Business overview: Frontier Developments Plc

Frontier Developments Plc (LON:FDEV) is a Cambridge, the United Kingdom based Leisure Group that is engaged in the business of the development of non-game applications, such as gameplay design, and User Interface for some of the most popular video game companies as well as animation companies in the world.

The Group is also in the business of selling merchandise and game accessories, as well as the video games that it publishes from its website. The Group also allows custom designing on these merchandise on its website, with a wide range of design tools available for customers using itâs in- game designs and pop culture references. Frontier Developments also sells a wide range of books that include multiple stories related to its games as well as storylines that are further included in the games. These books are sold in both hard and audio formats.

All the Groupâs published video games are available across various platforms like the personal computer (PC), Microsoftâs XBox360, Sonyâs Play Station 3, Appleâs iPhone operating system (iOS) as well as on Nintendoâs Wii U platform. The titles of some of the best games that the Group has helped in the development for are Planet Zoo, Jurassic World Evolution, Elite Dangerous, Kinectimals, Zoo Tycoon, Planet Coaster. The Group engages in the development of these games using itâs own proprietary technology. The Group has formerly developed designs for third party video game publishers such as the likes of Amazon, Microsoft, Konami, Atari, which were all backed by Cobra.

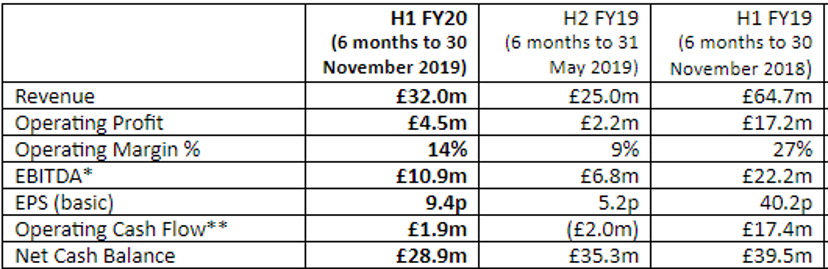

Frontier Developments Plc reports interim results for H1 FY20

(Source: Companyâs filings, London Stock Exchange)

Due to the companyâs strategy of evolving gameplay, free and paid content, price promotions and active community management, each of its four titles continued to perform well in both base game sales and paid-downloadable content and shall deliver material revenue contributions in the fiscal year 2020.

With all four titles performing well, the companyâs revenue was recorded at £32.0 million in the first half of the fiscal year 2020 in comparison to the revenue of £25.0 million recorded in the second half of the fiscal year 2019. The revenue recorded in the first half of the fiscal year 2020 included just 26 days of sales of Planet Zoo, which was launched exclusively for PCâs.

The company recorded a higher Gross profit margin of 67 per cent during the period due to the higher proportion of sales from own-IP games, particularly the launch of Planet Zoo as against 61 per cent in the second half of the fiscal year 2019.

In addition, the company recorded £4.5 million as operating profit in the first half of the fiscal year 2020 due to solid operating margin performance of 14 per cent in contrast to an operating margin of 9 per cent in the second half of the fiscal year 2019. The company had cash balances of £28.9 million as at 30 November 2019.

Frontier Developments Plc -Stock price performance

Daily Chart as at Feb-05-20, before the market close (Source: Thomson Reuters)

On 5th February 2020, at the time of writing (before market close, GMT 1:11 PM), Frontier Developments Plc shares were trading at GBX 1,252, down by 13.30 per cent against its previous day closing price. Stock's 52 weeks High and Low is GBX 1,452.00 /GBX 790.00. At the time of writing, the share was trading 13.77% lower than its 52w High and 58.48% higher than its 52w low. Stockâs average traded volume for 5 days was 33,188.40; 30 days - 55,380.43 and 90 days - 70,580.72. The average traded volume for 5 days was down by 40.07% as compared to 30 days average traded volume. The companyâs stock beta was 1.02, reflecting slightly higher volatility as compared to the benchmark index. The outstanding market capitalisation was around £560.33 million.

Business overview: GlaxoSmithKline PLC

GlaxoSmithKline Plc (LON:GSK) is a healthcare company, which focuses on the development, manufacture and commercialisation of pharmaceuticals, vaccines and consumer healthcare products. It offers drugs for the treatment of HIV, respiratory diseases, cancer, immuno-inflammation, viral symptoms, central nervous system (CNS) related, metabolic, cardiovascular and urogenital, anti-bacterial, dermatological and rare diseases. The company offers over the counter (OTC) products for pain relief, oral health, nutrition, skin health and gastrointestinal disorders. Its area of operations are categorised into three segments Pharmaceuticals, Vaccines and Consumer Healthcare products.

