As people find it more convenient to transact online rather than visiting a branch for making basic transactions, there has been a decline in footfall of customers in the banks in recent times. As a result, HSBC Holdings has joined its peers who are reducing their retail presence and is planning to close more than 25 branches this year. The bank is looking forward to reducing its number of branches under 600, though will continue to serve in some flagship locations. On the same time, the bank would be investing £34 million to revamp its branches along with the refurbishment of its sites. The bank accepted the fact that there has been a significant drop in the customersâ visits in the HSBC UK branches by almost 33 per cent.

Headquartered in London, HSBC Holdings Plc (LON:HSBA) is the parent company of the HSBC Group. HSBC Holdings Plc is one of the biggest banking & financial services giants across the globe with assets of US$2,715 billion as at 31st December 2019. The Group has representative offices in Asia, Europe, North Africa, Middle East, Latin America and North America. The Group services its customers in more than 60 countries.

However, this move by HSBC Holdings has nothing to do with the 35 thousand job cuts previously announced by the bank. Over the course of three-year period, the bank plans to reduce its cost base by £3.5 billion, which shall result in a reduction of 15 per cent in the Groupâs representative base worldwide. However, automation of some services might translate into some job losses as they would no longer be required. The workforce relieved from the redundant roles would be redeployed to nearby branches or would be moved to other roles within HSBC Holdings.

The bank understands the need for sustainable branch network for the future to service its customers, but the decision also reflects the change in the method of delivering services to the customers.

As the consumers are accepting technological advancements in Banking services, major banks in the United Kingdom have been cutting down their branch network. Lloyds Banking Group (LON:LLOY) will be shutting down 50 plus branches this year as announced in January, due to change in consumer behaviour. The Banking Group has already closed more than 650 branches since 2010. Between April and October this year, the Group shall close 15 Bank of Scotland branches, 31 Lloyds and 10 Halifax branches. The Group though has added that the customers can access banking services from Post offices along with bankâs mobile branches.

London based lender, Lloyds Banking Group Plc is a provider of a wide variety of banking and non-banking services across the United Kingdom. The companyâs offering includes deposit facilities, credit facilities (both long-term and short-term), credit and debit payment systems, investment instruments, finance facilities for consumables and debt instruments. The company operates in different segments, namely- Retail Banking, Commercial Banking, Consumer Finance and Insurance segment.

Another dimension to this business model is the section of society which is not tech-savvy and is used to conventional banking or making cash transactions, who will find it difficult if the branches are reduced. Most of the sections of the society rely heavily on cash transactions in their day to day lives.

Since the occurrence of the credit crisis in 2008, the banking industry across the globe has been through transition to improve upon customerâs banking experience and regain their trust. âBankâ literally means âto rely uponâ. The financial crisis of 2008 sent shockwaves to the entire banking sector across the globe. Banks are the engines of the economy, and once they are down, any economy can go south.

In order to improve the customerâs experience, the banking industry started to innovate and enter the domain of Fintech startups and deployed digital banking tools by using innovation, data and analytics and digitising processes. Paperwork has been reduced drastically. People find it more convenient to transfer money through online banking or mobile banking. In some countries, now even debit cards are not required. One can easily make withdrawals through ATMâs by authorising his account through OTP (One Time Password) generated through mobile banking application on his smartphone.

The banking industry in the United Kingdom comprises of 300 banks and 45 building societies. There are approximately 70 thousand ATMs and 9 thousand bank branches across the United Kingdom, making the sector fourth largest in the world and the largest in Europe. According to some estimates, the Big Four Banks (HSBC, Barclays, Royal Bank of Scotland and Lloyds Banking Group) make most of the market share in the banking sector with a portfolio of UK current accounts and business accounts. These banks together have a representative base of more than 500 thousand and total assets worth more than GBP 5 trillion.

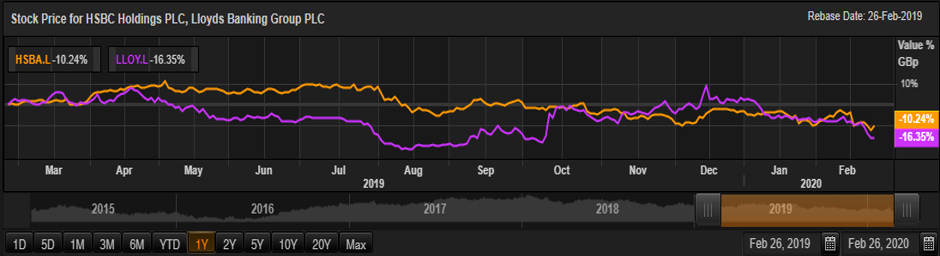

Share Price Performance of HSBC Holdings Plc

On 26th February 2020, at the time of writing (before market close, GMT 10:28 AM), HSBC Holdings Plcâs shares were trading at GBX 550.9, up by 2.08 per cent against its previous day closing price. Stock's 52 weeks High and Low is GBX 687.70 /GBX 537.60. At the time of writing, the share was trading 19.89% lower than its 52w High and 2.47% higher than its 52w low. Stockâs average traded volume for 5 days was 48,047,455.60; 30 days â 24,529,688.60 and 90 days â 20,944,482.39. The average traded volume for 5 days was up by 95.87% as compared to 30 days average traded volume. The companyâs stock beta was 1.13, reflecting higher volatility as compared to the benchmark index. The outstanding market capitalisation was around £108.98 billion along with a dividend yield of 7.29%.

Share Price Performance of Lloyds Banking Group Plc

On 26th February 2020, at the time of writing (before market close, GMT 10:33 AM), Lloyds Banking Group Plcâs shares were trading at GBX 51.68, which remained flat against its previous day closing price. Stock's 52 weeks High and Low is GBX 73.66/GBX 48.16. At the time of writing, the share was trading 29.84% lower than its 52w High and 7.31% higher than its 52w low. Stockâs average traded volume for 5 days was 232,383,044.60; 30 days â 147,004,344.10 and 90 days â 163,468,565.68. The average traded volume for 5 days was up by 58.08% as compared to 30 days average traded volume. The companyâs stock beta was 0.78, reflecting lesser volatility as compared to the benchmark index. The outstanding market capitalisation was around £36.34 billion along with a dividend yield of 6.48%.

(Comparative chart of HSBA & LLOY: Source: Thomson Reuters)