Summary

- 4D Pharma announced clinical trial benefit in Phase A trial from the combined use of MRx0518 and Keytruda®. Also, disease control rate of 42 percent in 12 patients was achieved in Phase A trial.

- The Company is undergoing Phase B of clinical trials, and it is setting up four trial sites in the US.

- N4 Pharma reported that human embryonic kidney cells in vitro were successfully introduced by Nuvec® loaded with coronavirus plasmid. The covid-19 related research project has moved to the third stage.

- The Company is required to make an application in territories where it requires patent protection for Nuvec®.

4D Pharma PLC (LON:DDDD) & N4 Pharma (LON:N4P) are two FTSE AIM-listed healthcare stocks. Based on 1-year return, shares of DDDD and N4P were up by around 24.06 percent and 291.8 percent, respectively. Shares of DDDD and N4P were down by around 1.43 percent and 4.40 percent, respectively (as on 27 August 2020, before the market close at 11:10 AM GMT+1).

4D Pharma PLC (LON:DDDD) – Issued new shares to raise £7.7million

4D Pharma PLC is a UK based pharmaceutical company that is engaged in the development of Live Biotherapeutics and platform MicroRx®. Live Biotherapeutics drug contains bacteria that are used in the prevention and treatment of diseases. MicroRx® platform identifies Live Biotherapeutics based on functions. Six clinical studies of the Company are in-progress. 4D Pharma is included in the FTSE AIM All-Share index.

Trial benefits of MRx0518 and Keytruda®

On 26 August 2020, the Company reported clinical trial benefits from Phase A test that used Live Biotherapeutic candidate MRx0518 and an immune checkpoint inhibitor (ICI) Keytruda®. The Company achieved a 42 percent disease control rate (DCR) in 12 patients that were treated with MRx0518 and Keytruda®. Five patients out of 12 had a significant benefit, whereas three patients out of 12 patients experienced partial responses.

All the 12 patients had metastatic non-small cell lung cancer and metastatic renal cell carcinoma. The five patients that showed clinical benefits underwent treatment for 13.2 months. MRx0518 is a live biotherapeutic for the treatment of cancer, and it is safe as no increase in immune-related adverse events was noticed.

The combination had a good safety profile, unlike most of the trials where there are other adverse effects for the promising treatment of one problem. On 6 July 2020, 4D Pharma reported that it started the clinical trial on a cancer patient for Phase B trial. The Company is opening four sites in the US for trials, and it has increased the recruitment of patients for the trial. Phase B would evaluate the benefit of the combination of MRx0518 and Keytruda®.

Issue of New shares

On 13 July 2020, the Company announced that it raised a gross amount close to £7.7million from the issue of approximately 12 million new shares. 16,807,616 new shares were placed and 5,090,784 new shares were subscribed at 35 pence per share. 4D Pharma highlighted that it would use the funds for the clinical development and to increase liquidity headroom.

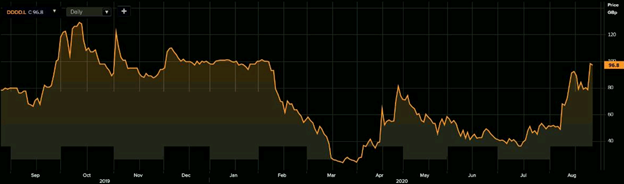

Share Price Performance Analysis

1-Year Chart as on August-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

4D Pharma PLC's shares were trading at GBX 96.80 and were down by close to 1.43 percent against the previous closing price (as on 27 August 2020, before the market close at 11:10 AM GMT+1). DDDD's 52-week High and Low were GBX 131.00 and GBX 23.50, respectively. 4D Pharma had a market capitalization of around £129.03 million.

Business Outlook

The Company is hopeful over the results achieved from the clinical trials. The 42 percent disease control rate was above the threshold of 10 percent the Company agreed with its partner MSD. The encouraging results would support the Phase B of the study. 4D Pharma would study Phase B for 30 additional patients per tumour type.

N4 Pharma (LON:N4P) – Optimization programme on Nuvec® is on track.

N4 Pharma PLC is a UK based pharmaceutical company that is engaged in the development of Nuvec®. Nuvec® is a delivery system used for cancer treatments and vaccines. N4 Pharma partners with other companies to develop antigens using Nuvec® for the treatment of cancer. N4 Pharma is included on the FTSE AIM All-Share index.

Recent Developments

- On 14 August 2020, the Company announced the exercise of warrants for issuance of 112,500 new shares at 0.4 pence per share. The total proceeds were close to £4,500.

- On 12 August 2020, N4 Pharma reported that human embryonic kidney cells in vitro were successfully introduced by Nuvec® loaded with coronavirus plasmid. The protein spike was witnessed within the cells. The Company, along with Evotec, is undergoing a three-stage covid-19 research plan. The research has moved to the third stage after successful completion of the second stage.

- On 6 July 2020, N4 Pharma announced that the optimization programme for data generation related to use of Nuvec® as an injectable delivery system for vaccines was on track. It has noticed through research that Nuvec® could be used as a delivery system for oral vaccines. If the Company is successful in the use of Nuvec® for oral vaccines, it will get a competitive advantage.

- On 18 May 2020, the Company reported that it is required to make an application in territories where it requires patent protection for Nuvec®. Given the requirement, it would file an application in the UK, Europe, Japan, India, Australia, Canada and China. The Company filed the patent application on 15 November 2018 for Nuvec®.

Share Price Performance Analysis

1-Year Chart as on August-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

N4 Pharma PLC's shares were trading at GBX 11.95 and were down by close to 4.40 percent against the previous closing price (as on 27 August 2020, before the market close at 11:10 AM GMT+1). N4P's 52-week High and Low were GBX 16.00 and GBX 2.00, respectively. N4 Pharma had a market capitalization of around £19.04 million.

Business Outlook

It is hopeful of the third stage of research after the successful completion of the second stage of covid-19 research. The Company is aware of the dreadful impact coronavirus has had worldwide, and any successful outcome from the study would be encouraging. N4 Pharma would seek partners for how Nuvec® could be used as a delivery platform. The Company is seeking patent protection in the potential markets keeping in mind the expense related to it.