Summary

- Ferguson to sell Wolseley to Clayton, Dubilier & Rice for £308 million

- The FTSE-100 stock aims at concentrating on its US operations after selling off its UK business

Ferguson PLC (LON: FERG) has announced today that it has entered into an agreement with Clayton, Dubilier & Rice to sell-off Wolseley UK in a £308-million deal. The FTSE-100 stock aims at concentrating on its US operations after disposing of its UK business. The Board of the company expects the transaction to be completed by the end of this month.

The Wolseley business will retain no ongoing liabilities relating to the UK benefit pension scheme, which recorded US$ 27 million as of 31 July 2020. Ferguson, the distributor of plumbing and heating products, intends to return the net cash proceeds from the sale to shareholders in the form of a special dividend. The disposal will be carried under the guidance of Rothschild & Co, which is the financial advisor to Ferguson PLC.

(Image source: ©Kalkine Group 2021)

The revenue generated by Wolseley UK for the year ended 31 July 2020 was $1,879 million, while the underlying trading profit of $8 million was recorded on a pre-IFRS 16 basis. Gross assets for the UK business amounted to $1,093 million on 31 July.

Ferguson Chief Executive Officer Kevin Murphy said that the company’s leading heating and plumbing distribution business in the UK, Wolseley will definitely gain after it merges with Clayton, Dubilier & Rice.

Murphy added that the transaction will enable the group’s simplification and will allow it to focus entirely on investing in and developing its North American business, which is supposed to have the greatest opportunities for profitable growth.

The plumber's merchant came to be known as Ferguson after it changed its name from Wolseley three years back.

Financial Highlights

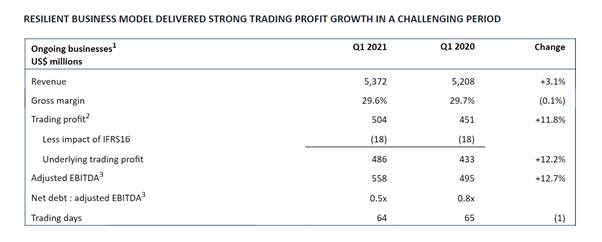

- The Group delivered a strong performance as evident from the Q1 trading update for the period ending on 31 October 2020.

- Revenue: An increase of 3.1 per cent on Y-o-Y basis and 3.3 per cent on an organic basis was witnessed in the revenue generated from the ongoing business, which amounted to $5,372 million.

- Gross margins: This was down by 0.1 per cent from 29.7 per cent in Q1 2020 due to the particular product mix adopted for the period. However, the operating costs continued to be well controlled, resulting in an overall good trading performance.

- Trading profit: Ongoing underlying trading profit recorded a surge of 12.2 per cent (or $53 million) to $486 million, excluding a loss of $18 million from IFRS 16 (2019-20: $18 million).

- Adjusted EBITDA: The group was well positioned with a strong balance sheet, reporting an EBITDA of 0.5 times.

(Source: Ferguson’s RNS Report, LSE)

The stocks of FERG were quoted at GBX 8,892.00 on the London Stock Exchange on 4 January at 12:09 PM GMT, observing a 0.09 per cent rise from its previous close of GBX 8,884.00.