Summary

- WH Smith has abandoned its plans to reward its chief executive with a windfall of shares worth millions

- The book and the stationery chain has braced itself for a headline loss before tax of between £70-75 million for 2020

- The shares of the leading books and stationery chain slumped over 41 per cent in a year’s time mainly due to the pandemic crisis.

UK’s leading books and stationery store chain WH Smith Plc (LON:SMWH) was in the news recently when it was severely criticised for planning to reward its chief executive with a share windfall worth millions despite the losses and pandemic crisis. But later, the company dropped its plan following a backlash from its furious investors.

Company’s top executive Carl Cowling, with a basic salary of £525,000 was scheduled to receive long-term incentive shares, which are nine times higher in value in comparison to his basic salary. The 228-year-old stationery chain was in discussions with its leading shareholders about a proposal, according to some media reports.

Also read: Covid-19: How the second lockdown will affect British hospitality and retail sectors

During the peak of the unprecedented crisis, the high street and travel retail group laid-off nearly 1,500 people and has furloughed thousands of staff members. Despite the challenging environment, the stationery chain had managed to raise £166 million from investors in a bid to bolster its liquidity position. Despite the weakened position of the company, the management was eager to remunerate the top official and therefore, was criticised by the investors.

As a result of protests, the stationery chain decided to abandon the plan to reward Cowling with the proposed bonus worth £4.5 million. The company has been working closely with shareholders in devising a new remuneration policy in the last two months. However, a significant chunk of shareholders was against the decision. The only good thing for the company is that during the second lockdown, several stores of WH Smith will remain open and therefore, the business activities won’t close totally.

Also read: British retail sales drop at the sharpest pace since June

The company’s travel arm has also suffered as the pandemic has changed the landscape of all travel related businesses. The national lockdown and travel bans have contributed immensely by wiping out billions from the businesses. During the peak of the crisis, the company witnessed a huge decline in the footfall of the travellers as the skies remained closed for a considerable amount of time.

How is WH Smith doing?

FTSE-250 listed retail company, engaged in high-street retail and travel businesses, has attained a CAGR (compounded annual growth rate) of just over 3 per cent in its Operating Profit, which rose to £140 million in FY19 from £124 million in FY15, over the course of four-year period.

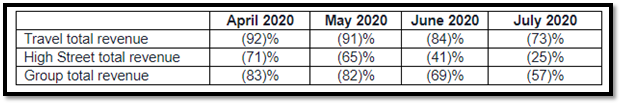

The company has witnessed a gradual recovery after easing of lockdown restrictions globally. Sales for the period are less than last year’s data for the same period. Notably, the group suffered a plunge of 85 per cent in its top-line, as per the trading update released in April. The company reopened 53 per cent of the UK Travel store estate and is focussed on improving average transaction value. The company expects a quicker recovery in the US markets as compared to other markets and has fast tracked the integration of In Motion head office into Marshall Retail Group (MRG).

(Source: Company’s filings, LSE)

The company expects a full-year headline loss due to the Covid-19 outbreak in the second half. The company has though experienced some recovery in the travel business. WH Smith is expected to grow in terms of market shares once the travel bans are completely lifted.

The company has decided to review its store operations across both its Travel and High Street businesses due to a considerable amount of impact on passenger numbers and lower footfall on the UK high street. This has made the company ponder over reducing 11 per cent of its workforce and could eventually lead to business restructuring. The restructuring could further dent the business with additional costs of £15-19 million.

Due to the coronavirus pandemic in the second half of 2020, the book and the stationery chain has braced itself for a headline loss before tax of between £70-75 million for the financial year ending 31 August. The company had cash balances of approximately £63 million along with a revolving credit facility of £200 million on 4 August.

On 10 November around 11:47 AM GMT, the shares of WH Smith Plc were trading at a price of GBX 1,370.00 per share, which were up by 0.29 per cent from the last closing price of the previous day. WH Smith group’s market capitalisation was hovering around £ 1,787.64 billion. The shares of the leading books and stationery chain slumped over 41 per cent in a year’s time.