Summary

- Hikma Pharmaceuticals generated revenue of USD 1,132 million, which was increased by 9 percent year on year in H1 FY20.

- The revenue in H1 FY20 was supported by strong demand for covid-19 related products in the US and Europe.

- Dechra Pharmaceuticals generated revenue of £515.1 million in FY2020, which was increased by 6.8 percent year on year.

- The growth in revenue was driven by increased market penetration and the acquisition of new products.

Hikma Pharmaceuticals PLC (LON: HIK) and Dechra Pharmaceuticals PLC (LON:DPH) are FTSE listed pharmaceutical stocks. Shares of HIK and DPH were down by around 0.36 percent and 2.06 percent, respectively from their last closing price (as on 24 September 2020, before the market close at 1:00 PM GMT+1). It is mindful to note that the share price of Hikma slipped by around 4.49 percent on 22 September 2020, after the Company revised its revenue target and core operating margin for its Generics business for FY20.

Hikma Pharmaceuticals PLC (LON:HIK) - Launched 76 new products in H1 FY2020

Hikma Pharmaceuticals PLC is a UK based pharmaceutical company. The Company develops, manufactures and sells branded and non-branded generic medicines. The Company sells its product in the US, Europe, the Middle East and North Africa.

Update on abbreviated new drug application (ANDA)

On 22 September 2020, the Company announced that it had received a complete response letter (CRL) for the new drug application for its generic version of GlaxoSmithKline's Advair Diskus® from the US FDA. Hikma needs to answer the questions related to the complete response letter, and once it completes the process, it will receive the response from the FDA in the next 90 days. In early 2021, it can receive approval for Advair Diskus®.

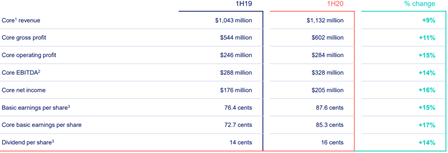

H1 FY2020 results (ended 30 June 2020) as reported on 7 August 2020

(Source: Company website)

Hikma reported core revenue of USD 1,132 million, which increased by 9 percent year on year from USD 1,043 million in H1 FY19. The core operating profit increased by 15 percent year on year and stood at USD 284 million. The profit for the shareholders was USD 205 million in H1 FY20, which increased from USD 176 million a year ago. The basic earnings per share were 87.6 USD cents per share, and it announced the interim dividend of 16 USD cents per share for H1 FY20. Hikma generated cash flow from operating activities of USD 292 million in H1 FY20, and net debt was USD 511 million as on 30 June 2020. In April 2020, Hikma repaid USD 500 million of Eurobond, and in July 2020, it issued a new USD 500 million Eurobond. During the reported period the Company launched 78 new products across all markets and signed a deal with Gilead Sciences to manufacture remdesivir for injections.

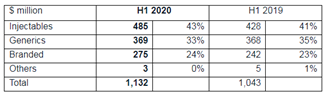

Performance by business division

(Source: Company website)

In H1 FY20, Injectables generated revenue of USD 485 million, which grew by 12 percent year on year from USD 432 million in H1 FY19. The revenue was supported by the demand for Covid-19 related products in the US and Europe. Generic sales were the same as last year and stood at USD 369 million in H1 FY20, and its performance was better than expected due to new products launched. Branded revenue increased by 14 percent year on year to USD 275 million in H1 FY20, and the sales were underpinned by the strong performance in the MENA region.

Pipeline of Injectables in the US

(Source: Company website)

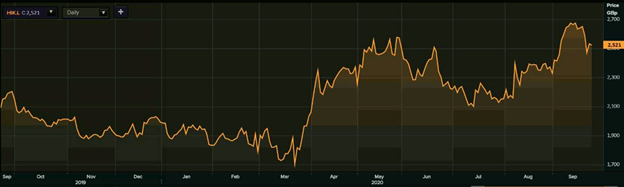

Share Price Performance Analysis

1-Year Chart as on September-24-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Hikma Pharmaceuticals PLC's shares were trading at GBX 2,521.00 and were down by close to 0.36 percent against the previous closing price (as on 24 September 2020, before the market close at 1:00 PM GMT+1). HIK's 52-week High and Low were GBX 2,698.00 and GBX 1,596.00, respectively. Hikma Pharmaceuticals had a market capitalization of around £5.84 billion.

