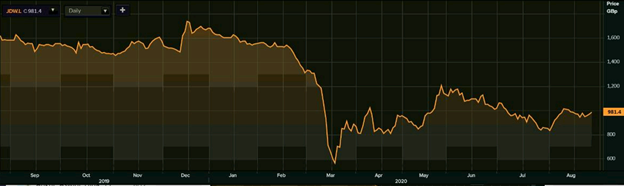

Share Price Performance Analysis

1-Year Chart as on August-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

JD Wetherspoon PLC's shares were trading at GBX 981.40 and were up by close to 1.44 percent against the previous closing price (as on 27 August 2020, before the market close at 11:10 AM GMT+1). JDW's 52-week High and Low were GBX 1,734.00 and GBX 492.00, respectively. JD Wetherspoon had a market capitalization of around £1.16 billion.

Business Outlook

The Company cited various published articles by the professors that are in favor and against reopening of economy and lockdown. The Company highlighted that business should operate as usual taking care of proper sanitization, capacity management and social distancing. The sales have picked up recently due to the government scheme on outside eating, but it expects the sales to subside once the scheme ends. JD Wetherspoon hopes that if the tax equality between pubs & restaurants and supermarkets is maintained for a longer duration, it will support the Company's business performance in the longer term.

Mitchells & Butlers PLC (LON:MAB) – Food and Drink sales were steady in Q1 FY2020

Mitchells & Butlers PLC is a UK based company that operates and manages pubs. The Company directly runs 1,674 sites out of the total 1,745 sites it operates in the UK and Germany. Mitchells & Butlers is included in the FTSE 250 index.

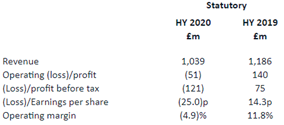

H1 FY2020 results (ended 11 April 2020) as reported on 2 July 2020

(Source: Company website)

In H1 FY20, the Company reported revenue of £1,039 million, which declined by 12.4 percent year on year from £1,186 million in H1 FY19. The sales and business performance was strong at the start of the period that started to decline due to covid-19. Based on the business segment, Food generated revenue of £535 million. Drink added £467 million to the total revenue and Services generated revenue of £37 million in H1 FY20.

The Company reported an operating loss of £51 million in H1 FY20 against an operating profit of £140 million. The loss before tax was £121 million in H1 FY20, whereas the Company reported profit before tax of £75 million in H1 FY19. The loss per share was 25 pence. The Company did a capital expenditure of £82 million in H1 FY20 as it opened two new sites and remodeled 166 sites.

The Company incurred an impairment charge of £524 million related to property valuation. As on 11 April 2020, Mitchells & Butlers had net debt of £2,158 million that included lease liability of £543 million. Mitchells & Butlers extended the borrowing facility by £100 million to a total facility of £250 million in June 2020.

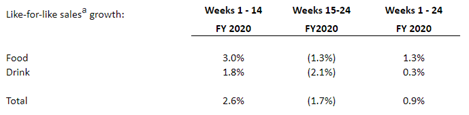

Performance comparison of Q1 FY20 and Q2 FY20

(Source: Company website)

The like for like sales for Food grew by 3 percent year on year in Q1 FY20, whereas Food sales declined by 1.3 percent year on year in Q2 FY20. The like for like sales for Drinks were up by 1.8 percent year on year in Q1 FY20, whereas the Drink sales fell by 2.1 percent year on year in Q2 FY20. The business trading in the Q2 FY20 was impacted due to the strict lockdown measures and government guidelines for social distancing.

Share Price Performance Analysis

1-Year Chart as on August-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Mitchells & Butlers PLC's shares were trading at GBX 158.91 and were up by close to 0.45 percent against the previous closing price (as on 27 August 2020, before the market close at 11:10 AM GMT+1). MAB's 52-week High and Low were GBX 483.00 and GBX 92.30, respectively. Mitchells & Butlers had a market capitalization of around £679.00 million.

Business Outlook

The Company started H1 FY20 on a strong note that was later impacted due to the lockdown measures. Mitchells & Butlers highlighted that the business performance in H2 FY20 would depend on the continued operations of the sites and response of customers amid the social distancing norms. The Company is looking at table spacing, disposable menus, cashless transaction and limited capacity to follow the safety procedures. The German business Alex reopened in May 2020 and sites in the UK started to reopen from July 2020. In Germany, the VAT on food has been reduced to 7 percent annually from the last 19 percent.