SoftBank Group Corp.

SoftBank Group Corp. (TYO: 9984) is a Minato-Ku, Japan based company that is engaged in a diverse range of businesses across the world through its various subsidiaries and other companies in which it has made investments. The companyâs flagship business segment is the telecommunications segment through which it is involved in providing mobile terminal services across Japan. So as to address the issues of different clients, the company is creating three brands of portable interchanges benefits: the fundamental brand "Softbank", the low-valued sub-brand "Yi Mobile", and "LINE Mobile".

SoftBank Group Corp. and Yahoo are creating versatile internet business benefits that enable clients to effectively and helpfully utilize different administrations, for example, web-based shopping given by Yahoo! JAPAN from "Softbank" and "Ymobile" cell phones. Moreover, the company is endeavouring to build the additional estimation of its administrations, for example, making Yahoo! Premium for all intents and purposes free for clients of the two marks and giving extra focuses when utilising Yahoo! Shopping.

Through its Sprint Business, which is known for developing, commercializing and marketing innovative technologies, it is giving the first 4G service as the US operator, and giving push-to-talk abilities both in Japan and abroad, providing operators as a worldwide Tier 1 supplier of internet foundation. As of now, the organisation is likewise in the situation of putting resources into cutting edge systems to give better systems. Notwithstanding improving the inclusion, speed, and unwavering quality of 4G LTE systems by combining various technologies, for example, steel towers and little base stations for LTE, "Sprint Magic Box" and "Massive MIMO," it has additionally begun VoLTE. The SoftBank Group Corp. has developed a tactical integrated group to move towards the SoftBank 2.0 vision by making investments in technologies, technological companies and entrepreneurs to bring the future, a little closer. Under the same policy, SoftBank Group Corp. Vision Fund and Delta Fund are aiming for large-scale and long-term investment activities. Regardless of whether it is listed or unlisted or has a large share in a wide range of technology fields such as communications infrastructure, communications business, computational biology, other data utilisation business, cloud technology, software, consumer internet business, financial technology, etc. The company will invest from emerging technology companies to large companies, through this vision fund, the company has also made a significant and renowned investment in the We Co., forming the WeWork brand, which is a massive provider of coworking space services and has also recently been in a lot of news. The vision fund has also invested around US $32 billion in the United Kingdom based company, Arm Holdings Plc, which is a semiconductor technology design company, or simply put, a chip designer for smartphones, including Appleâs iPhones. Arm's processor design is known to be built into the main chip of almost every smartphone. Arm's high-performance, power-saving processor design is embedded in more than 21 billion chips shipped from partners in 2017, enabling intelligent computing. From digital TVs to brake systems, smart sensors, and data centres that support the cloud, various digital devices use Arm technology.

Financial Performance

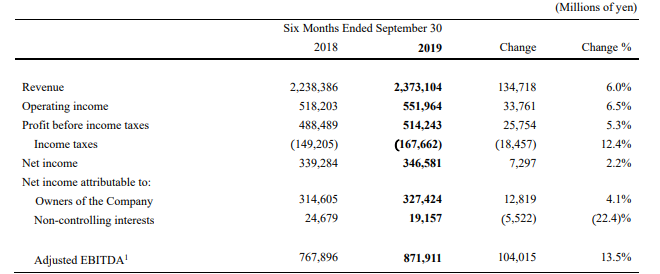

On 5th November 2019, the company announced a consolidated financial report for the six months ended 30th September 2019. The company reported the revenue for the period at JPY 2373.1 billion, an increase of around 6 per cent year on year as compared to the revenue reported during the same period in the previous year at JPY 2238.3 billion. Segment-wise, revenue increased by JPY 47.012 billion in the Consumer segment, JPY 12.497 billion in the Enterprise segment, JPY 53.499 billion in the Distribution segment, and JPY 20.354 billion in the Yahoo segment. The company reported the operating income to be at JPY 551.96 billion in H1 2019, an increase of 6.5 per cent or JPY 33.761 billion year on year as compared to the operating income reported in H1 2018 at 518.20 billion. Operating income increased by JPY 18.101 billion in the Consumer segment, JPY 3.862 billion in the Enterprise segment and JPY 2.603 billion in the Distribution segment, while decreasing by JPY 2.348 billion in the Yahoo segment. Operating income under Others increased by JPY 9.478 billion. This increase was mainly because of the recording of a gain on the loss of control due to the reclassification of Cybereason Japan Corp. from the Companyâs subsidiary to an equity-method affiliate. Net income for H1 2019 increased by JPY 7.297 billion or 2.2 per cent year on year to JPY 346.581 billion, from JPY 339.284 billion in the first half of 2018. The increase in income taxes in the period under review was because of a surge in profit before income taxes (PBIT) and the effect of the use of loss carryforwards in the same period of the previous year. The company reported Basic Earnings per share for H1 2019 at JPY 68.44 per share as compared to JPY 65.72 per share in H1 2018, and Diluted earnings per share of JPY 67.55 per share in H1 2019 as compared to JPY 65.72 per share in H1 2018. The company has declared an interim dividend of JPY 42.50 per share in the second quarter of the year in reflection of the sound financial performance.

Source: Company Website

Share Price Performance

On 5th November 2019, SoftBank Group Corpâs share price at Tokyo Stock Exchange closed trading at JPY 4294.00 per share, an increase of 2.43 per cent or JPY 102.00 per share as compared to the previous dayâs closing price, which was reported to be at JPY 4192.00 per share. At the time of closing, the SoftBank Group Corp share price was trading 28.96 per cent below the 52-week high share price, which was at JPY 6045.00 per share, set on April 16, 2019. This was also 26.24 per cent above the 52-week low price at JPY 3,401.50 per share, which the companyâs share set on December 26, 2018. The market capitalisation (m-cap) of the SoftBank Group Corp has been reported at JPY 8.76 trillion.

18.83 million of the companyâs shares traded in the market traded for the day. The average volume of trading per day, for the last one year in the market, was 17.61 million shares. The share has reportedly shown a negative change of 1.82 per cent in value in the last one year. The company has 2.09 billion outstanding shares floating on the Tokyo Stock exchange, with 1.53 billion shares in free float. The marketâs short-selling activity on the companyâs share has been low.

The beta of the companyâs share has been reported to be at 1.2895. This implies that the movement in the companyâs share is more volatile in nature, as compared to the movement of the benchmark market index.