Business Outlook

The Company stated that its performance in H1 FY20 was above expectation and it expects a strong performance in the future as it is a supplier of generic medications. After the update on Advair Diskus® generic drug, the Company expects for FY20, the Generic revenue to lie between USD 710 million and USD 730 million and the core operating margin in the range of 18 percent to 19 percent. The Injectables revenue is expected to be in the range of USD 950 million and USD 980 million with a core operating margin between 38 percent to 40 percent for FY20. Branded revenue would increase by mid-single-digit at constant currency.

Dechra Pharmaceuticals PLC (LON:DPH) - Acquired Osurnia in July 2020

Dechra Pharmaceuticals is a UK based veterinary pharmaceutical company that develops and markets products related to animal health and welfare. The products of Dechra can be classified under Companion animal product, Food producing animal products, Equine and Nutrition.

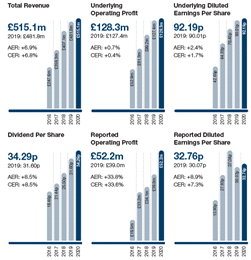

FY2020 results (ended 30 June 2020) as reported on 22 September 2020

(Source: Company website)

Dechra reported revenue of £515.1 million in FY20, which increased by 6.8 percent year on year from £481.8 million in FY19. The operating profit increased by 0.7 percent to £128.3 million in FY20. The diluted earnings per share were 92.19 pence, which grew by 2.4 percent year on year. In FY20, Dechra announced the full-year dividend of 34.29 pence per share. As on 30 June 2020, Dechra had net debt of £127.6 million and liquidity headroom of £353.2 million.

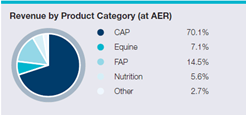

Performance by business division

(Source: Company website)

Companion animal product (CAP) constituted 70.1 percent to the total group sales. CAP reported revenue of £361.6 million in FY20, which increased by 6.3 percent year on year from £340.2 million in FY19. CAP revenue grew due to an increase in market penetration and the addition of Mirataz. Equine generated revenue of £36.4 million, and it grew by 5.8 percent year on year, and the acquisition of Caledonian underpinned it. Food producing animal products (FAP) revenue was £74.8 million in FY20, which increased by 30.5 percent year on year. FAP revenue grew following the acquisition of Venco.

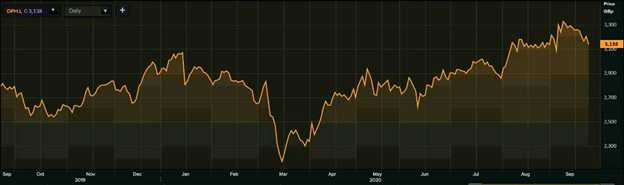

Share Price Performance Analysis

1-Year Chart as on September-24-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Dechra Pharmaceuticals PLC's shares were trading at GBX 3,138.00 and were down by close to 2.06 percent against the previous closing price (as on 24 September 2020, before the market close at 1:00 PM GMT+1). DPH's 52-week High and Low were GBX 3,414.00 and GBX 2,030.00, respectively. Dechra Pharmaceuticals had a market capitalization of around £3.46 billion.

Product pipeline

(Source: Company website)

Business Outlook

Dechra Pharmaceuticals highlighted that it had a resilient performance in FY20, despite supply chain disruption in the first half of the financial year and covid-19 impact in the second half. The in-house manufacturing capacity of the Company is likely to increase as it acquired Ampharmco and addition of Mirataz and Osurnia has increased the geographical presence of the Company.

.jpg)