How to plan for your retirement?

Retirement Planning is an important aspect of a personâ financial life. Retirement planning process not that complicated, if started early and if financial discipline is followed. But it is a long term process, and various factors have to be kept in mind. This includes identifying sources of income, estimating expenses, investing in long terms savings or an investment scheme, as well as the management of current and potential assets and risk. Financial tools like Future value of money, as well as inflation rate, are used to evaluate if the income and assets at the time of retirement will be in surplus of the expenses at the time. Other important factors that impact retirement planning are qualitative measures such as standard of living, and quantitative aspects such as cost of living.

While making savings and investments for the purpose of retirement, it is also imperative to understand some tools, such as equity and debt investments, savings management, asset management and banking on the right kind of instruments suitable for every individual. In the retirement planning process, dividend-paying stocks could play an important role.

How do dividends work?

When an investor acquires or buys a stock/share of the company, they become a part-owner of the company proportionate to the number or percentage of shares they own. This allows the investor of the stock to earn money in two ways. The first is, if a company performs well, its share prices on the stock exchanges tends to rise, which the investor can later sell for a profit, resulting in a capital gain for the investor. Becoming a proportionate owner of the company with the shares held, also allows the investor to receive profits generated by the company, which are paid out in the form of dividends, which are declared by the board of the company, on the basis of quarterly, half-yearly or annual financial performance of the company. The payment of dividends is generally on the discretion of the board of the company, and hence, some companies pay a very high share of earnings as dividends (Dividend Yield), while the others retain a major portion for their growth. Dividend yield is also a good tool to understand the financial health and stability as well as the quality of the earnings generated by the company.

High dividend-yielding stocks can play a crucial role in the retirement planning process of individuals.

Leveraging dividend stocks to improve retirement income

The primary reason for an investor to invest in dividend stocks for the purpose of retirement is low risk. Investors generally tend to make investments in low-risk assets, when planning for retirement, primarily because of the fact that they want these investments to be secure throughout their cycles. High dividend-yielding stocks are a good measure of evaluating if a companyâs stock is safe or not, because traditionally, the high dividend yield has been a sign of growth and extremely high financial stability for companies in general.

Dividends are also a good hedging strategy to protect investors from an economic downturn, which could potentially lead to a loss on the equity investments they hold for the purpose of retirement. The extra income generated through these dividends can act as a cover for the losses made through such investments. The dividend can also act as a cover against other financial downturns such as high interest and borrowing rates, which can have a deeper impact on returns on any kind of investments.

Another reason why investing in dividend stocks is important for financial planning is the power of compounding. Traditional investments in equity, bonds and other assets can lead to good capital gains, but if combined with good dividend receipts, over a long period of time, the returns from these investments become many-fold, primarily due to the power of compounding and the fact that generating extra money from dividends can lead to creation of even more wealth.

Dividend growth is another strategy used by investors to identify stocks that will pay higher dividends even in the future. A growth in dividend over a period of time is an indicator that the company is performing well and might continue to pay high dividends as and when they earn high profits. This, however, does not come without its risk, as the companies can choose to cut out on dividends or alter their dividend policy whenever they want, which makes the investment riskier.

Four Key FTSE Stocks with a high dividend yield that can help you build retirement income

The recent stock price performances of the companies that have paid good dividends in the past and have a high dividend yield.

Galliford Try Holdings Plc (LON:GFRD) Share Price Performance

On 22nd January 2020, at around 11:10 A.M (Greenwich Mean Time), at the time when this report was being written, Galliford Try Holdings Plcâs share price was reportedly at GBX 134.38 per share on the London Stock Exchange market, a drop in the price of 1.47 per cent or GBX 2.00 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 136.38 per share. The market capitalisation of Galliford Try Holdings Plc was reported to be at £151.45 million with regards, to the price at which the companyâs share was trading at the time of writing. The companyâs annual dividend was GBX 58.00 per share, while the annual dividend yield was reported to be at 41.59 per cent.

The companyâs stock beta was reported at a value of 0.95, giving an idea that the Galliford Try Holdings Plcâs share has been less fickle in nature, in comparison to the sensitivity of the comparative benchmark index in the previous year.

Evraz Plc (LON:EVR) Share Price Performance

On 22nd January 2020, at around 11:15 A.M (Greenwich Mean Time), at the time when this report was being written, Evraz Plcâs share price was reportedly at GBX 401.50 per share on the London Stock Exchange market, a drop in the price of 0.12 per cent or GBX 0.50 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 402.00 per share. The market capitalisation of Evraz Plc was reported to be at £5.836 billion with regards, to the price at which the companyâs share was trading at the time of writing. The companyâs annual dividend was GBX 82.74 per share, while the annual dividend yield was reported to be at 19.41 per cent.

The companyâs stock beta was reported at a value of 2.1, giving an idea that the Evraz Plcâs share has been more fickle in nature, in comparison to the sensitivity of the comparative benchmark index in the previous year.

Ted Baker Plc (LON:TED) Share Price Performance

On 22nd January 2020, at around 11:20 A.M (Greenwich Mean Time), at the time when this report was being written, Ted Baker Plcâs share price was reportedly at GBX 298.80 per share on the London Stock Exchange market, a fall in the price of 6.33 per cent or GBX 20.20 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 319.00 per share. The market capitalisation of Ted Baker Plc was reported to be at £142.17 million with regards, to the price at which the companyâs share was trading at the time of writing. The annual dividend yield of the company was reported to be at 15.27 per cent.

The companyâs stock beta was reported at a value of 0.91, giving an idea that the Ted Baker Plcâs share has been slightly less fickle in nature, in comparison to the sensitivity of the comparative benchmark index in the previous year.

Halford Group Plc (LON:HFD) Share Price Performance

On 22nd January 2020, at around 11:25 A.M (Greenwich Mean Time), at the time when this report was being written, Halford Group Plcâs share price was reportedly at GBX 161.00 per share on the London Stock Exchange market, a jump in the price of 1.64 per cent or GBX 2.60 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 158.40 per share. The market capitalisation of Halford Group Plc was reported to be at £315.40 million with regards, to the price at which the companyâs share was trading at the time of writing. The companyâs annual dividend was GBX 18.57 per share, while the annual dividend yield was reported to be at 11.56 per cent.

The companyâs stock beta was reported at a value of 0.15, Â giving an idea that the Halford Group Plcâs share has been less fickle in nature, in comparison to the sensitivity of the comparative benchmark index in the previous year.

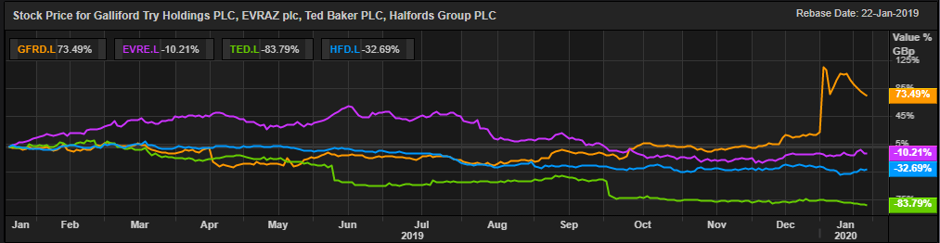

Comparative share price chart of GFRD, EVR, TED and HFD

(Source: Thomson Reuters) Daily Chart as on 22-January-20, before the closing of the LSE Market