US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 34.37 points or 0.77 per cent lower at 4,445.29, Dow Jones Industrial Average Index dipped by 297.76 points or 0.84 per cent lower at 35,327.64, and the technology benchmark index Nasdaq Composite traded lower at 14,636.10, down by 157.70 points or 1.07 per cent against the previous day close (at the time of writing – 11:55 AM ET).

US Market News: The major indices of Wall Street traded in a red zone after the release of the weak US retail sales data for July 2021. Among the gaining stocks, Endeavor Group Holdings (EDR) shares surged by about 8.27% after the entertainment company had reported a quarterly profit of 19 cents per share. Walmart (WMT) shares went up by about 0.06% after the Company had raised full-year forecast boosted by encouraging second-quarter results. Among the declining stocks, Home Depot (HD) shares slipped by around 3.10% after the Company’s comparable-store sales fell short of the estimates during the second quarter. Spirit Airlines (SAVE) shares dropped by around 1.28% after the Company mentioned of USD 50 million cost due to the recent operational problems.

UK Market News: The London markets traded on a mixed note after the release of encouraging UK unemployment data. According to the Office for National Statistics, the UK unemployment rate had dropped to 4.7% for the three months ended June 2021, a decrease of around 20 basis points from the previous quarter.

BHP Group shares surged by about 4.21% after the Company agreed to sell the petroleum business to Australia’s Woodside Petroleum. Furthermore, the Company had posted a robust growth of around 42% in the full-year net profit.

FTSE 100 listed Just Eat Takeaway.com shares grew by around 5.95% after the Company reported a significant top-line revenue growth during the first half of 2021.

Plus500 had announced a share buyback programme and anticipated full-year revenue to remain significantly ahead of the market expectations. Moreover, the shares rose by around 5.63%.

Genuit Group shares went up by around 1.21% after the Company reported a significant jump in the top-line revenue during the first half and resumed dividend payments.

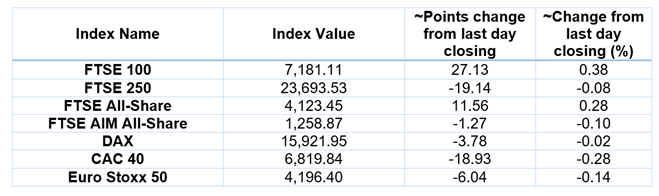

European Indices Performance (at the time of writing):

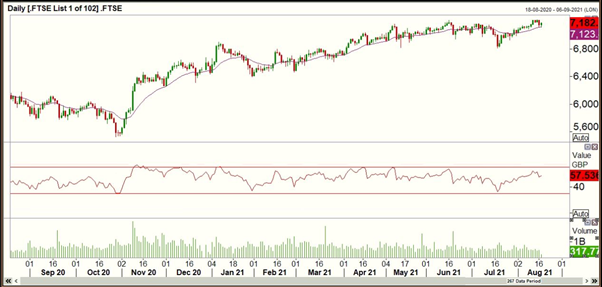

FTSE 100 Index One Year Performance (as on 17 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); BP Plc (BP.).

Top 3 Sectors traded in green*: Energy (+1.50%), Basic Materials (+1.18%) and Healthcare (+0.81%).

Top 2 Sectors traded in red*: Consumer Cyclicals (-0.58%) and Real Estate (-0.08%).

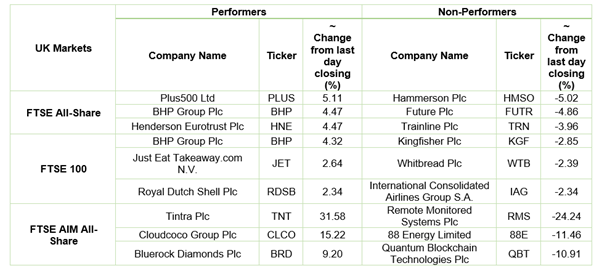

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $69.16/barrel and $66.47/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,786.35 per ounce, down by 0.19% against the prior day closing.

Currency Rates*: GBP to USD: 1.3738; EUR to GBP: 0.8528.

Bond Yields*: US 10-Year Treasury yield: 1.253%; UK 10-Year Government Bond yield: 0.5550%.

*At the time of writing