Summary

- UK debt to GDP ratio crosses 100 percent in May this year

- Government borrowing for FY 2021 could reach £298.4 billion: OBR estimates

- A result of ongoing coronavirus support schemes and falling revenues

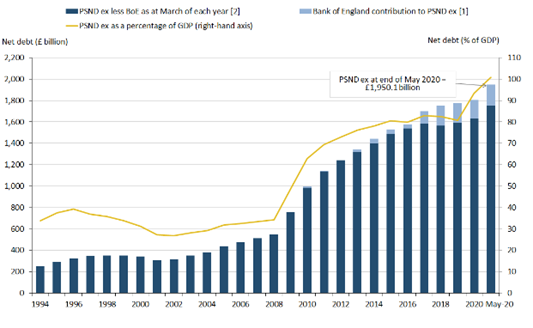

The total British Government debt reached an enormous figure of £1.95 trillion at the end of May 2020, which is more than the country’s economic output, at a value of 100.9 percent of its GDP, as the country completed its second month of lockdown. The UK’s debt to GDP ratio has surpassed a level of 100 percent for the first time since the year 1963.

This was 20.5 percent higher than the corresponding debt to GDP ratio during May 2019 and is the biggest year on year rise ever witnessed in the British records, which began in the year 1993. The underlying reason is that a whooping sum of £55.2 billion had to be borrowed by the public sector during the month of May.

By definition, a country’s debt to GDP ratio is the ratio between its total government debt and gross domestic product, and is measured in percentage terms. A low debt-GDP ratio is an indicator of better economic health as the country can easily pay off these borrowings without having to take further loans.

Public sector net debt (excluding public sector banks), UK, March 1994 to May end 2020

(Source: Office for National Statistics, UK Government)

Sven Jari Stehn, Economist at Goldman Sachs said that such a high debt to GDP ratio in the UK reveals the magnitude of the shock and the great expense of the government's fiscal support to the economy.

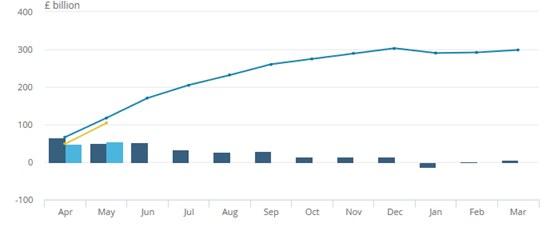

It is estimated by the Office for Budget Responsibility (OBR) that total government borrowing for FY 2021 could reach £298.4 billion, which is roughly five times the sum borrowed last year during FY 2020.

UK Public sector net borrowing (excluding public sector banks): OBR Estimates

(Source: Office for National Statistics, UK Government)

Why did it happen?

The main reason for government financial planning going hey wire this year was the unprecedented impact of the coronavirus pandemic on the British economy. Moreover, even now, it is difficult to calculate or predict the exact size of the impact, given the uncertainties with regard to the containment of the flu and the time by which the economy gets back to normal.

On the one hand, the government is grappling with giving a tall impetus to the economy due to the slowdown in businesses and job creation along with providing healthcare support to fight the disease, and on the other hand, it is managing with substantial losses in tax revenue and other income.

The UK Government launched various schemes to mitigate the effects of the coronavirus pandemic. These are Bounce Back Loan Scheme, COVID Corporate Financing Facility Fund, Coronavirus Business Interruption Loan Scheme, Coronavirus Job Retention Scheme, Coronavirus Large Business Interruption Loan Scheme, Self-Employment Income Support Scheme and Term Funding Scheme incentives for small and medium-sized enterprises. All these schemes have had a sizeable bearing on the UK public sector finances. For example, the government spends on the furlough scheme has nearly doubled from £5.2 billion in April to £9.8 billion in May this year.

During the month of May this year, the central government receipts totaled £40.7 billion. This was a drop of 28.4 percent as compared to the same month last year. Collections fell on all fronts – be it income tax, National Insurance, VAT (value-added tax) or the corporation tax

What is the Government doing about it?

There’s not much that the UK government can do to contain its mounting public debt in the present times when the economy continues to grasp with the aftermath of COVID-19 which is impairing growth throughout the world.

In fact, it is persisting with looking out for avenues to aid its public borrowing program. The government’s debt management office, has announced in April this year that it was arranging to raise £225 billion from the bond market to fund its huge public spending.

For instance, on June 21 the Bank of England intervened to inject £200 billion into the UK market via its quantitative easing (QE) policy, which generates electronic money to purchase bonds from financial institutions to reduce the government’s borrowing cost. It was the largest cash injection in the central bank’s entire history until now.

This move has enhanced the country’s borrowing prospects to a large extent. Andrew Bailey, Governor, Bank of England has emphasized that the UK government would have struggled to raise public finances without adequate support from its side, and might not have been able to fund itself, at least in the short-run, given the turbulence in the bond market and on the exchange rate front. He also feels that many British firms may not be able to survive the corona led recession and will perish, leaving the economy permanently at a loss. Bailey hinted that the government might have to locate an appropriate vehicle to resolve the bad debts of these failing firms.

As the UK economy starts to show signs of recovery, the exceptional monetary stimulus by the government will have to be withdrawn. Apart from other things, it may include measures like reducing public reserves and raising interest rates on a sustained basis.

Summary

The UK government’s debt is projected to peak in the financial year 2020-21, to reach a value of £298.4 billion for the year, which is worrisome. The debt to GDP ratio has crossed 100 percent at the end of May this year. While a cut in public spending is completely dependent on the end of the corona pandemic across the UK, this all-time high debt-GDP ratio will add further pressure on the Boris Johnson government to open up the economy for business-as-usual. It might also try and remove the restrictions currently in place, as much as it safely can, along with an additional race-up to find a corona medicine and a vaccine, so that businesses and jobs may get back on track.