US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 20.30 points or 0.61 per cent lower at 3,318.89, Dow Jones Industrial Average Index contracted by 35.63 points or 0.13 per cent lower at 27,498.95, and the technology benchmark index Nasdaq Composite traded lower at 10,768.12, down by 151.47 points or 1.39 per cent against the previous day close (at the time of writing, before the US market close at 2:05 PM ET).

US Market News: The key market indices of the Wall Street advanced as the US consumer prices increased. The Consumer Price Index increased by 0.4 percent in August 2020 against an expected increase of 0.2 percent. Among the gaining stocks, Clothing store operator Zumiez shares surged by around 14.1 percent after the company reported a quarterly profit of USD 1.01 per share. Cognizant Technology led the S&P 500 gain as it was up by around 5.2 percent. Shares of Oracle were up by around 3.5 percent after the company reported earnings better than the estimates as cloud-based products supported it. Peloton gained by close to 3.4 percent after the company reported quarterly earnings per share of 27 USD cents. Among the decliners, The sports bar & restaurant chain operator, Dave & Buster’s Entertainment, fell by close to 6.8 percent after the company reported a quarterly loss per share of USD 1.24.

US Stocks Performance*

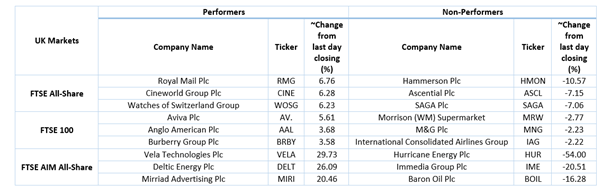

European News: The London market traded higher as the UK signed its first post-Brexit deal with Japan. As per the Office for National Statistics data, the UK GDP grew by around 6.6 percent in July 2020. Among the gaining stocks, Aviva was up by around 5.3 percent after the company announced the sale of a majority shareholding in Aviva Singapore. Anglo American shares were up by about 3.5 percent after the company reported a rough diamond sales value of USD 116 million and USD 320 million for the sixth and seventh cycle. Rio Tinto shares were up by close to 3.0 percent after the CEO Jean Sebastien stepped down over criticism for the destruction of Aboriginal cave. Among the decliners, Hurricane Energy plunged by close to 55.1 percent after the company stated that the reservoir performance of Lancaster EPS was below expectation. Shares of asset manager Ashmore fell by about 3.4 percent after the company reported a decline in assets under management.

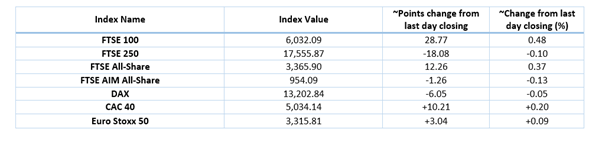

European Index Performance*

FTSE 100 Index One Year Performance (as on 11 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BT Group Plc (BT.A); Vodafone Plc (VOD).

Top 3 Sectors traded in green*: Basic Materials (+1.89%), Healthcare (+0.70%) and Telecommunications Services (+0.55%).

Top 3 Sectors traded in red*: Technology (-0.66%), Energy (-0.45%) and Consumer Cyclicals (-0.31%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $39.92/barrel and $37.38/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,949.20 per ounce, down by 0.77% against the prior day closing.

Currency Rates*: GBP to USD: 1.2795; EUR to GBP: 0.9249.

Bond Yields*: US 10-Year Treasury yield: 0.667%; UK 10-Year Government Bond yield: 0.180%.

*At the time of writing

.jpg)