US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 22.25 points or 0.68 per cent higher at 3,293.28, Dow Jones Industrial Average Index accelerated by 18.29 points or 0.07 per cent higher at 26,538.24, and the technology benchmark index Nasdaq Composite traded higher at 11,139.29, up by 134.42 points or 1.22 per cent against the previous day close (at the time of writing, before the US market close at 11:55 AM ET).

US Market News: The Wall Street opened in red as the US reports 751,000 jobless claims for the week ended 24 October 2020. In Q3 2020, the US reported GDP growth of 33.1% quarter on quarter. Meanwhile, the Pending Home sales declined by 2.2% month on month in September 2020 that was against the expected growth of 3.4%. Among the gaining stocks, Tapestry rose by about 6.4% after it reported profit per share of 58 USD cents. Comcast gained by around 1.4% after it added 663,000 broadband customers during the quarter. Tiffany was up by around 0.5% after it agreed on a revised takeover deal with LVMH. Among the decliners, shares of Spotify plunged by around 8.8% after it reported a loss in the quarter. Marvell Technology was down by close to 6.8% after the company plans to buy Inphi for USD 10 billion. Shopify fell by around 2.6%, although it reported earnings better than the estimates.

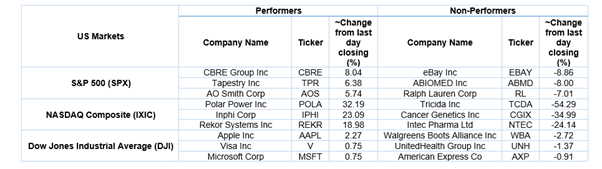

US Stocks Performance*

European News: The London and European markets traded in the red as France and Germany apply new lockdowns. The mortgage approvals in the UK increased to 91,454 in September 2020, and the mortgage lending was £4.83 billion. Among the gaining stocks, Lloyds Banking was up by nearly 2.9% after it reported healthy performance supported by demand for mortgages. BT Group rose by around 1.9% after it posted results in line with expectation in H1 FY21. Royal Dutch Shell gained by around 0.9% after it announced the dividend for Q3 20. Among the decliners, shares of WPP were down by 1.9% after it reported a 9.8% decline in Q3 20 revenue. Imperial Brands was down by close to 0.8% after it completed sales of the worldwide premium cigar business. Evraz slipped by 0.2% after it reported a decline in crude steel output.

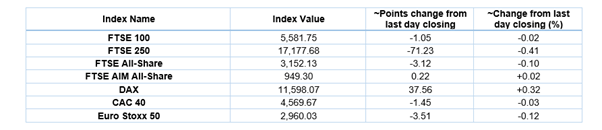

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 29 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top Sector traded in green*: Consumer Cyclicals (+0.71%).

Top 3 Sectors traded in red*: Consumer Non-Cyclicals (-1.66%), Healthcare (-1.17%), and Real Estate (-1.17%).

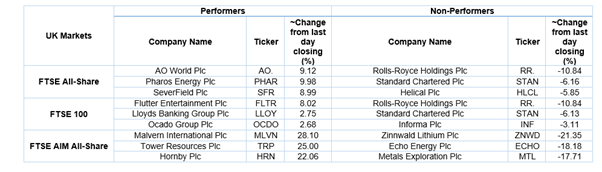

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $38.22/barrel and $36.16/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,866.55 per ounce, down by 0.67% against the prior day closing.

Currency Rates*: GBP to USD: 1.2921; EUR to GBP: 0.9032.

Bond Yields*: US 10-Year Treasury yield: 0.838%; UK 10-Year Government Bond yield: 0.230%.

*At the time of writing