Source: Copyright © 2021 Kalkine Media Pty Ltd.

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 66.09 points or 1.73 per cent higher at 3,887.44, Dow Jones Industrial Average Index surged by 223.74 points or 0.70 per cent higher at 32,026.18, and the technology benchmark index Nasdaq Composite traded higher at 13,049.01, up by 439.85 points or 3.49 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in a green zone amid increasing hopes of a higher stimulus package. Among the gaining stocks, shares of Peloton Interactive surged by about 6.07% after the Company announced plans to expand in Australia. Zoom Video Communications shares jumped by approximately 5.37% after regulatory reports showing that its founder had transferred around 40% of his stake to unspecified beneficiaries. Del Taco Restaurants shares went up by about 2.19% after reporting better fourth-quarter results than the expectations. Among the declining stocks, Stitch Fix shares plunged by approximately 19.78% after the Company had reduced its revenue forecast for the fiscal year.

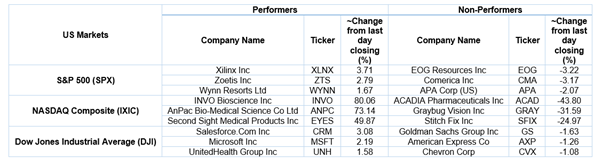

US Stocks Performance*

UK Market News: The London markets traded in a green zone after making substantial gains during the previous trading session. FTSE 100 traded higher by around 0.17%, underpinned by rising investor confidence regarding the Covid-19 vaccination and global stimulus measures. According to the leading market researcher, the British Shoppers had spent around 1.5 billion pounds on online groceries during the four weeks period ended on 27 February 2021.

Retailer WH Smith shares went up by approximately 0.63% after reporting a surge in online sales driven by improved performance during the latest lockdown. Moreover, it helped to reduce the monthly cash burn projection.

Britain’s ITV had reported a significant drop of nearly 21% in full-year adjusted earnings during FY20, adversely impacted by the Covid-19 pandemic. However, the advertising demand rebounded at the end of 2020. Meanwhile, the shares jumped by about 2.76%.

Office space provider IWG had updated that it would close underperforming centres as Covid-19 pandemic recovery is taking longer than anticipated. Moreover, the shares went down by approximately 6.19%.

FTSE 100-listed M&G shares jumped by around 2.83% after the asset manager had reported its operating profit well ahead of the consensus estimates.

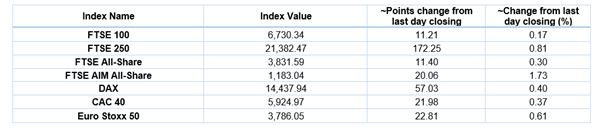

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 9 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Utilities (+2.17%), Technology (+2.06%) and Real Estate (+1.81%).

Top 2 Sectors traded in red*: Basic Materials (-2.25%) and Financials (-0.38%).

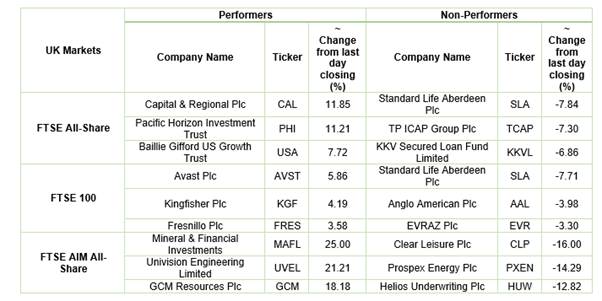

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $67.53/barrel and $64.08/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,716.90 per ounce, up by 2.32% against the prior day closing.

Currency Rates*: GBP to USD: 1.3891; EUR to GBP: 0.8560.

Bond Yields*: US 10-Year Treasury yield: 1.540%; UK 10-Year Government Bond yield: 0.719%.

*At the time of writing

.jpg)