US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 10.09 points or 0.28 per cent higher at 3,679.10, Dow Jones Industrial Average Index surged by 147.16 points or 0.49 per cent higher at 30,030.95, and the technology benchmark index Nasdaq Composite traded higher at 12,411.45, up by 62.08 points or 0.50 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The Wall Street opened mixed as the hiring continues to rise amid the pandemic. The jobless claims for the week ended 28 November 2020 was reported at 712,000 that was better than expected claims of 775,000. Among the gaining stock, shares of Crowdstrike surged about 11.5% after it reported revenue of $232.5 million. Boeing was up by around 2.9% as it gained the most on the DOW 30 index. Among the decliners, Express was down by nearly 5.9% after it reported wider than expected loss. Dollar General declined around 1.2%, although it reported an increase in same-store sales. Snowflake slipped by approximately 0.4% after the company reported its first results after IPO.

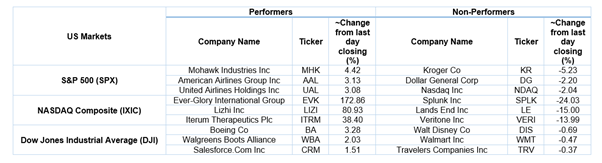

US Stocks Performance*

European News: The UK and European markets traded in the red, although UK firms see better 2021 after vaccine news. The Composite PMI in the was 49.0 in November 2020 that was better than the expected PMI of 47.4. The Services PMI in the UK was 47.6 in November 2020 above expected PMI of 45.8. Among the gaining stocks, shares of N4 Pharma skyrocketed around 36.6% after it announced an update on its ongoing research collaboration agreement with Nanomerics Limited. Flutter Entertainment gained about 9.3% as the company proposed placing new ordinary shares to raise £1.1 billion. Standard Life Aberdeen was up by around 0.5% after it announced Sale of shares in HDFC Life Insurance Company Limited. Among the decliners, Block Energy plunged around 21.6% after it reported close of accelerated bookbuild and results of fundraising. Phoenix slipped by around 0.1% after it reported a full-year cash generation of £1.7 billion.

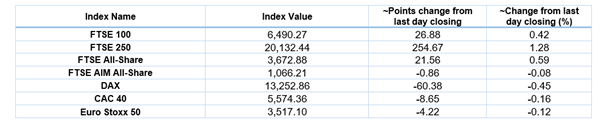

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 3 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); BT Group Plc (BT.A).

Top 3 Sectors traded in green*: Consumer Cyclicals (+2.26%), Basic Materials (+1.53%) and Industrials (+0.59%).

Top 3 Sectors traded in red*: Healthcare (-1.74%), Consumer Non-Cyclicals (-0.69%) and Utilities (-0.53%).

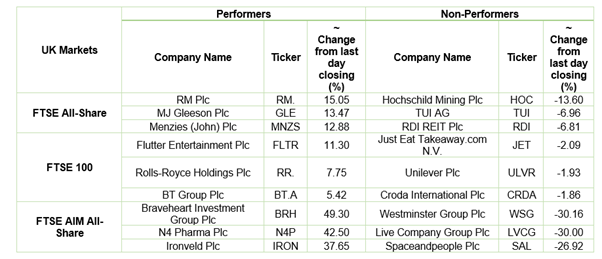

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $48.80/barrel and $45.73/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,841.95 per ounce, up by 0.64% against the prior day closing.

Currency Rates*: GBP to USD: 1.3475; EUR to GBP: 0.9008.

Bond Yields*: US 10-Year Treasury yield: 0.921%; UK 10-Year Government Bond yield: 0.326%.

*At the time of writing

.jpg)