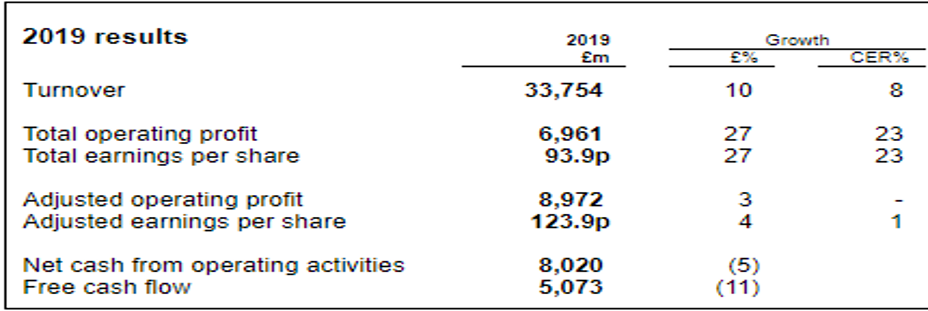

(Source: Companyâs filings, London Stock Exchange)

Group turnover for the year increased 10% AER, 8% CER to £33,754 million, with growth delivered by Vaccines and Consumer Healthcare and Pharmaceuticals remaining flat at CER basis. Pro-forma turnover growth for the Group was 4% CER.

Pharmaceuticals turnover in the year was £17,554 million, up 2% AER, but flat at CER. The turnover from Vaccines business surged by 19 per cent on constant exchange rate basis (CER) and 21 per cent on actual exchange rate basis (AER) to £7,157 million, while the sales from the Consumer Healthcare business went up by 17 per cent on both AER and CER basis to £8,995 million.

Total operating profit for the year was £6,961 million compared with £5,483 million in 2018. Adjusted operating profit was £8,972 million, up 3% AER, but flat at CER on a turnover increase of 8% CER. The Adjusted operating margin of 26.6% was down 1.8 percentage points at AER, 2.1 percentage points at CER and down 1.9 percentage points CER on a pro-forma basis.

Total earnings per share for the year was 93.9p, compared with 73.7p in 2018. Adjusted EPS of 123.9p compared with 119.4p in 2018, up 4% AER, 1% CER, with Adjusted operating profit remaining flat at CER. The improvement in Total earnings per share can be attributed to an increased share of after-tax profits of associates as a result of a non-recurring income tax benefit in Innoviva and a reduced effective tax rate, which was partially offset by a higher non-controlling interest allocation of Consumer Healthcare profits and increased net finance costs.

Net cash inflow from operating activities was £8,020 million (2018: £8,421 million), and free cash flow was £5,073 million (2018: £5,692 million). The reduction in Net cash inflow from operating activities primarily reflected the increased capital expenditure and higher payments for restructuring and significant legal matters, the initial step-down impact from US Advair generic competition, and the adverse timing of payments for returns and rebates.

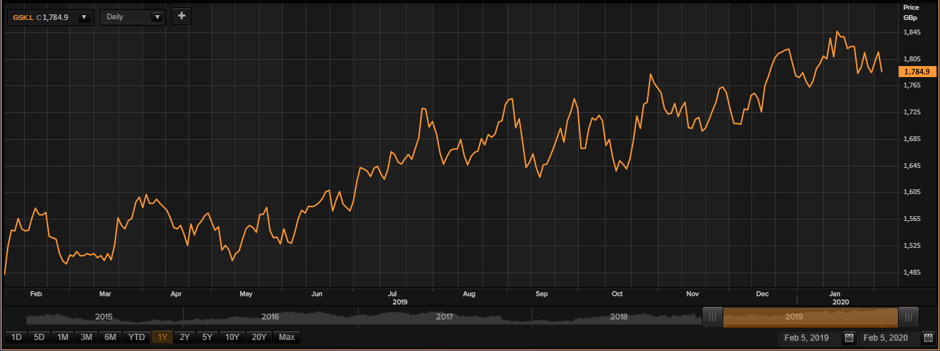

GlaxoSmithKline PLC-Stock price performance

Daily Chart as at Feb-05-20, before the market close (Source: Thomson Reuters)

On 5th February 2020, at the time of writing (before market close, GMT 1:15 PM), GlaxoSmithKline PLC shares were trading at GBX 1,784.90, down by 1.66 per cent against its previous day closing price. Stock's 52 weeks High and Low is GBX 1,857.00 /GBX 1,476.80. At the time of writing, the share was trading 3.88% lower than its 52w High and 20.86% higher than its 52w low. Stockâs average traded volume for 5 days was 6,180,779.20; 30 days - 5,655,772.40 and 90 days - 6,582,341.27. The average traded volume for 5 days was up by 9.28% as compared to 30 days average traded volume. The companyâs stock beta was 0.83, reflecting lower volatility as compared to the benchmark index. The outstanding market capitalisation was around £90.33 billion.