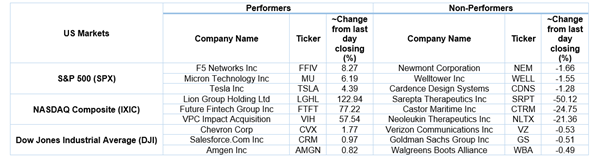

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 17.81 points or 0.47 per cent higher at 3,821.60, Dow Jones Industrial Average Index expanded by 17.16 points or 0.06 per cent higher at 31,058.29, and the technology benchmark index Nasdaq Composite traded higher at 13,185.09, up by 117.61 points or 0.90 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in green after Joe Biden was confirmed as 46th President of the United States offsetting the weak investor sentiments around US Nonfarm payrolls data. The Bureau of Labour Statistics had reported that nonfarm employment fell by 140,000, compared to the forecast for an increase of 71,000. Among the gaining stocks, PriceSmart jumped by 4.84% after the company had reported quarterly earnings of 90 cents per share more than the consensus estimate. Shares of Tesla went up by around 4.44% after Elon Musk became the world’s richest person. Shares of SolarWinds Corp went up by approximately 2.11% after the company hired a new consulting firm for its cybersecurity breach. Niu Technologies grew by about 1.64% after the company reported more than 40% growth in its revenues during the fourth quarter. Among the declining stocks, Shares of Sarepta Therapeutics went down by 49.10% after its gene therapy treatment did not meet one of its primary goals.

US Stocks Performance*

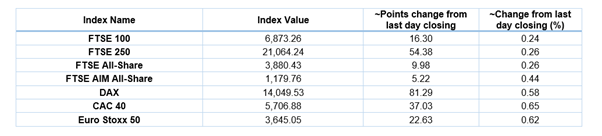

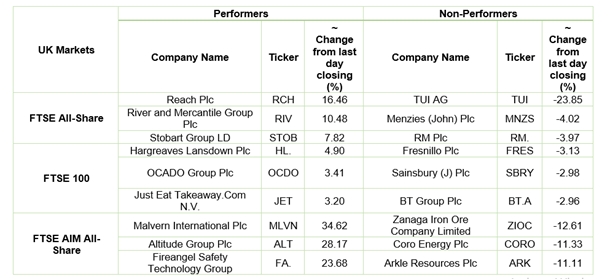

European News: The London and European markets traded in the mixed territory as the US economy sheds jobs during December 2020. The Halifax House Price Index reflected that house prices in December 2020 remained 6% higher than the prices during December 2019. Among the gaining stocks, Shares of Reach went up by 16.17% after the company expected profit ahead of its forecast due to surge in online sales. Shares of Pets at Home Group soared by 6.51% after the company upgraded its full-year profit guidance driven by robust growth in December 2020. Shares of Barratt Developments grew by 3.28% after it planned to start payment of dividends due to strong trading performance during its first half. Among the decliners, Shares of Signature Aviation fell by 2.58% after the Carlyle Investment Management had approached the company for a possible offer. Shares of Marks & Spencer Group went down by 1.88% after it reported a drop in the third-quarter revenues. Shares of Fresnillo had dropped the most on FTSE 100.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 8 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); BP Plc (BP.).

Top 2 Sectors traded in green*: Consumer Cyclicals (+1.15%) and Industrials (+0.43%).

Top 3 Sectors traded in red*: Technology (-0.39%), Real Estate (-0.38%) and Consumer Non-Cyclicals (-0.27%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $55.58/barrel and $51.79/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,841.65 per ounce, down by 3.76% against the prior day closing.

Currency Rates*: GBP to USD: 1.3574; EUR to GBP: 0.9004.

Bond Yields*: US 10-Year Treasury yield: 1.114%; UK 10-Year Government Bond yield: 0.285%.

*At the time of writing

.jpg)