US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 14.30 points or 0.42 per cent higher at 3,415.50, Dow Jones Industrial Average Index expanded by 213.17 points or 0.76 per cent higher at 28,208.77, and the technology benchmark index Nasdaq Composite traded higher at 11,191.75, up by 1.43 points or 0.01 per cent against the previous day close (at the time of writing, before the US market close at 12:10 PM ET).

US Market News: The Wall Street continued the gaining streak on Wednesday ahead of the Federal Reserve meeting. The US retail sales increased by 0.6 percent month on month in August 2020 against an expected increase of 1.0 percent. Among the stocks that moved upwards, Kodak surged by close to 42.1 percent after the committee finds that no law was broken related to the US government loan. DraftKings jumped by around 7.6 percent after it entered into a deal with the New York Giants. FedEx was up by about 4.9 percent after the company reported revenue of USD 19.32 billion that was above the market’s expectation. Alibaba was up by close to 1.3 percent after the reports that it is planning to invest USD 443 million along with China Mobiles in Zhejiang Dahua Technology. Among the decliners, shares of Adobe were down by around 2.6 percent, although the company reported growth in digital media business. Facebook was down by close to 1.5 percent after some of the celebrities boycotted Instagram.

US Stocks Performance*

European News: The UK and European markets traded in the red as the EU Chief highlighted that the Brexit deal is getting murkier day by day. Meanwhile, the month on month inflation in the UK fell by 0.4 percent in August 2020, but it was less than the expected fall of 0.6 percent. Among the gaining stocks, Energean jumped by around 19.1 percent as the company signed two gas sales and purchase agreement from its Karish project. Shares of Pan African Resources gained by close to 2.2 percent after it reported an increase in gold production in FY2020. Assura was up by close to 2.0 percent after it announced a virtual tour of two projects. Law Debenture was up by close to 0.34 percent after the company would maintain the dividend of 26 pence per share for FY2020. Among the decliners, shares of Redrow were down by close to 1.7 percent after the company reported lower revenue in FY2020. Plus500 was down by around 0.7 percent, although stated that good progress is made on the operational and financial front in H2 FY20.

European Index Performance*:

FTSE 100 Index One Year Performance (as on 16 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: HSBC Holdings Plc (HSBA); Lloyds Banking Group Plc (LLOY); Taylor Wimpey Plc (TW.).

Top 3 Sectors traded in green*: Consumer Cyclicals (+0.32%), Basic Materials (+0.18%) and Technology (+0.17%).

Top 3 Sectors traded in red*: Energy (-1.44%), Utilities (-1.18%) and Consumer Non-Cyclicals (-0.93%).

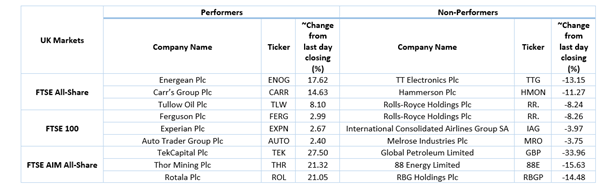

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $42.16/barrel and $40.12/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,973.85 per ounce, up by 0.39% against the prior day closing.

Currency Rates*: GBP to USD: 1.2977; EUR to GBP: 0.9116.

Bond Yields*: US 10-Year Treasury yield: 0.677%; UK 10-Year Government Bond yield: 0.213%.

*At the time of writing