Summary

- The retail sales in the UK grew at the fastest pace in September to +11 as compared to -6 in the month of August.

- Furniture, DIY, and grocery sales have increased sharply while Clothing and department store retailers continued struggling

- Tesco and J Sainsbury stocks have bounced back from the lows of March when the lockdown was announced

The retail sector has been the major driving force behind the UK’s economy during the unprecedented crisis caused by the novel coronavirus. The retail sales in the UK grew at the fastest pace in September 2020 since April 2019 as per the survey conducted by the Confederation of British Industry (CBI). According to the survey, monthly retail sales balance surged unexpectedly to +11 level in September from -6 in the previous month. Clothing and department store retailers have been struggling despite the easing of lockdown. However, Furniture, DIY, and grocery sales have increased sharply.

The momentum of retail spending by the consumers has been carried forward in September from the previous months. The retail sales are expected to rise further as the nation fears another wave of the pandemic due to a sudden spike in the number of coronavirus infections. People might resort to stockpiling and buying stuff in bulk quantities.

Other data have also been pointing to the retail sales improvement, according to Office of National Statistics (ONS), the retail sales volumes increased by 0.8 per cent month-on-month in August 2020 in comparison with July. In comparison to pre-pandemic levels (February), peoples’ expenditure on home improvements continued to rise in August as sales volumes within household goods stores increased by 9.9 per cent. The major strength of the retail sector is its online delivery model. The online retail sales in the UK were still 46.8 per cent higher in comparison to the pre-pandemic levels (February).

Also read: Retail Sales Volume and Value Increases in the Month of June in the UK

Let us put our lens through some of the UK’s leading retailers: Sainsbury’s and Tesco.

J Sainsbury Plc

FTSE 100 listed J Sainsbury Plc (LON:SBRY) is a general retailer company, which operates and manages a chain of supermarkets across the UK. During the first quarter of the financial year 2021, the Company witnessed an increase in overall sales primarily driven by its online marketplace. The Company experienced a single-digit percentage of grocery sales growth during the lockdown period and was expecting that this growth shall sustain through the first half of 2021.

Over the course of four years (FY16 – FY20), the Company’s revenue surged from GBP 23,506 million in FY16 to GBP 28,993 million in FY20 at a CAGR (Compounded annual growth rate) of 5.38 per cent.

Business Highlights Q1

- Although the sales in the clothing segment declined by 26.7 per cent on a year-on-year basis, the Online sales of the company surged more than double during the first quarter of 2021.

- The sales from grocery business surged by 10.5 per cent; general merchandise surged by 7.2 per cent on a year-on-year basis driven by strong sales performance in Argos.

- The leading retailer witnessed an increase in retail sales by 8.2 per cent on a like-for-like basis during the period.

Daniel Kretinsky, a Czech billionaire, has bought a 3.05 per cent stake recently in the supermarket chain and has become one of the major shareholders in the company.

J Sainsbury or Sainsbury’s has a strong brand recognition across the country and the company has been associating well with the customers through its online food delivery schemes during the crisis.

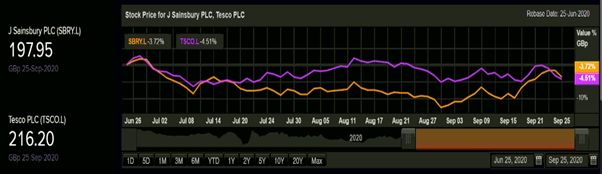

The stock created a new bottom of GBX 174.95 during mid of March. Since then, the stock has delivered a share price return of 13.15 per cent.

Tesco Plc

The United Kingdom-based food & drug retailer Company, Tesco Plc (LON: TSCO) has performed really well in the UK, Ireland, and Central Europe in the recent times despite adverse trading conditions, primarily because of its online business model.

Tesco has increased its online capacity to almost twice in recent times. The UK based retailer has transformed the shopping experience by implementing extensive social distancing measures and offering support to the vulnerable sections of the society.

Business Highlights Q1

- With an increase in sales of 8.2 per cent in the UK and Ireland, there was a surge in total sales of 8 per cent and 7.9 per cent on an LFL basis, respectively.

- The Company managed to increase online capacity significantly to 1.3 million slots per week from 600 thousand slots per week and expects around £2 billion of sales growth in FY2021

- The sales from the Central European region (except Poland) stood decent with an increase of 3.3 per cent and 3.9 per cent on an LFL basis, respectively.

Tesco has been investing heavily in innovative technologies that can certainly be the game-changer in the coming years apart from increasing the number of online delivery slots.

British multi-retailer Tesco is expected to try drone delivery for grocery items. People still avoid going out to public squares or supermarkets for shopping due to fear of falling prey to the deadly virus. Therefore, drone deliveries offer a good alternative given the current circumstances in the UK with reference to the rising number of infections in the UK.

Tesco, in collaboration with Manna, a drone delivery company would be testing doorstep deliveries of essentials in small quantities in less than 30 minutes by drone. Tesco is expected to commence testing doorstep deliveries through drone next month.

The stock created a new bottom of GBX 211.20 during mid of March. Since then, the stock has delivered a share price return of 2.37 per cent. The performance of both the stocks has been identical to some extent.

Also read: Tesco’s Experiment with Drone Can Be A Game Changer for Supermarkets

Comparative chart: 3-month period SBRY vs TSCO

(Source: Refinitiv, Thomson Reuters)

The retail sector witnessed a minimal impact on its operations due to the pandemic. The major challenge for the retailers will be to keep their supply chains intact if there is indeed a second wave of infection as people might shop in bulk quantities as they fear another strike of the deadly virus. Some of the retailers are investing in new technologies as they gear up for the festive season and are also likely to get the support of the Chancellor’s announced new job support scheme.

.jpg)