UK Market News: The London markets traded in a green zone amid solid gains made by oil, mining, and financials stocks. According to the latest data from the IHS Markit/CIPS, the UK construction PMI came out to be 55.2 during August 2021 as compared to 58.7 for July 2021.

Dechra Pharmaceuticals shares went down by about 3.46%, even after the Company reported a significant growth in total revenue and the underlying operating profit during FY21 as consumers spent more on pet welfare during lockdowns.

Lloyds Banking Group shares went up by around 0.39%, even though the Company got accused by 150 shared appreciation mortgage borrowers.

Powerhouse Energy Group had confirmed that it remained in talks to sign a deal with Linde to roll out energy plans across Europe. Furthermore, the shares surged by around 13.19%.

Inchcape shares rose by around 0.32% after Jefferies had reiterated the “buy” stance on the Company.

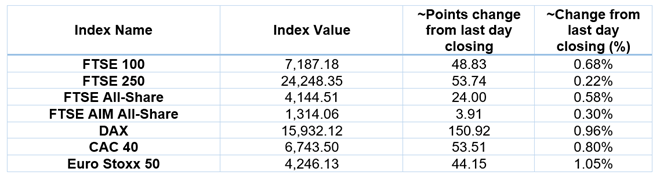

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 6September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Vodafone Group PLC (VOD); Glencore PLC (GLEN).

Top 2 Sectors traded in green*: Technology (+1.21%), Financials (+1.06%), Industrials (1.05%).

Top 3 Sectors traded in red*: Real Estate (-0.35%), Utilities (-0.13%) and Basic Materials (-0.10%).

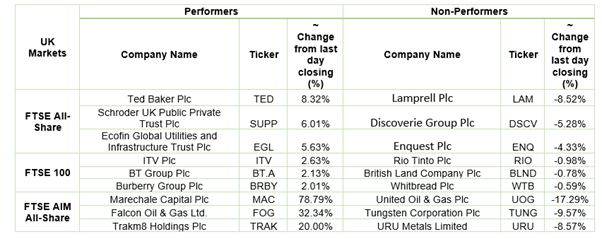

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $72.09/barrel and $68.88/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,825.50 per ounce, down by 0.45% against the prior day closing.

Currency Rates*: GBP to USD: 1.3836; EUR to USD: 1.1869.

Bond Yields*: US 10-Year Treasury yield: 1.326%; UK 10-Year Government Bond yield: 0.6940%.

*At the time of writing