US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 77.58 points or 2.25 per cent higher at 3,521.02, Dow Jones Industrial Average Index expanded by 601.75 points or 2.16 per cent higher at 28,449.41, and the technology benchmark index Nasdaq Composite traded higher at 11,868.99, up by 278.21 points or 2.40 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The Wall Street traded in the green as the US Presidential election remains too close to call. The US weekly jobless claims reported at 751,000 for the week ended 31 October 2020. Among the gaining stocks, shares of Capri Holdings gained around 6.2% after the sales improved due to online sales and strong demand in China. General Motors gained about 3.4% after it reported quarterly earnings per share of 2.83 USD cents. The insurance company Cigna was up by around 1.0% after it reported earnings per share of USD 4.41 per share. Merck shares rose by nearly 1.8% after the company is buying VelosBio for USD 2.75 billion. Among the decliners, Biogen declined by around 6.2% on NASDAQ 100. Regeneron was down by close to 0.6%, although it reported revenue above market estimates.

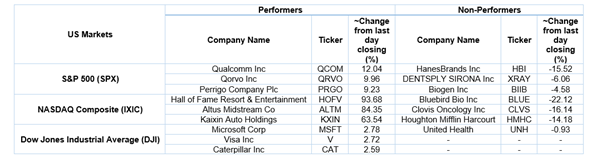

US Stocks Performance*

European News: The London and European markets traded in green as Rishi Sunak announces plans to support jobs. New car registrations in the UK declined by 1.6% in October 2020. Meanwhile, the Bank of England boosts bond-buying by £150 billion as the UK imposes new lockdown measures. Among the gaining stocks, Homeserve gained 5.9% and led the FTSE-100 gain. Wizz Air gained around 1.3% after it sees travel recovery from spring. AstraZeneca was up by close to 0.4% after the company got a go-ahead signal from the Chilean government for the clinical trial of vaccines. Among the decliners, J Sainsbury fell by around 4.5% after the reports that the company will cut around 3,000 jobs. Superdry was down by about 4.3% after the sales got affected due to a lower footfall. Auto Trader slipped by approximately 1.4% after it reported a 37% decline in the first half revenue.

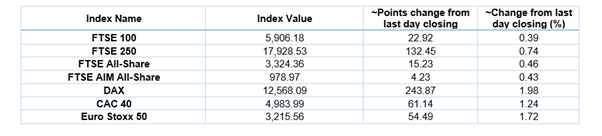

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 5 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Real Estate (+1.58%), Consumer Cyclicals (+1.04%) and Industrials (+1.03%).

Top Sector traded in red*: Energy (-1.34%).

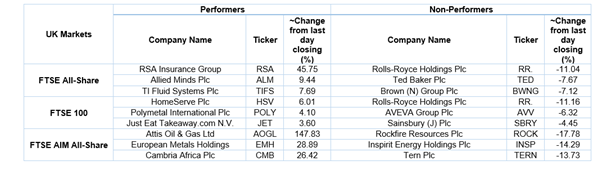

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $40.91/barrel and $38.74/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,949.55 per ounce, up by 2.81% against the prior day closing.

Currency Rates*: GBP to USD: 1.3109; EUR to GBP: 0.9009.

Bond Yields*: US 10-Year Treasury yield: 0.783%; UK 10-Year Government Bond yield: 0.229%.

*At the time of writing